By Rick Manning

It is not a pleasant thing when the chickens come home to roost, things get real messy in a big hurry and you want to make certain you don’t have a fan around to avoid anything hitting it.

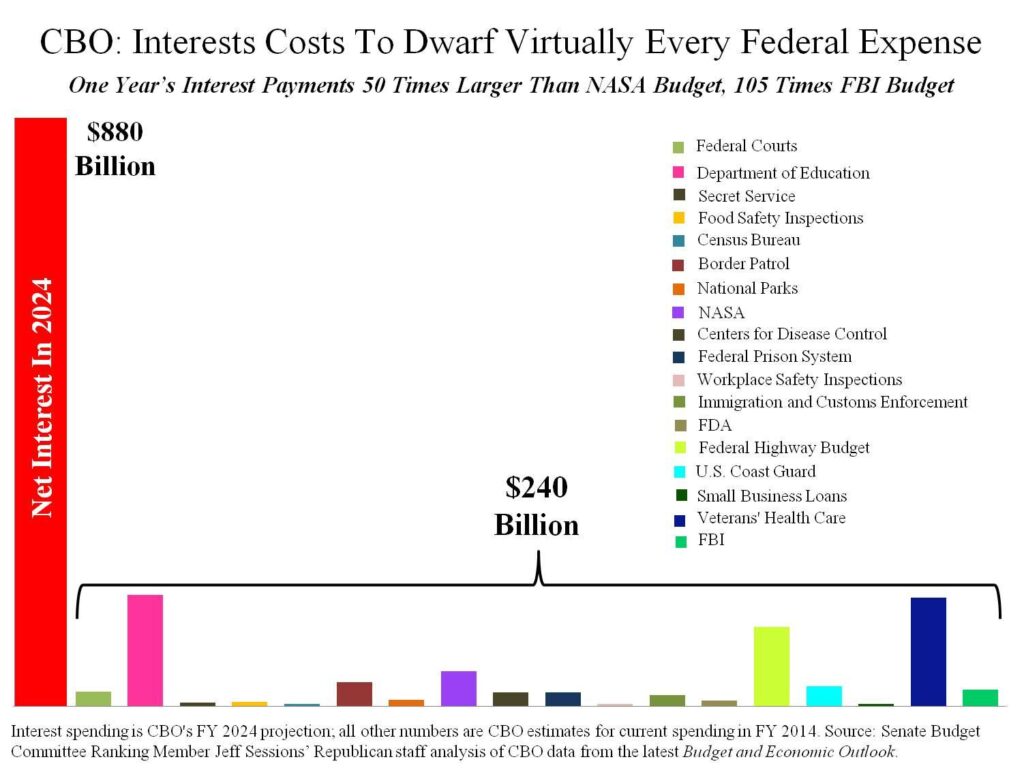

Senate Budget Committee Ranking Member Jeff Sessions points out, “The U.S. gross federal debt currently stands at $17.548 trillion, and net interest payments to our creditors are the fastest-growing item in the budget. In 2014, the Congressional Budget Office projects that the nation will spend $233 billion on interest payments. By the end of the budget window in 2024, however, CBO forecasts that interest payments will nearly quadruple to an astonishing $880 billion. Every dollar spent paying our creditors is a dollar wasted—money for which we get nothing in return. Interest payments threaten to crowd out every other budget item.”

But the reality is the interest payments on the debt are actually dramatically understated by the Congressional Budget Office. The CBO only counts net interest payments, excluding payments that are owed to U.S. government sources like the Social Security and Medicare Trust Funds. When all these interest payments are included, the interest payments made in Fiscal Year 2013 soar to $415 billion.

While it seems ludicrous to operate on the assumption that the United States government will choose to not pay Social Security recipients out of general operating expenses when the Trust Fund needs those promised interest payments to meet its obligations, that is what the CBO does.

Rather than debate this pretty significant accounting difference, let’s just assume that the CBO numbers accurately reflect the interest payment obligations. Under their projections, these interest payments will overwhelm the federal budget in just ten years, and this projection assumes a relatively low, stable interest rate environment.

This is why every big government liberal who believes in the welfare state should be clamoring for cuts in government outlays now, before the full weight of the dead money spent on paying our nation’s creditors hits.

To make it clear, the CBO generously estimates that in 2024, our nation’s non-payroll tax revenues will be about $3.8 trillion, a 45 percent increase over those collected in 2013. Note payroll tax revenues are not allowed to be spent for paying interest on the debt, national defense or social welfare programs that they were not intended to cover.

With $880 billion in projected interest payments taken off the top of the projected $3.8 trillion in revenues, every other federal government program is going to face an interest rate squeeze before this year’s high school graduates reach the age of thirty.

On top of that, the bulk of the baby boomers will be eligible to collect social security and Medicare, putting additional strains on the system. To make matters worse, the CBO projects this demographic shift will help account for a dramatic drop in the percentage of workers participating in the labor force — meaning that there will be a smaller percentage of taxpayers to carry the burden.

So what is the answer to the fiscal disaster that awaits our nation as interest rates consume a larger and larger percentage of our budget?

Congress needs to take real, meaningful measures to balance the budget immediately. They need to tackle so-called “mandatory” spending which currently consumes almost two-thirds of all federal spending before it is too late.

The longer they wait, the harder it is going to get. All the while, the ability to control interest rates that our nation pays on our debt is lost due to the increased concern about a strategic default on non-government held debt — the exact kind of vicious cycle that has forced other nations to take draconian actions to keep the government afloat.

This is why if you like your federal government safety net, Obama’s massive debt increase is likely to mean that you won’t be able to keep it. The longer our federal lawmakers wait to honestly address this threat, the larger hole the interest to cover the borrowing gnaws into federal government social safety net spending.

The CBO’s projected 400 percent increase in interest rate payments over the next ten years should wake up even the most ardent far left ostrich to the debt train bearing down on our nation, and its implications.

However, somehow I doubt it will, and they will be the first to cry foul, when those chickens come home.

Rick Manning is the vice president of public policy and communications for Americans for Limited Government.