Pimco CEO Bill Gross has left the company he founded, the largest bond fund in the world with over $2 trillion in assets under management, and that has everyone wondering what’s next for interest rates.

Bloomberg View columnist Megan McArdle has an interesting pieced entitled, “Gross gets out of bonds just in time,” wherein she notes, “interest rates and inflation pretty much can’t go any lower, so bond funds have entered a tougher market.”

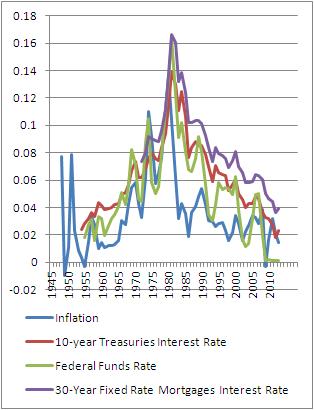

For a bit of context here, since the great inflation of the 1970’s, interest rates and inflation as measured by the Consumer Price Index have been collapsing. This has generally been a good thing for bond investors, since bond prices and yields share an inverse relationship. The lower the interest rate drops, the higher the value of the bond you bought yesterday, since it pays a higher guaranteed interest rate.

With rates dropping for as long as they have been, bonds have enjoyed more or less a 30-year bull market. The buy low, sell high wisdom has reigned supreme.

But if “interest rates and inflation pretty much can’t go any lower,” as McArdle suggests, suddenly flipping bonds as an investment strategy makes a whole lot less sense, for the return on investment is not as attractive as it once was. Plus, holding super-low interest rate bonds to maturity is not necessarily that attractive either.

So, with the bond market in a tougher spot, reasons McArdle, Gross got out just at the right time.

Does that mean higher interest rates are at hand?

Not necessarily. Consider a few factors. With deficits coming down in the post-financial crisis, there are fewer new U.S. treasuries to buy. The supply of new bonds has been dropping, so if demand remains stable, then the price should go up.

The same might be said of overall credit, which has been in a slowdown for six years. Not as much new debt means fewer new debt securities to be sold. Yet if there is steady demand for bonds, prices should rise.

Therefore, rates would keep dropping in principle. Except, that as rates approach zero, demand presumably drops off. So, what happens?

It could just mean that prices and thus interest rates remain stable at historically low rates for the time being.

But, there are other factors that might push rates even lower. If growth continues to remain sluggish as it has in the past few years, if the recession in Europe continues, or should a credit contraction take hold in Asia, suddenly, the flight to safety is back on, and demand for bonds rises because at least there’s a guaranteed yield.

Or there’s always the Federal Reserve, which although it is winding down its net purchases, still has other things it could do if it believed that even lower rates were still warranted.

Besides keep the federal funds rate near zero, for example, bonds the Fed bought 3 years ago when rates were higher might be flipped into the current market in exchange for lower interest rate bonds. This would generate artificial demand, and although not making that much of a dent, could drive rates lower. With $4.2 trillion of securities in hand built up over the past six years, it has a lot of bonds it could trade.

Of course, it is near impossible to write about interest rates without engaging in speculation about where they’re headed next. The past after all does foretell the future, but the fact is, rates along with inflation have been collapsing for three decades.

Surely, it will take more than Bill Gross leaving Pimco to change those dynamics.

Robert Romano is the senior editor of Americans for Limited Government.