Most rational observers should agree that in order to create jobs and boost wages, the economy must grow.

That is certainly true. However, because government spending is included as a part of the Gross Domestic Product (GDP) published by the Bureau of Economic Analysis, it is difficult to gauge how well the private sector is actually doing based on the reported headline number, because one cannot be certain how much government spending is biasing the GDP measure.

And for that matter, what impact the private sector has on job creation and income levels versus that of government spending.

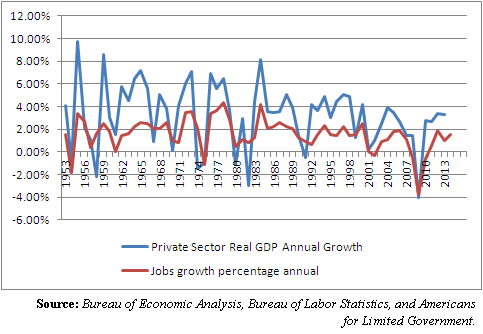

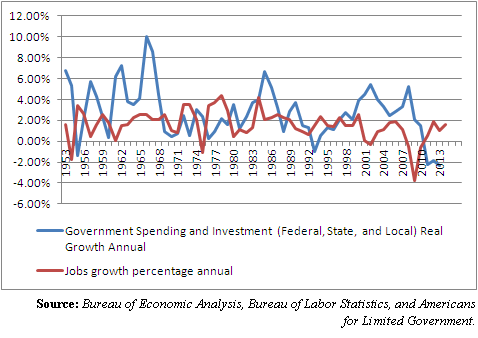

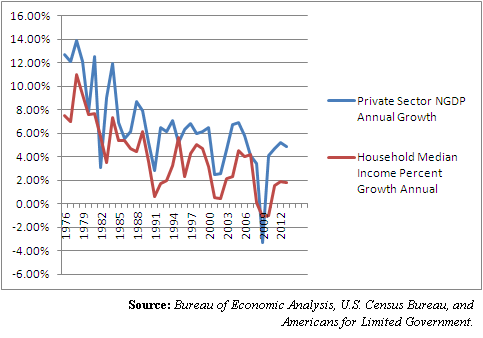

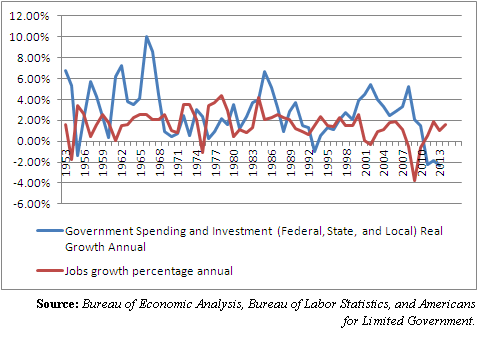

With that in mind, Americans for Limited Government has separated the data compiled by the Bureau of Economic Analysis and compared its performance with the growth of jobs in the Bureau of Labor Statistics’ monthly household survey, and household median income measured by the U.S. Census Bureau.

What emerges is a very strong correlation between inflation-adjusted private sector GDP and the growth of jobs, and much less so for government spending at the federal state and local level.

That is not to say government spending is wholly irrelevant to the jobs question, but since only 14.9 percent of those with jobs work for the government at all levels — or 21.9 million — it is easy to see why its impact might be limited.

Whereas, job creation as a whole is joined at the hip with economic growth. When the private sector expands, since over 85 percent of us work there, we all benefit and jobs are created.

When government grows, on the other hand, comparatively fewer people tend to benefit.

A similar story emerges on the question of income, where nominal private sector growth appears to show a direct causal link to higher incomes.

Whereas, government spending at the federal, state and local level does not appear to drive wages at all. If anything, it’s the other way around, with spending fluctuations lagging behind wage growth. Higher incomes, resulting in higher tax revenues, seem to have more of an impact on increasing government spending — particularly at the state and local level — than the inverse.

All of which means for those interested in creating jobs and growing wages in the New Year, and with the new Congress, should be primarily focused on the task of growing the private sector — not government.

Robert Romano is the senior editor of Americans for Limited Government.