The past decade was the worst economy from a growth perspective in U.S. history.

All the economy could manage was a pitiful 1.3316 percent average, inflation-adjusted growth a year. That was worse 1930 through 1939 at 1.3334 percent a year, according to data compiled by the Bureau of Economic Analysis.

The slowdown runs longer than that, however, where growth has not topped 3 percent since 2005, and not 4 percent since 2000.

Since the turn of the century, labor participation has been contracting like clockwork among working age adults aged 16 to 64, accounting for about 9 million people who either left the labor force or did not enter on a net basis, compared to participation during the late 1990s.

Incomes are flat, only growing 2 percent a year the past decade.

So, there’s fewer people working and looking for work as a percent of the population, and the jobs that do exist are not seeing much in the way of pay raises.

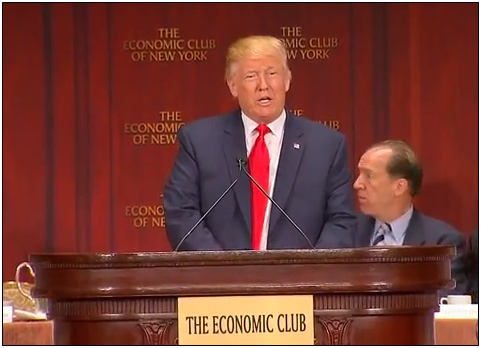

In that context, it might seem almost impossible for the economy to do much worse under President Donald Trump.

But now, Trump owns this economy. It’s his. If it improves, he’ll get the credit. If it doesn’t, he’ll get his share of the blame. And it can always get worse.

During this same period, the national debt, now nearly $20 trillion, has averaged 7.7 percent average annual growth since 2000 — 106 percent of debt of the current $18.86 trillion economy. If it continues to grow at that rate, it will be $37 trillion after 8 years.

In 20 years, it would be $93 trillion. But if the economy continues at its current anemic rate, the GDP would only be $40 trillion — a debt to GDP ratio of 232 percent.

That’s just stupid money. We’d never pay it back. Default would be certain.

The surest way to avoid such a catastrophe is to get the economy growing again at a robust rate, faster than the growth of spending, which itself must be reduced. With millions of new taxpayers, receipts would soar while spending could be held tame, and the deficit would narrow.

We really, really hope Trump is able to generate robust growth, when the alternative appears to be a looming sovereign debt crisis in the not so distant future.

To that end, Trump has promised to reduce the cost of doing business, including via tax and regulatory reform, and certainly this is welcome news to job seekers. He has also pushed for a new approach on trade away from global trade deals to bilateral deals and punish trade partners that use tariffs against U.S. goods.

Coupled with that is the promise to repeal Obamacare, which has been a net drag on growth.

Trump has the right idea, but he cannot get there without Congress.

Fortunately, there is a lot of slack in the economy. Recall the 9 million Americans who might otherwise be in the labor force right now but for the slow growth. With a surplus supply of labor, Trump and Congress with policies that incentivize production could generate a boom in the near term.

Trump has also promised to spend more on infrastructure, but a word of caution. Surely Congress will be willing to spend more money — when is that not the case? — but unless it is coupled with policies that foster more economic growth, those infrastructure dollars will have to be borrowed, adding even more to the debt.

As Trump has noted, he inherited a big mess. That is true, and the only way out of that mess is economic growth.

Corrected to put debt to GDP ratio at 106 percent instead of 107 percent.

Robert Romano is the senior editor for Americans for Limited Government.