The measured 0.7 percent Gross Domestic Product by the Bureau of Economic Analysis in the first quarter of 2017 is no surprise, said Americans for Limited Government President Rick Manning in a statement.

“The U.S. economy is already coming off its worst decade ever from a growth perspective, averaging just 1.3329 percent inflation-adjusted growth a year from 2007 to 2016, worst than even the Great Depression’s 1.3334 percent average annual growth from 1931 to 1939,” Manning noted.

“This is a bigger problem than anyone is willing to admit,” Manning added.

The problem is that the economy has been slowing down all century long. Growth has not topped 4 percent since 2000, and not been above 3 percent since 2005.

This in turn has coincided with slower job creation — that is the number of people reporting they have jobs in the Bureau of Labor Statistics’ monthly household survey — which has not increased by more than 2 percent since 2000. It averaged just 0.49 percent a year the past decade, down from 1.32 percent a year from 1996 to 2007 and 1.47 percent annually from 1986 to 1997.

It has coincided with nominally slower growth of incomes, following U.S. Census Bureau data. Incomes grew by at an average, annual 2.03 percent rate from 2006 to 2015, slower than 2.95 percent from 1996 to 2005 and 3.75 percent from 1986 to 1995.

So a lot of things are slowing down alongside the economy. Other key factors slowing down include inflation and interest rates, which have been dropping long-term since their peaks in the early 1980s.

Overseas, the same trends have more or less been playing out in Europe and Japan. Slow growth of the economy, jobs and incomes. Declining interest rates, inflation.

Another correlating constant has been the slowdown of the growth of the working age population and fertility. In the U.S., since the financial crisis, fertility has dropped below two babies per female. Europe has been below population replacement rates since the mid-1970s, as has Japan. The U.S. was on a similar trajectory, dropping below two babies per female in the early-1970s, but recovering by 1990. Now, we’re off track again, and the economy is following suit.

In the meantime, the amount of national debt has spiraled upwards to almost $20 trillion as the U.S. has generously spent out social retirement and health benefits to the Greatest Generation and now the Baby Boomers. But with comparatively fewer taxpayers being produced — the population will start declining in the coming decades if things do not change — questions abound how future generations will be able to continually refinance the gargantuan, growing debt. A bond market funding crisis followed by default sometime this century could shake things up dramatically.

Another major problem is declining employment-population ratios. Take a look at 16 to 64 year olds in particular. That too peaked in 2000 at a little more than 74 percent, and has collapsed since then, standing at 69 percent. to give you an idea that declining growth rates are not necessarily benign. It accounts for almost 10 million missing jobs since the turn of the century if the economy were producing jobs for working age adults the way it was almost two decades ago.

If these trends persist, it is hard not to see a gloomy future for the American, and indeed, the world’s economy as one that works less, produces less and thus eventually creates less wealth.

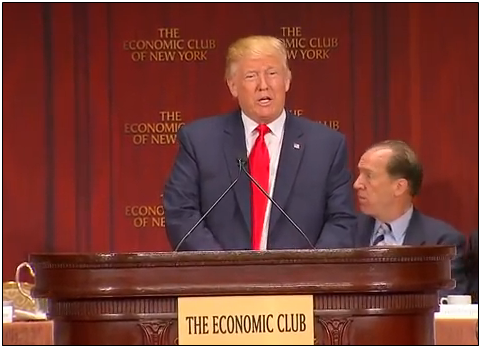

But we need not be cynical in our outlook. That is why Americans for Limited Government’s Manning urge Congress to “get its act together and implement the Trump agenda on tax cuts, regulatory reform and repealing Obamacare.”

Manning concluded, “Congress must act on the necessary economic reforms in front of them, not hide behind the limits of Senate rules. Trump has outlined an ambitious tax cutting plan that help the economy to grow. Lifting the burdens imposed by Obamacare will help the economy grow. Legislatively prohibiting the use of funds to carry out economy-killing regulations enacted beyond the Congressional Review Act’s 60-day legislative window will help the economy to grow. These obstacles to growth were enacted by Congress and via the regulatory administrative state long before Trump took office, and it is Congress that must act in order to remove these impediments to growth. President Trump can only accomplish so much on his own. It is Congress’ Article I responsibility to take the lead on needed legislation.”

If nothing else, the Trump economic program is worth a shot. It may not matter, if the long-term trends we are following are immutable, but if they can be changed, we should try for the sake of our children and children’s futures. Growth is the answer.

Robert Romano is the senior editor of Americans for Limited Government.