Consumer inflation increased another 8.3 percent annualized in April, according to the latest data compiled by the Bureau of Labor Statistics (BLS), amid increases in prices for housing, food, airline tickets and new vehicles.

And it is crushing wages, with BLS reporting a 2.6 percent drop in real average hourly earnings, thanks to the inflation.

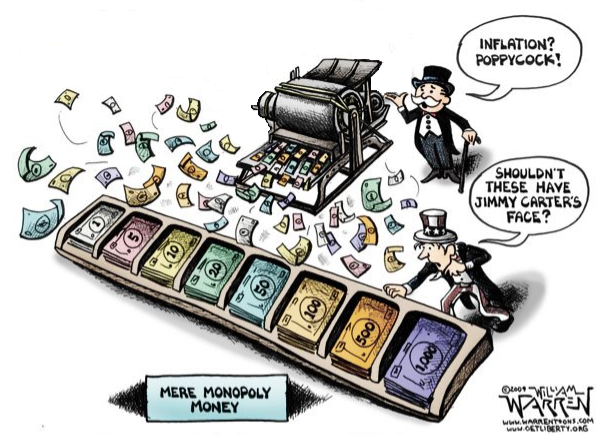

Inflation has now been north of 5 percent since June 2021, in what is the worst inflation since the late 1970s and early 1980s. It caused recessions then, and it may have already induced another recession now just two years after the 2020 Covid recession.

The U.S. economy already contracted 1.4 percent on an inflation-adjusted basis, according to the Bureau of Economic Analysis. The economy did grow on a nominal basis by almost 6.5 percent annualized, by $382 billion to $24.4 trillion, but because inflation averaged about 8 percent the first quarter, real GDP came in negative.

The same thing could be happening right now. With April’s inflation number on the books, May and June will tell the tale of whether President Joe Biden will preside over a recession in 2022 — or perhaps in 2023 or 2024.

If inflation remains above, say, 7 percent throughout the second quarter, nominal growth appears unlikely to be that high. In just 18 economic quarters out of 127 quarters since 1989, nominal growth annualized was above 7 percent. That is only 14 percent of the time. Meaning, there’s about an 86 percent chance it will be less than 7 percent nominal growth in the second quarter.

But when one considers that there have already been massive nominal gains in GDP following the Covid lockdowns — including a monster 38 percent nominal gain in the third quarter of 2020, and a 14.5 percent nominal gain in the fourth quarter of 2021 — it is hard to imagine another big nominal GDP gain in the current environment with high inflation, the continued supply chain crisis and now the war in Ukraine.

It’s like a flock of black swans flying in a triangle formation. What else could possibly go wrong?

Again, in the first quarter, growth was almost 6.5 percent, which was the lowest reading since 2019. So, the economy is already slowing down. Before that, one has to go back to the second quarter of 2018 to find annualized nominal growth above 7 percent, and the second quarter of 2014 before that. It has not been happening a lot in the past 20 years.

Meaning, the escape route to avoid a recession right now is rapidly narrowing. It is still possible, but politically, President Joe Biden and Congressional Democrats might be better off in the long run if the recession happens right now, which would certainly impact the Congressional midterms in November, but might be far enough away from 2024 to provide ample time for a robust economic recovery.

Ronald Reagan had a massive recession in 1982, but by 1984, the recovery was fully underway and he easily defeated Walter Mondale in a 49-state landslide.

On the other hand, given the ongoing supply chain crisis and no end in sight for Russia’s war in Ukraine, which is further exacerbating oil, natural gas and wheat global supply lines, it is foreseeable that even with a recession right now, inflation could remain elevated for the foreseeable future — which could have the economy overheating once again in 2023 headed in the 2024 presidential election cycle.

The point is that it is never a great time for an administration to have to weather a recession. The American people can be quite forgiving, but in Biden’s case, if the inflation remains a going concern after 2022, their patience may end up running thin.

Robert Romano is the Vice President of Americans for Limited Government Foundation.