Enough is enough. That is the thought of many Republican Congressmen as well as private organizations when it comes to America’s spending spree.

Efforts to save face by the Administration and Obama’s own economists by telling the American people the nation is in a recovery period and just a little more money is needed to get her to complete restoration isn’t working any longer.

All the American people have to do is look around their neighborhoods, communities and states to realize that instead of being on a healthy recovery path, America is on a destructive road far from any sort of improvement.

Unemployment rates are still flirting within the 10 percent range, Sen. Harry Reid (D-NV) and House Speaker Nancy Pelosi (D-CA) have added insurmountable amounts of debt to the nation since taking over Congress and American businesses are being forced to close because of new legislation or the unknown tax rates looming in the future.

But don’t worry, they continue to say, more spending will solve the problems.

Meanwhile Wisconsin Republican Rep. Paul Ryan, Oklahoma Sen. Tom Coburn, M.D., as well as private organizations like Americans for Limited Government (ALG), The Cato Institute and the Mercatus Center are working towards a different end. Their thinking is the sooner the spending stops and critical cuts are made, the better America will be.

When asked about the Administration’s economic strategy of borrow-and-spend Keynesian policies, they all agreed the current method isn’t working, nor will it ever work as the government claims it will.

Bill Wilson, president of ALG, explains his reaction to the reasoning of the Administration’s economic policies this way, “The Federal reserve has more than doubled the supply of money since the housing bubble popped in August 2007. Coupled with the $700 billion TARP, the $862 ‘stimulus,’ which included more than $145 billion in bailouts to balance bankrupt state budgets, and more than $4.242 trillion in new debt since then — nobody can honestly argue that government attempts at monetary and fiscal ‘stimulus’ have not been robust. The spending has not worked; it has only crowded out the potential for a robust private sector recovery.”

Donald Boudreaux, Mercatus Center senior education advisor, agrees and adds, “They have no basis for this belief other than their faith in Keynesian dogma. And this dogma is based on an overly simplistic model of economic activity — a model that ignores the negative expectations created by deficit financing and ignores the need for millions upon millions of individual economic actors to adjust to new economic situations in ways that cannot be foreseen in detail by economists or by policymakers.”

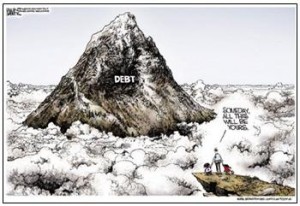

In addition to not having a sound economic system, Obama and the Democrats in Congress have also added incredible amounts of debt to America. As previously reported by ALG, since Sen. Reid and Rep. Pelosi took over Congress, every American now owes one out of every three dollars of their income to the federal government for their share of the debt. That’s approximately $18,912 for every adult in the U.S., and $36,886 for every household.

This should make any taxpaying citizen upset, as they are the ones who will carry this debt burden for years to come. Sen. Coburn couldn’t agree more.

“Families and small businesses across the country are being forced to look at their annual budgets and make sacrifices due to the difficult economic situation in our country. So why shouldn’t Congress be held to the same standards?” he asks. “We are currently borrowing $3.8 billion dollars a day that we don’t have to pay for things that we don’t need. This type of spending is absolutely unsustainable. We are playing with the future of our country if we continue on this path of reckless spending.”

If the spending doesn’t stop, America could quite possibly follow the path of Greece. A negative credit rating for the U.S. is becoming more of a possibility as debt levels continue to seep higher into revenue.

“America is a long way from being another Greece, but we’ll get there sooner or later if politicians continue to over-tax and over-spend,” says Dan Mitchell, Senior Fellow at The Cato Institute.

Though Congress passed the financial reform bill and Obama signed it into law, this legislation still does not get to the root of what started the financial disaster in 2007. Freddie Mac and Fannie Mae, which the government now owns, possess more than $5 trillion in liabilities, including mortgage-backed securities. Holding onto these assets as well as the 650 or so million acres of land the federal government also owns, won’t help growth in America.

“These assets must be sold off piece by piece to American entrepreneurs who can again make unused land and the housing market profitable,” says ALG’s Wilson. “The government hoarding resources and nationalizing housing finance has only stagnated the economy.”

Rep. Ryan agrees and also has other ideas for Fannie Mae and Freddie Mac. “Fannie and Freddie were noticeably absent from the Majority’s 2,000+ page financial regulatory reform bill so Congress still needs to examine how these enterprises are operating to determine the exact amount of taxpayer exposure,” he says. “Common sense reforms like ending conservatorship, shrinking their portfolios, establishing minimum capital standards and increasing transparency would be steps in the right direction.”

Common sense seems to be what this Administration is lacking when it comes to the handling of America’s economic policies. The U.S. sits at a tipping point. If borrowing and spending continue, the U.S. could be poised to face a huge financial meltdown unlike any other. If new economic policies like those of Rep. Ryan and Sen. Coburn are introduced, America could recover.

The American people have seen what doesn’t work. Maybe it is time to exercise different economic policies and give the country a chance to really recover.

Rebekah Rast is the national correspondent to the Americans for Limited Government (ALG) News Bureau.