04.18.2024

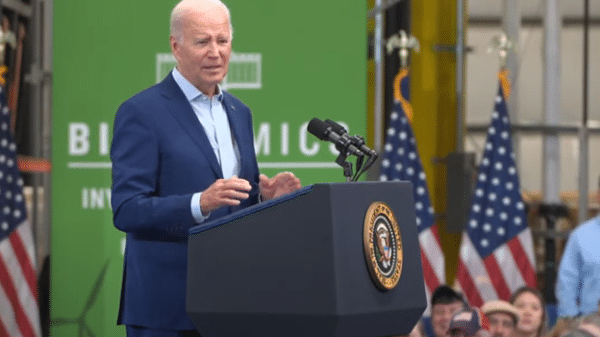

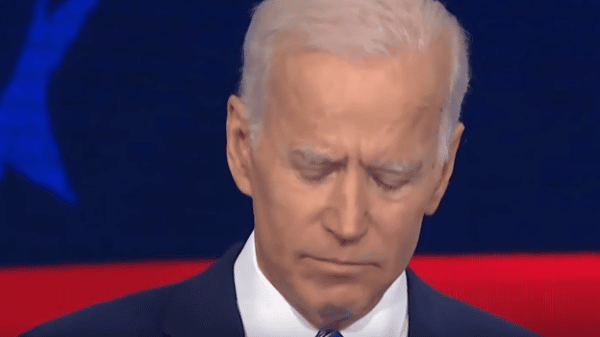

By Robert Romano In the latest Emerson poll showing former President Donald Trump leading incumbent President Joe Biden by 3 points, 46 percent to 43 percent, a remarkable 5.5 percent of 2020 Biden voters now say they are supporting Trump in 2024. Comparatively only 0.9 percent of 2020 Trump voters […]

04.17.2024

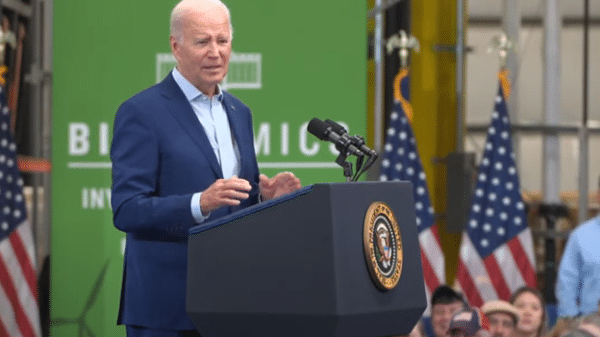

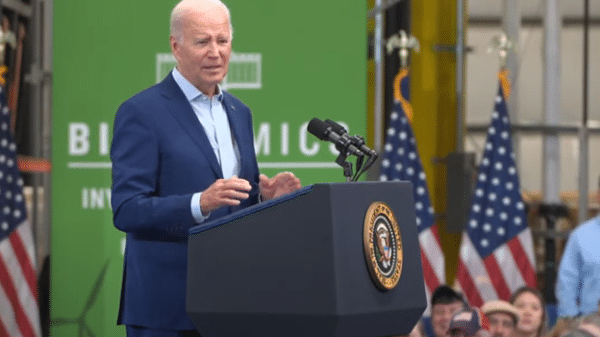

By Manzanita Miller Despite having upside-down approval ratings on virtually all key issues – including strong negative rankings on immigration, the economy, foreign policy, and crime – President Joe Biden is supposedly closing the gap against former President Donald Trump. A blistering new poll from the […]

04.17.2024

By Rick Manning Ken Griffin, founder and 80 percent owner of the hedge fund Citadel LLC, warned his investors, “As we have cautioned over the past year, the surging U.S. public debt is a growing concern that cannot be overlooked.” It seems these types of warnings happen over […]

04.16.2024

By Robert Romano Job openings have collapsed more than 3.4 million, or 28 percent since March 2022 when they peaked at 12.1 million, now down to about 8.7 million. That’s a massive drop-off but there’s still more job openings than unemployed as since that time, the number of unemployed has […]

04.10.2024

By Robert Romano Consumer inflation in the U.S. once again spiked upward to 3.5 percent over the last 12 months, or 0.4 percent the past month in March, according to the latest data from the Bureau of Labor Statistics . The news comes as the Federal Reserve had been anticipating reducing the Federal Funds Rate this year as inflation had slowed down to 3.2 percent in February, but […]

04.08.2024

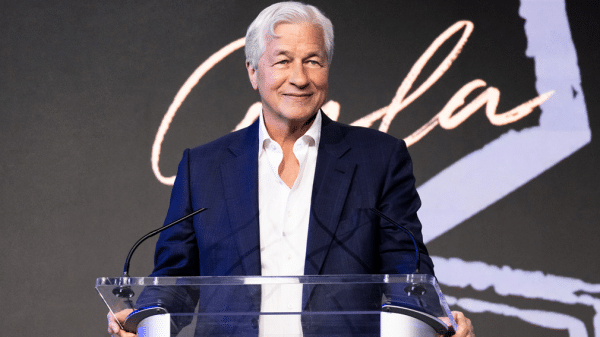

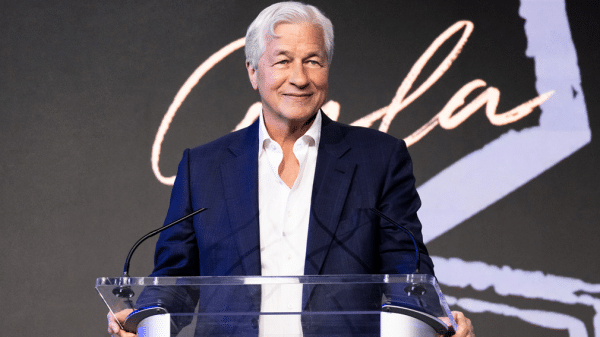

By Robert Romano Don’t look now, but inflation might not automatically return to below 2 percent before it starts going up again, and it could lead to much higher interest rates, JP Morgan Chase CEO Jamie Dimon is warning in a letter to his company’s shareholders. In the letter, […]

04.05.2024

By Manzanita Miller The latest Wall Street Journal poll drives home the point that Americans strongly dispute the White House’s rosy picture of the economy, and that disconnect could cost President Joe Biden heavily in November. Trump leads Biden in six of seven battleground […]

03.29.2024

By Robert Romano President Joe Biden and former President Donald Trump are running neck and neck among Millennials in a Economist-YouGov poll take March 10 to March 12 , with Biden leading Trump narrowly 41 percent to 36 percent among 30-to-44-year-olds, and 10 percent saying “other” that might be a proxy for Robert Kennedy, Jr. Among […]

03.26.2024

By Robert Romano 71 percent of registered voters say that post-Covid inflation has “proven sticky and is here to stay” according to the latest Harvard-Harris poll take March 20-21 , even as President Joe Biden struggles to assure voters that inflation is calming down. That includes 87 percent of Republicans, 70 percent of independents […]

03.19.2024

By Robert Romano “Now, if I don’t get elected, it’s going be a bloodbath for the whole — that’s going to bet the least of it — it’s going be a bloodbath for the country. That’ll be the least of it.” That was former President Donald Trump […]