Where no matter how much money we print via the Federal Reserve’s so-called quantitative easing, no matter how much debt we take on, we cannot grow.

For the uninitiated, Japan is a textbook example of the futility of “stimulus”. Regardless of how easy its monetary policy is, or how low interest rates are pushed down by the central bank (10-year Japanese government bonds now yield a cool 0.7 percent interest rate), or how large the debt gets (it’s well north of 200 percent of GDP), it is still a zombie. It contracted by 0.7 percent in 2011, according to data from the World Bank.

Compare that to the U.S., where the Fed’s balance sheet has exploded to nearly $3 trillion since the financial crisis began, 10-year treasuries only yield 1.4 percent and dropping now while the Federal Funds Rate has remained at near-zero since 2008, and the $15.8 trillion national debt has surpassed 100 percent of GDP just this year.

When coupled with the hard landing in China, Germany and the United Kingdom headed back into recession, and the Euro collapsing in slow motion, there is hardly any good news out there.

Nonetheless, markets rallied on July 27 on news of the anemic 1.5 percent growth number, claiming it had beaten expectations.

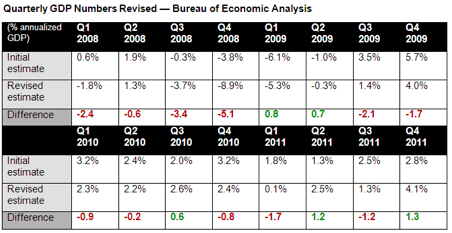

But everyone should be taking the Bureau’s advance estimate with a big grain of salt. GDP numbers through the first half of 2008 failed to show that we were in a recession, when in reality the downturn had already begun at the end of 2007.

Once again, the economy is visibly slowing down, but are we already in another recession? At best, we’re at stall speed, but we may already be contracting.

In fact, in 11 of 16 economic quarters from 2008-2011, the Bureau’s advance estimate of GDP has been revised downward. As a result, there is a greater than 68 percent likelihood that July 27’s 1.5 percent growth number too will be lowered.

On average, in the past 4 years, the Bureau’s advance estimate has been revised downward by 1.1 percent for every quarter represented.

Our early warning systems are broken, and economists are left only to extrapolate that we are in serious trouble. Meanwhile, Obama has done nothing to get the economy back on its feet. His only plan is to raise taxes on job creators, wage his war on business, and spend us into oblivion.

The “stimulus” has failed, and yet all the talk is the Fed will try to administer another dose of quantitative easing, or money printing, that will do nothing to get us out of this ditch, just as it has not helped Japan.

Fed Chair Ben Bernanke admits that all he can do is buy U.S. treasuries and agency debt, like Fannie Mae and Freddie Mac mortgage-backed securities. But does anyone believe even if Bernanke committed to another $1 trillion of purchases, it would help get the economy moving or lower unemployment?

It is time for new leadership. We need a return to sound money, fiscal responsibility, lower taxes, and a complete unraveling of the environmental, labor, and health regulations that are strangling growth. Like Japan, we are on the verge of a lost decade.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.