By Dustin Howard

Fifty years ago, on Sept. 22, 1965, the Great Society reached its apex with the Senate’s passage of the Immigration and Naturalization Acts of 1965. The Great Society sought to change the way we aided the elderly and the poor — and our very essence as a people.

The immigration law, along with Medicare, Medicaid and other measures, has changed the face and character of the United States, leaving a mixed legacy at best, and at worst has caused many of the fiscal problems we face today.

The Great Society was born in 1941; at that time it was one of the “Four Freedoms”, specifically the “Freedom from Want.” This “Freedom” was orphaned by the death of Franklin D. Roosevelt. Like many orphans, it had a rough childhood, particularly in the Truman-Eisenhower era of relative prosperity, tax cuts and fatigue from New Deal era spending. Then came its big break: in 1964, during the unfinished term of John F. Kennedy, President Lyndon Johnson adopted it, and christened it with its current moniker, the War on Poverty.

At the dawn of the Johnson administration in 1965, the President proclaimed “The Great Society asks not how much, but how good; not only how to create wealth, but how to use it; not only how fast we are going, but where we are headed.”

After 50 years, the Great Society is due for a performance review; with more than 100 programs under its umbrella, Americans deserve to know their efficacy.

War on Poverty

The Great Society was tasked with making provision for those who lacked basic financial security to purchase food. The food stamp program, now known as Supplement Nutrition Assistance Program (SNAP), was thought to be a reliable indicator of poverty. The food stamp Act of 1964 initially appropriated $75 Million to 350,000 people in 40 impoverished counties and 3 cities across the United States. By 1969, that number increased to nearly 3 million users.

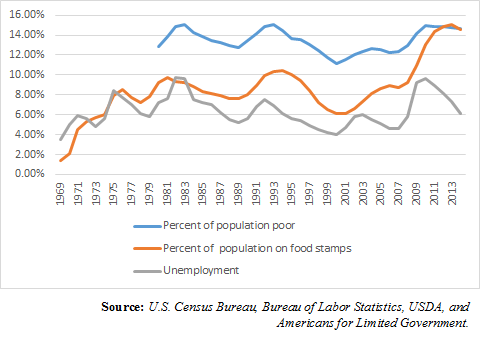

In 2014, that number exploded to over 46.5 million users, costing taxpayers over $74 Billion that year alone. Accounting for population growth, food stamp usage increased from 1.42 percent of our population in 1969 to 14.59 percent of the population in 2014 (the latter number assumes illegal immigrants are not benefiting from this program, which is certainly occurring, but difficult to quantify).

Data suggests that, immediately after the program’s establishment, usage consistently grew to the point of exceeding mere parity with the unemployment rate. This indicates children using the program, plus any people with jobs using the program in greater numbers, particularly during the Great Recession. While usage traditionally waxed and waned with economic conditions, usage has greatly expanded because of the 2008 farm bill that increased eligibility, passed during the Bush-Pelosi era.

The fact remains that the only decrease in usage occurs when jobs are more plentiful; if the programs were truly effective, they would have greater consistency in spite of economic fluctuations.

Medicaid spending is one of the largest line items in the Federal budget, projected to take up 4 percent of the Gross Domestic Product (GDP) by 2017; it was less than 1 percent at the program’s inception.

The program started as the fail safe for the poorest Americans but has become the default option for the uninsured, illegal immigrants and, now, the middle income Americans. The program is on an inflationary spiral that will continually rise with healthcare costs, to say nothing of increasing enrollment as mandated by the so-called “Affordable Care Act” (Note: Governors like John Kasich opting into Medicaid expansion similarly add hundreds of billions of dollars to this balance).

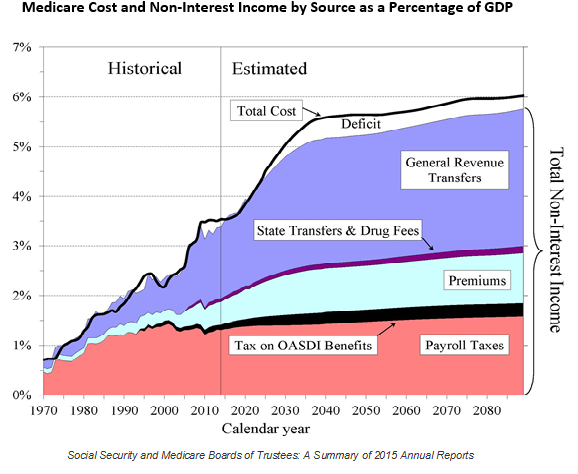

In 1965, Medicare Part A alone was initially projected to cost $9 Billion by 1990, and instead overran to $14.76 Billion, a 64% overage. The Trustees of Social Security have stated that Medicare “will grow from approximately 3.5 percent of GDP in 2014 to 5.4 percent of GDP by 2035 and will increase gradually thereafter to about 6.0 percent of GDP by 2089.” Below is the Trustees’ chart depicting Medicare cost and non-interest income as a percentage of GDP. The programs’ accelerating costs and enrollment are currently destined for insolvency, creating an ever larger footprint on America’s debt and deficits.

Importing Poverty

These two programs are exacerbated by the Hart-Celler Act, which threw out the quota system that regulated immigration levels and created our current system that imports the world’s poor. The cumulative effect of around one million new citizens every year is that the aforementioned programs are burdened by people who generate more costs than contributions. The confluence of these and other factors create a system that engender dependency and create a self-perpetuating system that continually justifies its own existence.

Time to retire the Great Society

What is at issue is not the desired ends of the Great Society, which could have been accomplished without robbing future taxpayers, but the woefully inefficient means. The War on Poverty alone is estimated by the Cato Institute to have cost over $15 trillion, capital that if invested in other ways, could have served the impoverished in multitudinous ways.

If the Great Society were a person contractually obligated to rescue the poor, it would have faced civil action for its inability complete its task, and would be indicted for its profligate cost overruns.

The supposed success of the Great Society had many progressive fathers, but its legacy of crushing debt and deficits, remains an orphan that burdens current and future generations.

After 50 years, it seems only reasonable to retire the Great Society in magnanimity, but America can no longer afford its golden parachute.

Dustin Howard is the social media manager of Americans for Limited Government.