By Natalia Castro

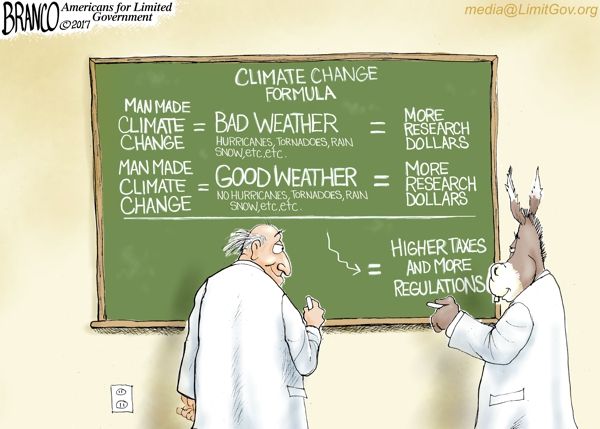

Politicians are feeling the pressure to distance themselves from burdensome environmental policies that show little benefit while draining the economy. As political figures both in the United Stated and Canada, push against a carbon tax, one Florida representative has decided to move in the opposite direction.

Representative Carlos Curbelo (R-Fla.) has proposed a new carbon tax bill which, according to analysis done by the Wall Street Journal, would likely add three to 11 cents to the average pump price per gallon of gasoline to drivers.

Curbelo has claimed the tax would protect his South Florida coastal district, which he says is vulnerable to the effects of climate change; however, as our friends in Canada have taught us through their own failed policy, a carbon tax will bear significant cost while producing little benefit.

A study conducted by the University of Regina Institute for Energy, Environment, and Sustainable Communities funded by the Saskatchewan government, found a federal carbon tax would reduce the Canadian provinces gross domestic product (GDP) by almost $16 billion by 2030.

The study also concluded that the federal carbon tax would reduce emissions by less than one mega-ton. This is approximately 1.25 percent of the provinces total emissions yet would maintain a cost of $1,890 per ton to GDP.

As Environment Minister Dustin Duncan explained, “If the whole point of the carbon tax is to reduce emissions, then this model says that for Saskatchewan doesn’t actually reduce emissions, it only hurts the economy.”

Additional research from the University of Calgary estimated a federal carbon tax could cost the average Saskatchewan household more than $1,000 per year.

Across Canada citizens are voting pro-carbon tax politicians out of office and preparing law suits against the federal government.

A majority of Congressmen in the U.S. seem to be learning from Canada’s mistakes.

Last week, the House of Representatives passed a nonbinding resolution affirming that a tax on emissions of carbon dioxide would “be detrimental to American families and business, and is not in the best interest of the United States.”

The measure, sponsored by Majority Whip Steve Scalise (R-La.), passed on a 229-180 vote with six Republicans breaking with their caucus and voting against the resolution. Florida Representative Curbelo was one of these Republicans.

Rep. Curbelo needs to get on board with the majority of Republicans in Congress and even many Canadian citizens who view a carbon tax as economically destructive. While producing minimal benefit for the environment, a carbon tax would cost hardworking Americans significantly. If combatting climate change is so important to Curbelo and his constituents, he should look toward free market solutions that do not further harm his people. It is clear in the United States and around the world that a carbon tax is not and never will be a good answer.

Natalia Castro is the Public Outreach Coordinator at Americans for Limited Government.