As originally published by Investor’s Business Daily.

By Howard Rich — Nearly two centuries ago Daniel Webster stood before the U.S. Supreme Court on behalf of James McCulloch, head of the Baltimore branch of the Second Bank of the United States. At issue were two basic questions: Did the federal government have the authority to establish a bank? And did states have the authority to tax that bank (and by extension the federal government)?

“An unlimited power to tax involves, necessarily, the power to destroy,” Webster famously argued in opposition to the latter question.

Chief Justice John Marshall agreed, parroting Webster’s words almost verbatim in his ruling.

“That the power to tax involves the power to destroy … (is) not to be denied,” Marshall wrote.

Yet this “undeniable” premise – first invoked in 1819 on behalf of an onerous expansion of federal authority – has been explicitly rebuked 193 years later in support of an even more onerous expansion of federal authority. In fact the destructive power of taxation has just been extended far beyond a mere list of items subject to duties, imports or levies – it can now actually compel participation in the private sector.

More than at any other time in American history, the power to tax has indeed become the power to destroy – our economy, our liberty and perhaps one day even our lives.

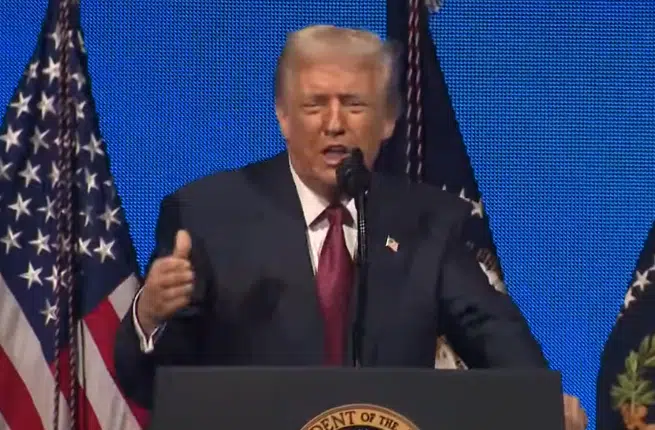

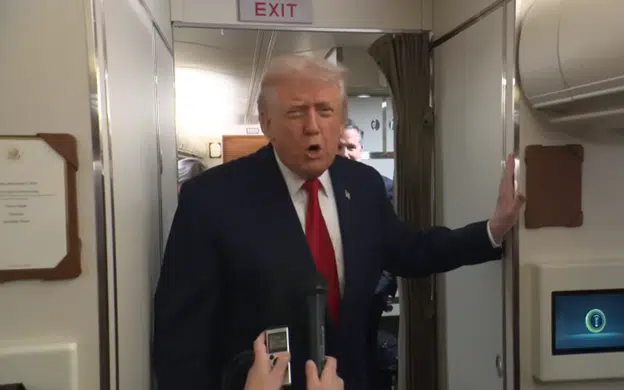

Chief Justice John Roberts’ refusal to rein in this destructive force will have immediate and lasting reverberations. First, Roberts’ decision singlehandedly turned a 5-4 overruling of U.S. President Barack Obama’s socialized medicine monstrosity into a narrow upholding of its “constitutionality.”

“Obamacare” – which will impose $800 billion in new taxes, add $2 trillion to the national debt and raise health insurance costs by an average of $2,100 per family – is now poised to wreak havoc on a nation that’s already suffocating under high taxes, crippling deficits and a devalued dollar.

Obviously this is a catastrophic outcome – yet it pales in comparison to the long-term damage done by this decision.

By declaring Obamacare’s individual mandate to be a “tax,” Roberts has not only endowed the federal government with sweeping new revenue-generating authority, he’s endowed it with the authority to dictate private purchases.

“It might be hard for Congress to put through a tax on not buying The New York Times or not buying broccoli, but that will be only a political check not a constitutional one,” says Ilya Shapiro, senior fellow in constitutional studies at The Cato Institute.

Indeed, as Roberts specifically noted in his ruling “it is not our job to protect the people from the consequences of their political choices.”

Is that accurate, though? Have prior Courts not protected citizens from such “consequences” on numerous occasions? In fact were it not for such protections, wouldn’t the federal government still view African-Americans as three-fifths human? Or women as ineligible to vote?

It is precisely the duty of the Court to block such overreach – yet rather than fulfill this responsibility Roberts has permitted government to slip its tentacles deeper into our private lives than ever before. Make no mistake: Under the taxing authority now available to the federal government any American can be compelled to purchase any product at any time – or face whatever financial penalty our overlords deem appropriate.

Obviously we won’t see mandates compelling Times subscriptions or broccoli consumption – at least not initially. What will we see? Mandates compelling the purchase of solar panels in our homes, ethanol fuel in our vehicles or vaccinations in the arms of our children.

Wherever and whenever government sees a new politically correct end to achieve, it will exercise its “taxing authority” in an effort to achieve it. In fact it’s not hard to envision citizens using their government-mandated smart phones to count calories while sweating through a government-mandated two-mile daily walk. And to make these required constitutionals easier we’ll all soon be compelled to purchase only skim milk, light beer and fat free ice cream.

But are mandates that dictate consumption really taxes?

“I absolutely reject that notion,” Obama said in 2009 as he pushed his signature legislation through the U.S. Congress.

Of course that was his answer. After all, Obama promised not to raise taxes on Americans making less than $250,000 a year – something his socialized medicine law does on at least a dozen different occasions. But Obama was correct at the time. The individual mandate wasn’t a tax, it was a mandate – prior to Roberts’ fateful ruling, anyway. Now it is much more than just a tax – it is a gateway to unprecedented government control over our lives.

“What is left?” Justice Antonin Scalia asked several months ago as the Court heard oral arguments for Obamacare. “If the government can do this, what can it not do?”

The answer to that question is as simple as it is terrifying: Nothing.

The author is chairman of Americans for Limited Government.