This time however, instead of buying mortgage-backed securities or U.S. treasuries, the Stanford trio wants Fed head Ben Bernanke to begin making purchases in the $3.7 trillion state and municipal bond market.

Since these bonds often fund infrastructure projects, they argue that this will create more jobs — the central bank’s stated intention in its prior efforts — than by buying $480 billion of mortgage debt every year as in the newly announced QE3.

Really, though, it would just be yet another bailout of state and local governments, which have been hit hard in the recession with revenues plummeting on the heels of diminished property values. Moreover, it would further erode any concept of value in the dollar.

During the Obama Administration, the federal government has already spent $344.7 billion bailing out state and local governments through various “stimulus” efforts offered when Democrats controlled both houses of Congress.

This put off the necessary cuts needed at the state and municipal level, creating a perverse incentive for lawmakers to ignore their fiscal troubles and believe in the D.C.-inspired delusion that these jobs could be “saved.”

The bailout included the $173.6 billion Build America Bonds program, a Treasury program subsidizing 35 percent of interest payments on state and local government debt, $103.1 billion for Medicaid spending, plus another $68 billion for government workers. However, the bond program ended in 2010, the last of the Medicaid money was spent in 2011, and most of the money for bailing out government jobs had already been spent by the close of the fiscal year that ended on July 1, 2010.

Since that time, state and local governments finally shed 358,000 jobs, a 5 percent drop from its June 2010 level of 19.5 million, according to data compiled by the Bureau of Labor Statistics. That means each job “saved” from 2009 through 2010 cost approximately $962,849.

Grundfest, Lemley, and Triantis claim it was 1 million government workers that were lost since 2010 — a number that can only be reached by counting more than 400,000 temporary federal Census workers from that year, plus another 237,000 federal layoffs since that time. They will not be hired back no matter how many municipal bonds the Fed buys.

One wonders if they’d still support a Fed muni-buy if they realized 64 percent of their perceived crisis was on account of a computation error — but we won’t let the details get us bogged down. After all, it could have just been a purposeful distortion on their part to bolster their case.

Besides, the reason for the Fed to buy state and municipal bonds — or other forms of government debt — has less to do with meeting ordinary operating expenses including employment anyway, let alone creating jobs. Although those expenses are substantial, with states facing a $28 billion funding shortfall this year alone.

The actual point would be to shore up some $3 trillion of unfunded public pension and health care liabilities state and local governments will owe, as calculated by Northwestern University Professor Joshua Rauh and Pacific Research Institute’s Steven Greenhunt. Those are the real cost drivers of muni debt.

Add to that the $21 billion in additional unfunded mandates imposed on states by ObamaCare to add 15.9 million people to Medicaid rolls from 2014-2019 alone, according to the Kaiser Family Foundation. Kaiser’s estimate assumes that the federal government will pay for about 95 percent of the $464.6 billion Medicaid expansion through 2019, as opposed to the current 57 percent.

That comes atop another $224 billion approximate annual spending already owed by states on Medicaid.

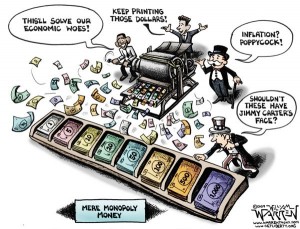

In short, the fiscal crisis that states face is set to move beyond being unsustainable to becoming simply insurmountable. And so, Grundfest, Lemley, and Triantis want the Fed to fire up its printing presses. This proposal is nothing more than a new system to monetize this flood of welfare spending.

The hitch, they note, is that the Federal Reserve Act only allows the central bank to purchase bonds with six-month maturities at the most, and so, “none of the beneficial effects we predict from QE-Muni can occur unless the Fed is able to buy longer-dated muni paper.”

Therefore, they want Congress to remove the maximum six-month limitation, which has been in effect for almost a century since the adoption of the Federal Reserve Act in 1913.

As if the limit would stop the Fed. In the age of computer trading algorithms, helping bankrupt states like California and Illinois roll over ever-larger sums of debt every six months into perpetuity would be a cakewalk for the central bank. It helps the U.S. Treasury do that practically every week with short-term issues.

In other words, if the Fed were intent on purchasing muni debt, it would just do so under existing law. And that’s the problem.

Instead of removing the six-month limit, Congress should repeal the Fed’s power to purchase the debts of state and local governments altogether — post haste. It might also consider axing the power to buy foreign debt, too, as Europe circles the edge of the Abyss.

Political support for more “stimulus” bailouts for state and local governments — which fails to produce jobs — has collapsed in Congress. As New York Senator Chuck Schumer is fond of noting to Mr. Bernanke, “the Fed is the only game in town.”

If this trial balloon is being floated by the Ivory Tower in the pages of the New York Times, surely it is already an option on the table being considered by the Fed in the halls of its D.C.-based headquarters in the Eccles Building. This is as clear a signal as any it may finally be happening.

California and Illinois, which refuse to get their fiscal houses in order, are already teetering on the brink of default. Once the crisis begins, there will be nothing to stop the Fed from expanding its balance sheet yet again to bail them out. Which means Congress needs to act immediately to stop this farce before it begins.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.