Since 2009, the working age population has increased by 11.4 million people, and yet, in all that time, only 2.15 million of them have found jobs.

The rest of them, more than 8 out of 10, are not officially unemployed, according to data compiled by federal government’s Bureau of Labor Statistics. They never technically entered the labor force. So bad is their current predicament, they are not even looking for work.

If the labor force participation rate had held steady, 6.2 million of the 11.4 million would have entered labor markets. Another 5.5 million or so of them would have found jobs.

But they didn’t.

“Every year, millions of potential workers are being displaced in the Obama economy, with no end in sight. This is a depression of sustained high joblessness, and no amount of sugarcoating can change what going forward is a very bleak outlook,” Americans for Limited Government president Nathan Mehrens remarked in a statement.

It is situation that does not appear to be improving any time soon. In the September jobs report, 133,000 found jobs, and 136,000 left the labor force, Mehrens noted. “As many people left the labor force in September as found jobs, casting doubt on whether we have at all turned a corner in this dismal labor market.”

Some have attributed the overall drop in labor participation to Baby Boomers retiring, however, labor participation of those 65 and older without a disability has actually increased from 21.9 percent in 2009 to 23.7 percent today.

Meanwhile, participation among college graduates 25 years and older has dropped from 77.6 percent to 75.3 percent today, matching an all-time low.

So, older people are working longer as they cannot afford to retire with higher life expectancies, and younger people cannot enter the labor force because the economy is not creating jobs for them. This is exactly the dynamic that has been seen in Europe that has led to dramatic increases in youth unemployment.

Over time these numbers will overwhelm any attempts by policymakers either on the fiscal or monetary side to “stimulate” job growth. The supposition that older individuals retiring will be replaced by younger people may not be such a smooth transition, either.

Meaning, when the Boomers finally do retire, there will be two government dependent classes increasing dramatically: the retired, and the jobless.

For those without work, this is the makings of a permanent underclass. In September alone, the labor force expanded by a meek 73,000, while the population grew by 209,000, a pitiful absorption rate of 35 percent.

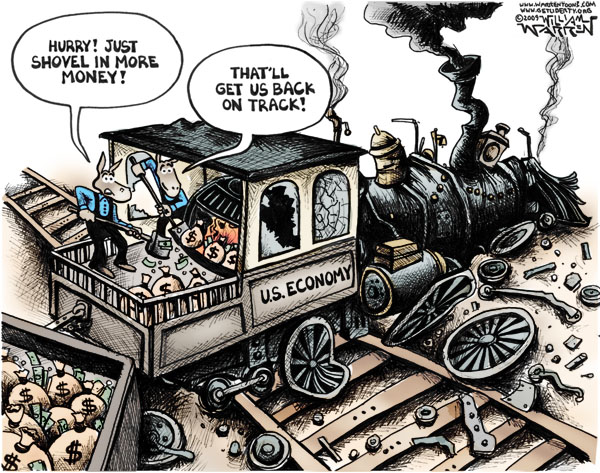

If this continues another ten years, you can expect another 8 million or so to join this lost generation. This is not an indictment of those who are trapped in this vicious cycle. Nor can it be ascribed to a lack of so-called “stimulus.” Since the crisis began, the Federal Reserve has expanded its balance sheet by about $3 trillion.

This conundrum will not be easily solved with simplistic policy that merely treats the symptoms by throwing money at them, but instead will require an in depth, thoughtful approach that addresses the root causes of the credit bubble and the financial crisis that led to the implosion of the job market in the first place.

What that looks like is the topic of another piece. Suffice to say, five years into this depression, for regular Americans who cannot find jobs, we are in worse shape than when we started, with a declining workforce that will never regain the years and productivity lost.

Moments like this in history are not new. It took about ten years or so to work our way out of the Great Depression and the 1970s malaise.

But it took dramatic nation-altering changes to bring about those recoveries. Not until World War II ended and the government gave up control over the economy did the Depression really end. And it was not until the great inflation of the 1970s was slain by the Reagan Revolution did interest rates eventually begin receding, unemployment dropped, and the 1980s boom began.

None of the decisions in either of those cases were by any stretch easy.

The danger now is that we will become complacent to what has been called the “new normal.” It is perhaps the greatest danger of all. Nobody should look at these numbers and believe this status quo is acceptable. The future is not set in stone.

Robert Romano is the senior editor of Americans for Limited Government.