Only 40 percent of respondents in a recent New York Times-SurveyMonkey online poll thought they had received tax cuts under the 2017 tax cut legislation that was signed into law by President Donald Trump.

A separate NBC-Wall Street Journal poll found 28 percent believe they will pay more in taxes.

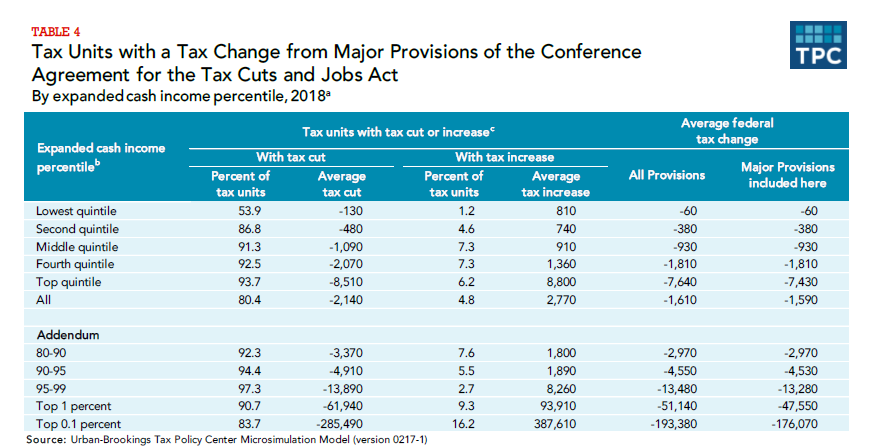

There’s just one problem. Among those who pay taxes, in 2018, 80 percent of all taxpayers got a tax cut under the bill, 5 percent paid more and 15 percent paid about the same, according to analysis of the law by the Tax Policy Center.

So, check your tax return again. Most probably, you paid less in taxes than last year. Doubling the standard deduction and lowering the rates overall captured most taxpayers, and more than offset restrictions to the mortgage interest and state and local tax deductions.

Even the New York Times’ Ben Casselman and Jim Tankersley said that the reason for the wide disparity was because opponents of the law had so effectively, falsely demonized it. Per Casselman and Tankersley, “the gap between perception and reality on the tax cuts appears to flow from a sustained — and misleading — effort by liberal opponents of the law to brand it as a broad middle-class tax increase.”

But it is not true.

One of the biggest reasons for that was Tax Policy Center’s own analysis at the time the legislation was being considered, which found that by 2027, 53 percent of taxpayers would see a tax increase.

But not because of the law.

Because of Senate budget rules, the tax cuts will sunset in 2026. The old rates will go back to where they were. The old deductions will go back into effect. And then by 2027, cost-of-living adjustments — already baked into present law — will technically result in households receiving an insignificant tax increase.

How big? As NPR reported, “the average $50,000 to $75,000-earning household would have a tax bill that’s $30 higher” compared to 2017, when the law was being considered.

So, that one misleading stat, that by 2027, after the law’s rates had already sunset, an unrelated cost of living adjustment would result in an insignificant tax hike, repeated by media outlets and politicians opposed to the bill, was enough to convince a good section of the American people of something that was patently false before the law was ever in effect.

And then after the law was enacted, per Casselman and Tankersley, it was reinforced by how the law took effect: “in contrast to 2001, when President George W. Bush’s Treasury Department mailed rebate checks to taxpayers, last year’s tax cuts showed up mostly in the form of lower withholding from workers’ paychecks. A few extra dollars in a biweekly paycheck proved easy to miss. Moreover, as taxpayers filed their returns, many found they were due smaller refunds than in the past, which may have further skewed perceptions of the law.”

Of course, refunds occur when taxpayers pay more than they actually owe. So, getting a smaller refund, in this case, would be an indication of not having overpaid as much.

What is astonishing is that anybody can be convinced that they are paying more for something when objectively, they were paying less.

Nice propaganda mill there on the left. Undoubtedly, it’s the same one that convinces some seniors that Republicans are cutting Social Security and Medicare even as the monthly checks keep showing up.

But in the end, the best advocates on behalf of taxpayers will be themselves. So, double-check your tax returns from this year and last. Some of you will have paid about the same, and very few, about 5 percent will have paid more. But the vast majority, about 80 percent, should be seeing that you paid less.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.