It looks like the odds that a recession will occur before the presidential election in Nov. 2020 are dropping.

That’s undoubtedly great news for the American people economically, if disappointing to those hoping to oust President Donald Trump next year.

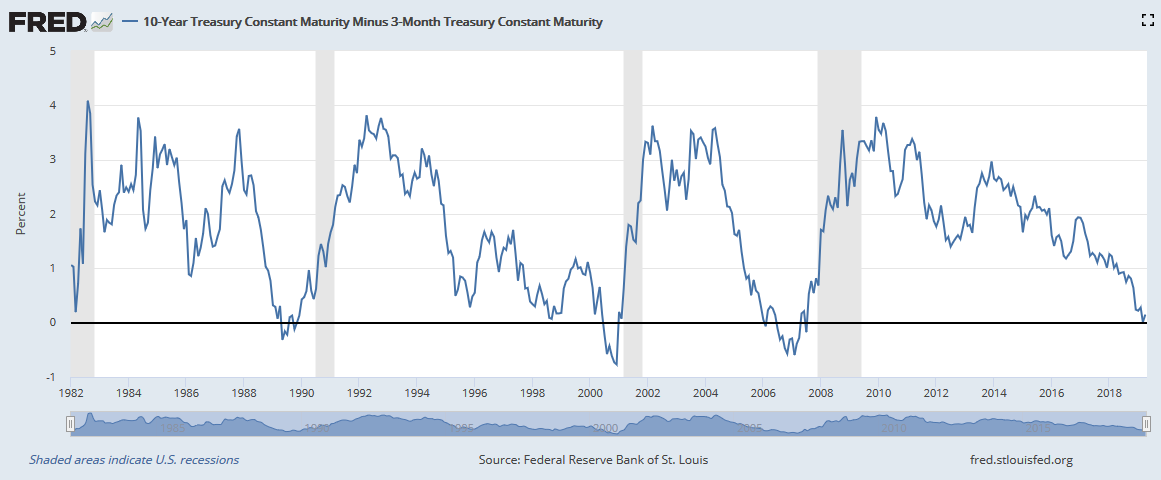

A month ago, the spread between 10-year and 3-month treasuries inverted briefly from March 22 until March 29, meaning the short-term interest rate was higher than the long-term interest rate, leading many analysts including this author to question whether a recession was on the horizon.

The rationale behind the worry is sound enough. Short-term and long-term interest rates, such as the 10-year, 3-month, tend to invert some time prior to recessions as demand shifts out of short-term debt to longer-term debt. This occurs because of an expectation that interest rates will drop during a recession, and so investors want to lock in higher, longer-term interest rates now.

A recession ensues anywhere in a range from 8 months to 17 months after the 10-year-3-month inverts — with an average of 13 months — data going back to 1981 suggests. Most recently, that looks at the inversion that began in July 2006 going forward.

But if you look back just a little bit further, you can see it also briefly inverted towards the end of Jan. 2006 before it bounced right back. The more prolonged inversion did not begin for about another six months, and the recession did not begin until the end of Nov. 2008. So, sometimes the inversion can give you a false read or a head fake, if you will.

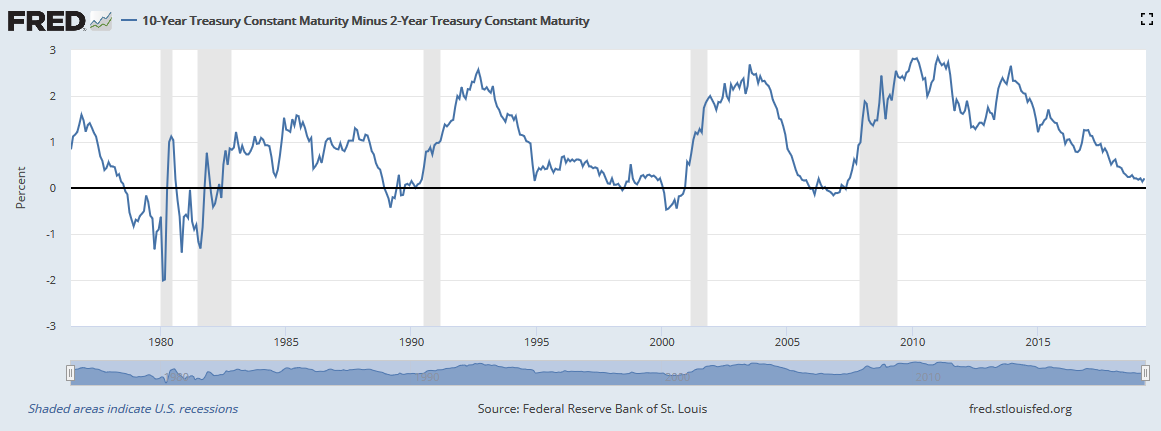

That’s why other data should also be considered when looking for similar recession signals, for example the 10-year, 2-year spread, which has not inverted yet. If a recession were to occur without the 10-year, 2-year inverting, it would be the first time in modern history. So, the fact that it has not yet inverted in the most recent cycle is most certainly good news for the U.S. economy.

Recessions tend to occur on average about 16 months after the 10-year, 2-year inverts, and so even if it were to invert tomorrow, that would not put a recession beginning until perhaps in Aug. or Sept. 2020. But if anything, the 10-year, 2-year spread is rising right now. It got close to inverting in Dec. 2018, down to about 0.1 but now it’s back up to 0.2.

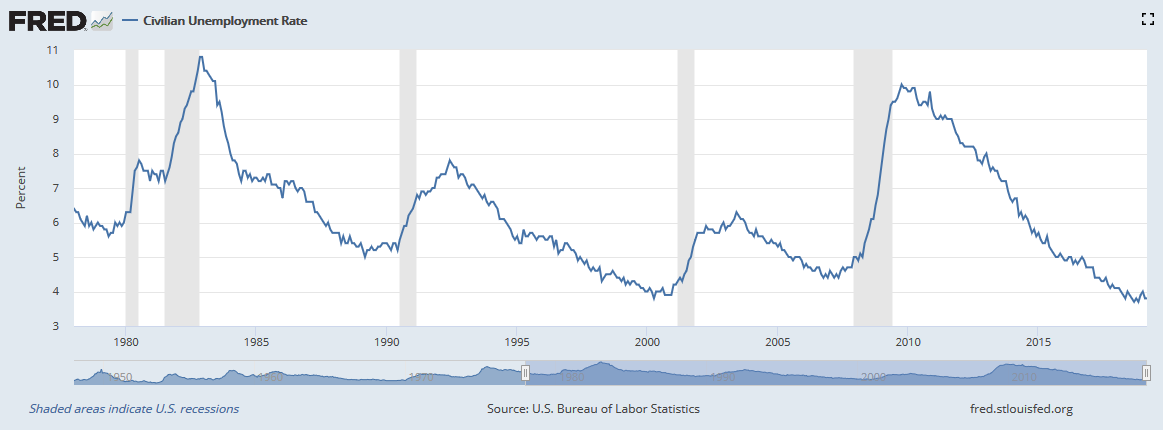

Other indicators that tend to portend a recession include the unemployment rate, which is still quite low at 3.8 percent. Once peak employment has been reached for the first time in a business cycle, a recession comes on average about 11 months later, although in recent history that period has been as long as 16 months. It’s harder to track because you don’t know peak employment has been hit until after the fact and in hindsight. But every time a new low in the unemployment rate is hit, that clock resets.

So, right now, it’s hard to imagine that the rate could get lower than 3.7 percent that was first reached in Sept. 2018, but then again, unemployment claims right now are the lowest they’ve been since 1969, despite the fact that the labor force is twice the size. That’s pretty amazing. This is arguably the best labor market in U.S. history, and the current unemployment rate is most certainly in striking distance of hitting a new low.

The time to start worrying is when the unemployment rate begins to steadily rise over several months, but we’re not there just yet.

Eventually, of course the business cycle will end and there will be another recession. Pinning down when that might be is obviously the source of a lot of debate and speculation. There is no exact science to this sort of forecasting. We look to the charts.

That said, the economy is still performing rather well as we get to end of President Donald Trump’s first term with yet another presidential election cycle upon us. For now, the 10-year, 2-year has not yet inverted and the unemployment rate remains low, and until those things change, it will be difficult to say a recession is imminent. As usual, stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.