A long-standing bit of conventional wisdom holds that the Great Depression, which began in 1929, was worsened and made global by tariffs in the Smoot-Hawley tariff act of 1930, and that it was not until the 1934 Reciprocal Trade Act that recovery was possible.

But this is a caricature, for it leaves out a critical element of the Great Depression that separates it from normal recessions: Deflation.

An example of this myopic caricature can be found at History.com’s article, “The Great Depression Lesson About ‘Trade Wars’,” which follows this narrative but does not mention deflation. It does not even mention unemployment, which should tell you a thing or two. It solely examines the implementation of tariffs, and their impacts, which grossly simplifies the matter and ignores why tariffs were resorted to.

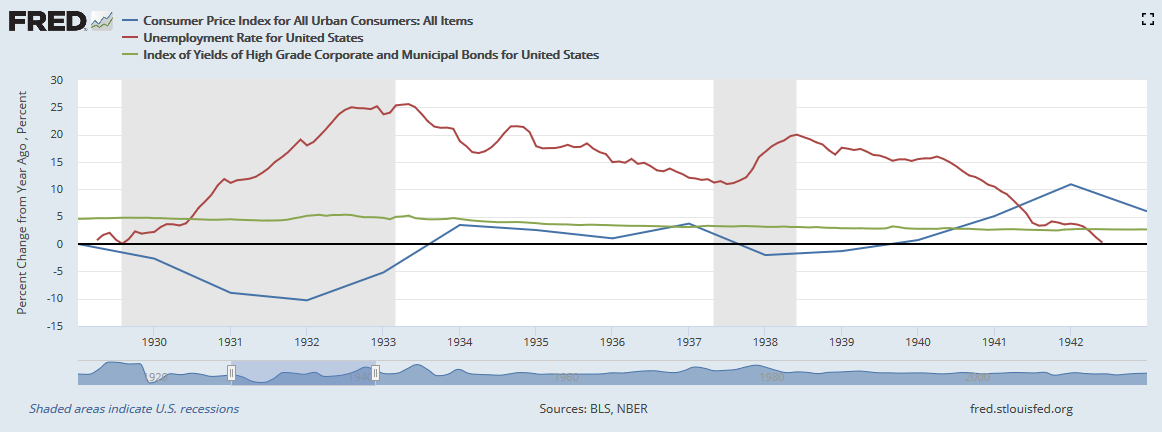

Deflation in the U.S. began after the great inflation of World War I and the ensuing credit expansion, had a brief respite in the 1920s before beginning again in 1927. It then slowed in 1929, and then went crazy starting in 1930 as banks began failing en masse. Inflation was marked at -2.7 percent in 1930, -8.9 percent in 1931, -10.3 percent in 1932 and -5.2 percent in 1933.

As that occurred, unemployment skyrocketed, reaching 11.2 percent by the end of 1930, up to 19.2 percent by the end of 1931, up to 25 percent in 1932 and peaked in March 1933 at 25.4 percent.

It was not until Franklin Roosevelt ended the interwar gold standard in 1933 that some relief was felt as unemployment began collapsing, before spiking again in the 1937 and 1938 recession as deflation ensued again.

In fact, countries that abandoned the gold standard and engaged in currency devaluation and depreciation to combat the deflation saw the quickest recoveries. The countries that were the last to devalue were the worst off, a 1985 paper, “Exchange Rates and Economic Recovery in the 1930s,” by economists Barry Eichengreen and Jeffrey Sachs finds.

The United Kingdom had a similar experience of deflation following World War I, with unemployment rising dramatically in 1921 to 11 percent before dropping and again rising in 1930 to 11 percent. The UK quickly came off the gold standard in 1931, after which unemployment peaked in 1932 at 15 percent, before slowly coming back down.

What was the impact of the devaluations? Eichengreen and Sachs observe, “In all cases of unilateral devaluation, currency depreciation increases output and employment in the devaluing country. By raising the price of imports relative to domestic goods, depreciation switches expenditure toward domestic goods. The increased pressure of demand will tend to drive up domestic commodity prices, moderating the stimulus to aggregate demand and (by reducing real wages) stimulating aggregate supply, until the domestic commodity market clears. The same effect switches demand, of course, away from foreign goods, exerting deflationary pressure on the foreign economy.”

So, because the UK was one of the first major economies to leave the gold standard in 1931, it was ahead of the game. It boosted exports and restored inflation and then unemployment began dropping.

Note that 1931, as the UK went off the gold standard, was the same year inflation in the U.S. went from -2.7 percent to -8.9 percent and unemployment went from 11.2 percent to 19.2 percent. A good question might be what impact the UK’s devaluation in 1931 and other countries leaving the gold standard had on the U.S., which did not devalue and depreciate until beginning in 1933? In that context, the uneven devaluations of certain countries may have exacerbated the Great Depression in other countries that waited to devalue.

Admittedly, this simplifies the matter, but in that context, the move by Roosevelt in 1933 was left with little choice and was certainly a case of competitive devaluation. Per Eichengreen and Sachs, the U.S. “restricted foreign exchange dealings and gold and currency movements, and the following month he issued an executive order requiring individuals to deliver their gold coin, bullion, and certificates to Federal Reserve Banks. From this point the dollar began to float. By setting a series of progressively higher dollar prices of gold the Administration engineered a substantial devaluation. When the dollar was finally stabilized in January 1934 at $35 an ounce it retained but 59 percent of its former gold content.”

By then, the unemployment rate had begun dropping. There would be more rounds of currency battles as remaining gold bloc countries fell off the gold standard. It was not until World War II that the cycle was fully interrupted.

There were other aspects, such as the boom that preceded the bust, fueled by credit. Going to Eichengreen again and Kris Mitchener, this time in 2003, “The Great Depression as a Credit Boom Gone Wrong,” the authors outline how the interwar standard was managed in particular helped in part to facilitate the credit bubble that contributed to the bank failures and ensuing monetary contraction: “focusing on the credit boom of the 1920s directs attention to the role of the interwar gold standard in setting the stage for the slump of the 1930s. Our analysis suggests that equally pronounced credit booms were not a facet of the classical gold standard… the amplitude of credit fluctuations appears to have been less under the pre-1914 gold standard than under the more flexible exchange rate regimes that followed. Evidently, however, the interwar gold standard was different.”

Eichengreen and Mitchener continued, “the strongly procyclical behavior of the foreign exchange component of global international reserves and the failure of domestic monetary authorities to quickly install stable policy rules to guide the more discretionary approach to monetary management that replaced the more rigid rules-based gold standard of the earlier era are important for explaining the fragilities that set the stage for the Great Depression. Previous work has emphasized the role of the interwar gold standard in the post-1929 collapse of foreign-exchange reserves and money supplies and in the international transmission of destabilizing impulses. But the credit boom view suggests that the structure and operation of the interwar gold standard also played a role in the expansion phase, when the endogenous response of the foreign exchange component of global reserves allowed credit to expand more rapidly than would have been possible under traditional gold standard arrangements. This is an important extension of the conventional gold-standard-and-Great-Depression story.”

In essence, there was not enough gold to back up the credit expansion at the chosen exchange rates, which contributed to ensuing monetary contraction.

On the issue of tariffs, in 1932, a year after coming off the gold standard, the UK implemented a pretty hefty tariff. In the years that followed, however, unemployment in the UK dropped from 15 percent to 13.9 percent in 1933 and 11.7 percent in 1934. There was no retaliatory reverberation that worsened the UK’s experience. At that point, the U.S. enacted the Reciprocal Trade Act, and was already off the gold standard, and the competitive devaluations and tariffs could begin to get under control.

In the U.S., it appears policymaker misdiagnosed the problem. Deflation was affecting consumer prices across the board, but at the time, in 1930, the value of imports was dropping even faster than exports, which you’d expect with the formulation offered by Eichengreen and Sachs. Domestic devaluation decreases the prices of exports, and increases the prices of imports. Deflation, on the other hand, does the opposite. Per a CQ Researcher report, “Foreign Trade of the United States,” which notes that in 1930, “The value of American exports during the first nine months of this year showed a drop of 23 per cent from 1929, and the value of imports a drop of 28.5 per cent.”

At the time, policymakers pursuing the Smoot-Hawley tariffs may have thought that normal adjustments such as tariffs would restore domestic consumption. But these were not normal times. Prices kept dropping for domestic goods after the tariff as globally countries were leaving the gold standard. The drop in prices arrested growth as consumption was delayed both for foreign goods and domestic goods. The tariffs could not substitute the changes that were needed in monetary policy. The dollar, relative to foreign currencies that were leaving the gold standard, was too strong. The tariffs were an exercise in futility. They were a response to the deflation, and a failed one.

By 1934, with the Reciprocal Trade Act, U.S. tariffs were reduced from about 60 percent, but only to their pre-war levels of about 40 percent. That is still fairly high. But even with the reduced tariffs, the economy again went into recession in 1937 and 1938, but not because of tariffs, but because deflation had begun again. Deflation was the root cause.

After World War II, the allied countries were able to come to an understanding, not just about tariffs with GATT, but about monetary policy. The competitive devaluations of the 1930s ended and a regime of floating exchange rates was implemented that has lasted. Gold convertibility in the U.S. was finally ended in 1971 when Richard Nixon severed the final tie to gold, setting off the great inflation of the 1970s. Then, the limits of currency devaluation were learned, and policymakers realized you could get high unemployment with too much inflation, too.

After inflation was stabilized in the 1980s, arguably we had price stability, that is, until China entered the World Trade Organization in 2001 with its unstable, artificially cheap fixed exchange rate regime.

If all this history of sounds familiar, that’s because the competitive devaluations of the 1930s closely resemble the policy that China has pursued with its cheap currency fixed exchange standard with the U.S. dollar. By keeping the yuan artificially cheap vis a vis the dollar, China has managed to capture global manufacturing market share in a very short period of time. It made its exports cheaper. It is a non-tariff barrier.

China was granted permanent normal trade relations in 2000 and admitted to the World Trade Organization in 2001. Since then, U.S. global manufacturing market share has dropped from 13.4 percent to 7.5 percent in 2017, according to World Bank data. China has risen from 5.3 percent to 16.6 percent in 2017 as companies moved there, hollowing out the Rust Belt, although their percent of global manufacturing market share has peaked in 2015 at 18.8 percent.

Did this global shift in production towards China play a role in contributing to the Great Recession of 2008 and 2009, which was surely a deflationary period? As Eichengreen and Sachs warned in 1985, “The same effect [of devaluation] switches demand… away from foreign goods, exerting deflationary pressure on the foreign economy.” It is certainly a topic that warrants more study. It seems the true lessons of history from the Great Depression are that unstable global monetary regimes can lead to serious global imbalances.

It also teaches us that other countries’ monetary policies, particularly those of top trading partners, can have an immediate and sometimes catastrophic impact on a domestic economy. We ignore other countries’ monetary policies and shifts at our peril.

The bottom line is that tariffs on their own did not cause the Great Depression, and I believe, personally, not attributing my views to anyone cited here, but that their role is overemphasized. Deflation brought on by the weak interwar gold standard seems to have played a far more critical role.

The tariffs of 1930 might not have helped, by in themselves, do not necessarily set off retaliatory cycles and certain do not adequately explain the conditions that arose in the late 1920s, particularly the deflation. The 1932 tariff by the UK was followed in the U.S. in 1933 leaving the gold standard and then enacting the 1934 Reciprocal Trade Act.

Ultimately, the resolution to the problem after World War II was an international monetary accord. With relatively stable money, GATT could be followed to bring down tariff and non-tariff barriers. The key facet is stability, something we have lacked since China entered the scene in the 2000s with its fixed exchange rate.

In the present case, President Donald Trump is attempting to cure the current imbalances with China in part with the 25 percent tariff on $250 billion of Chinese goods. But that is simply to get China to the table. The tariff is likely an imperfect tool. China can further devalue to offset it, but would competitive devaluation by the U.S. be a better alternative to get China talking or to counteract the effects of China’s fixed rate?

This is the Art of the Deal. Trump is using his leverage while he still can. There is some urgency insofar as nobody can predict when the next recession will hit. But sitting around waiting and hoping that China’s monetary policy won’t have global distortionary reverberations seems folly since it seems to already have had such effects, but also based on the past experience where the countries that did not acclimate to the devaluations abroad had experiences that worsened the Great Depression. If this is not addressed soon, we could all be regretting it.

The important part is this story does not need to end the same way as the 1930s. Regardless of politics, we should all hope Trump succeeds in his negotiations. We need a reciprocal agreement. The root cause is the yuan’s peg to the dollar, which makes the dollar too strong versus the yuan and the U.S. less competitive. In the trade talks with China, currency must be brought front and center for U.S. negotiators — before it is too late.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government. The views expressed, particularly on the issue of tariffs, are his alone.