The price of a barrel of oil briefly fell below zero dollars this week, demonstrating clearly what happens when there is no longer demand for a product or commodity, as tens of millions of Americans are leaving cars in their driveways and airlines are largely grounded. All around the world, it’s much the same situation as the global economy has collapsed in the wake of the Chinese coronavirus pandemic.

In that environment, prices fall, and sometimes they can fall all the way to zero with a sufficient collapse of demand. In the case of oil, there’s simply nowhere left to store the oil being pumped out the ground and as it is, it will take months or longer to clear existing inventories.

Overall, last month consumer prices fell by 0.4 percent led by the drop in energy prices.

This is a flashing red light warning of further economic calamity. Oil is just one example, but a collapse of demand appears destined to affect many sectors of the economy. The one I’m the most worried about at the moment is housing given how catastrophic it was the last time prices began falling on home prices. How many homes are being sold right now? What should happen to prices if there is no demand for new homes because unemployment lasts a lot longer than we would like?

In the last financial crisis, suddenly, homeowners owed more on their houses than those houses could be sold for at the same time they were losing their jobs. Many just stopped paying their mortgages. Financial institutional holders of mortgage securities then stopped receiving payments of principal and interest, and they couldn’t afford to service their own debts and credit markets began seizing up.

8.3 million jobs were lost in that recession, with 6 million foreclosures between 2007 and 2010. Already at least 22 million Americans have lost their jobs in just a month, and it looks like that number will only continue getting worse until states begin reopening over the next couple of months as the virus wanes.

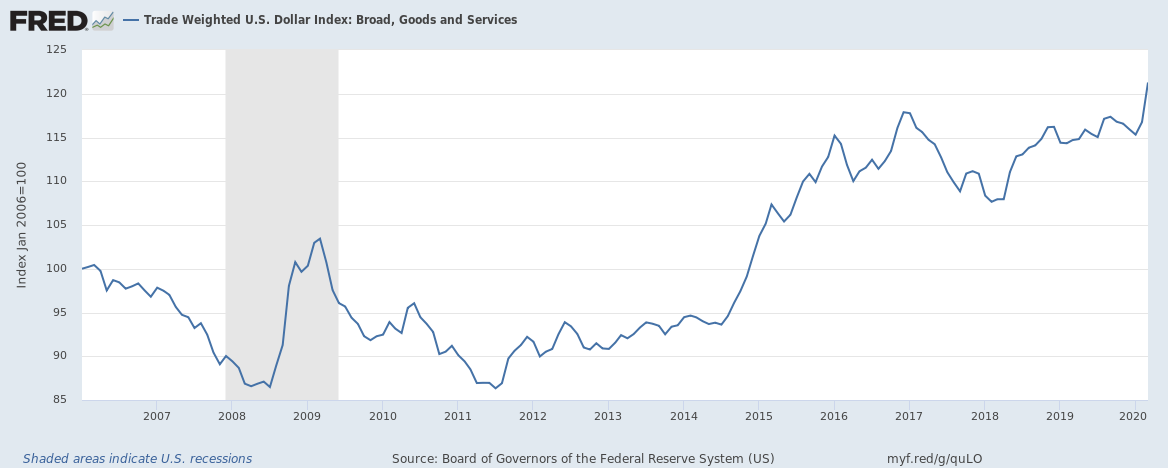

Making matters worse, the dollar was already quite strong relative to other currencies when the pandemic-induced recession began. And, in March, the Trade Weighted U.S. Dollar Index rose to an all-time high as the world poured into U.S. treasuries in a flight to safety. This might be the biggest warning light of all.

The Great Depression dragged on for as long as it did because of the failure to understand the unintended consequences of keeping the dollar exchange rate to gold too high as other economies engaged in massive competitive devaluation and retired the interwar gold standard.

Then as now, deflation was the problem amid collapsed demand, and as long as prices kept falling, unemployment kept on rising. Deflation began after World War I, stopped in the 1920s before beginning anew in 1927 and then went nuts in 1930. Inflation was marked at -2.7 percent in 1930, -8.9 percent in 1931, -10.3 percent in 1932 and -5.2 percent in 1933. As that occurred, unemployment rose dramatically, hitting 11.2 percent by the end of 1930, up to 19.2 percent by the end of 1931, up to 25 percent in 1932 and peaked in March 1933 at 25.4 percent.

Something quite similar already appears to be happening here.

It was not until 1933 when Franklin Roosevelt ended the interwar gold standard that unemployment finally began collapsing down to 11 percent by 1937 before spiking again in the 1937-38 double dip recession as deflation started up again. Ultimately, the ongoing problems were not fully alleviated until the massive mobilization of World War II.

Today we are arguably in the same exact position or maybe even worse with the global economy effectively shut down. The dollar is way too strong, unemployment is rising faster than at any time in history and it is unclear how many businesses will be able to survive being shuttered for more than a month, with states not expected to begin to fully reopen for a few weeks longer. Amid all the uncertainty, financial institutions and central banks are stocking up on U.S. treasuries, which has the perverse effect of making the dollar even stronger.

To combat the deflation, the Treasury could use the CARE Act’s increased Exchange Stabilization Fund, which was boosted to $500 billion from $90 billion to support small and large business lending by also using to quarantine foreign currencies and weaken the dollar relative to other currencies. How?

According to an Aug. 21, 2019 report from the Congressional Research Service, “In addition to its initial capitalization ($2 billion), Congress allowed the ESF to remain outside of annual appropriations. Instead, the ESF retains all of the earnings from its operations. The main limitation on the ESF’s ability to intervene to reduce the value of the dollar is the amount of dollar-denominated assets in its portfolio… In order to secure more dollars for foreign exchange operations, Treasury could (1) seek an additional appropriation from Congress;(2) monetize its holdings of IMF special drawing rights (SDR, an international reserve asset), valued at $50 billion, by temporarily selling them to the Fed; or (3) engage in a currency swap arrangement called ‘warehousing,’ in which the ESF sells foreign currency to the Fed and agrees to repurchase it at a later date, during which the Fed credits dollar reserves to the ESF for the duration of the swap.”

In addition, the Fed could help a lot, as it has all the same powers as the Exchange Stabilization Fund, but without limits. Per the Congressional Research Service, “The Fed can also purchase foreign currencies to reduce the value of the dollar; but unlike the Treasury, it is not limited in how much it can purchase. Because the Fed controls the money supply, it has the option to create bank reserves as desired to purchase foreign currencies.”

Meaning, the Fed could act on its own since the Treasury is currently backstopping American businesses, and could help devalue the dollar from its current all-time highs.

The Fed has already cut interest rates to zero, which should also help in principle, per the Congressional Research Service: “In addition to foreign exchange intervention, economic theory predicts that short-term interest rates, the Fed’s main policy tool, also affect the value of the dollar. The value of the dollar is determined by the relative demand for U.S. goods and services and U.S. assets. In practice, capital flows dwarf trade flows, so the value of the dollar is particularly sensitive to interest rates in the United States relative to the rest of the world. Foreign capital can only flow into the country on net (i.e., when foreign purchases of U.S. securities or physical capital exceed U.S. purchases of foreign securities or capital) through the exchange of foreign currency for dollars. Theory predicts that if the Fed lowers interest rates relative to the rest of the world, it would reduce the demand for U.S. capital, thereby reducing the value of the dollar. This is one of the standard channels through which lower interest rates stimulate the economy. Although U.S. interest rates are currently low, they are even lower for many major trading partners.”

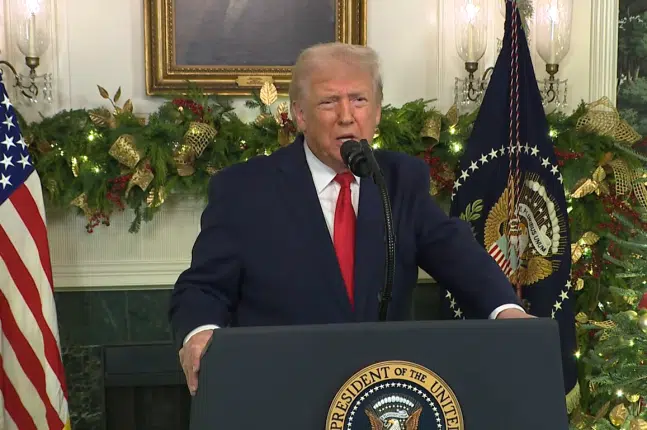

But if the Fed refuses to intervene to keep the dollar’s value stable — again, it just hit an all-time high — President Donald Trump needs to pay attention. Congress has already acted to increase the size of the Treasury Exchange Stabilization Fund but with the program currently invested in payroll protection, its ability to intervene in foreign exchange markets is limited at the moment.

The President could direct Treasury Secretary Steven Mnuchin to work with the Federal Reserve Board of Governors to engineer a devaluation, using the boosted the Exchange Stabilization Fund to buy foreign exchanges and then selling them directly to the Fed. Or get the Fed to unlock its own exchange stabilization powers and conduct those operations directly. As long as the dollar keeps rising, based on past experience, unemployment could keep increasing — even after states reopen their economies.

In fact, the Fed has already authorized this practice, known as warehousing, to occur, in its Jan. 2017 meeting: “the Committee authorizes the Selected Bank, with the prior approval of the Subcommittee and at the request of the United States Treasury, to conduct swap transactions with the United States Exchange Stabilization Fund established by section 10 of the Gold Reserve Act of 1934 under agreements in which the Selected Bank purchases foreign currencies from the Exchange Stabilization Fund and the Exchange Stabilization Fund repurchases the foreign currencies from the Selected Bank at a later date…”

Everything should be on the table. What is occurring right now could be the greatest economic emergency since 2008 and 1929, and so far the federal government is focused rightly on preserving American jobs on the fiscal side of the equation. But on the monetary side, far more aggressive action is needed by the Fed and the Treasury to stabilize the dollar amid falling prices. Oil markets are just the beginning. Deflation is not to be trifled with, and the longer action is postponed, sadly, the worse it will get, and everything that is done in the end will be everything we should have been doing from the get-go. The dollar was already way too strong before the pandemic, and it is most certainly too strong for this recession, Mr. President. Act now while you still can.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.