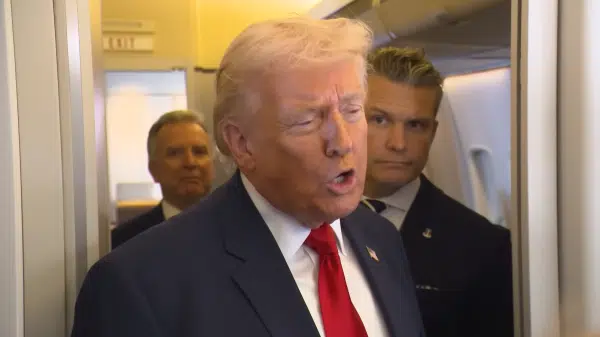

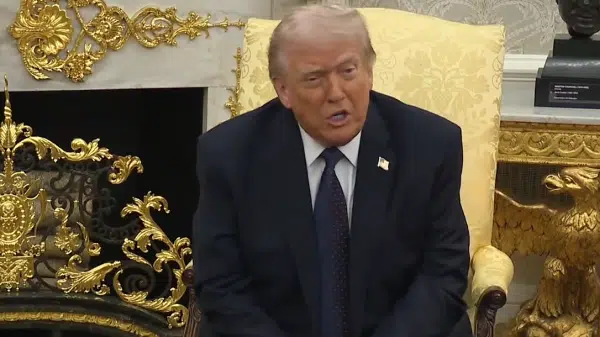

President Trump Says High Oil Prices ‘Small Price To Pay’ For ‘Destruction Of The Iran Nuclear Threat’

By Robert Romano As the Iran War entered its second week of major combat operations, crude oil prices continued their massive spike, briefly surging above $119 a barrel — currently at $92 a barrel as of ...

President Trump Is Working On A Powerful Solution To Healthcare Costs

By Manzanita Miller While the recent conflict between the U.S. and Iran is front and center in early March and will no doubt have a massive impact on the midterm election cycle, domestic issues must ...

If You Think The Iran Oil Shock Is Bad Now, Imagine How Bad It Would Have Been If They Ever Got Nukes

By Robert Romano The unemployment rate once again increased to 4.4 percent after decreasing for two consecutive months, as the unemployment level jumped 208,000 to 7.57 million, according to the latest data compiled by the U.S. ...

Cartoon: No More Waiting

By A.F. Branco Click here for a higher level resolution version.

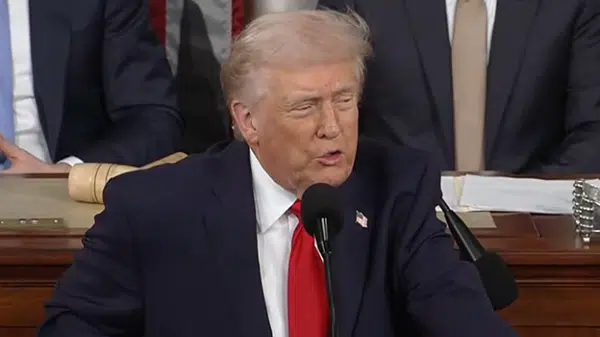

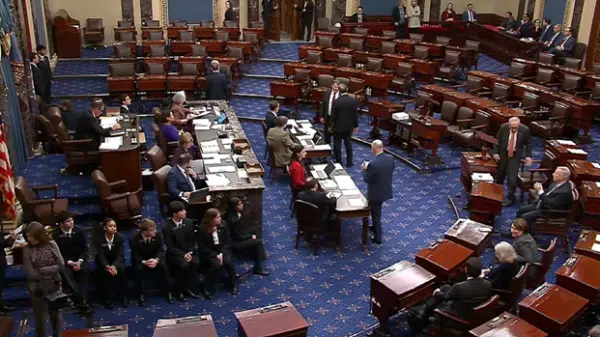

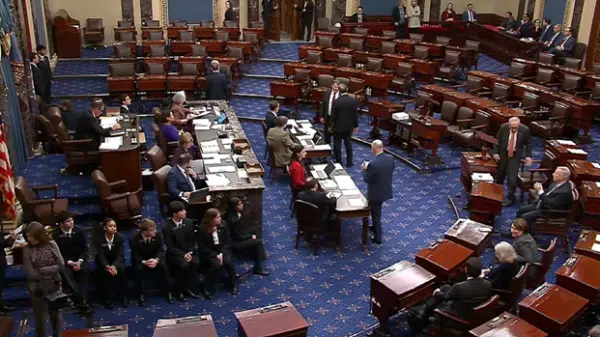

Democrats’ War Powers Resolution To Ban U.S. From Defending Itself Against Iran Fails

By Robert Romano Senate Democrats’ War Powers Act resolution against the U.S. war in Iran has failed, with just 47 senators in favor and 53 opposed in what was largely a party line vote, with Democrats ...

Poll: Over 75 Percent of Americans Support Military Action Against Iran, But Only If Conflict Lasts Days Or Weeks

By Manzanita Miller The way the public views the war with Iran is complex and rapidly evolving, but a March 3 CBS News-YouGov poll shows a full 76 percent of Americans support military action against Iran ...

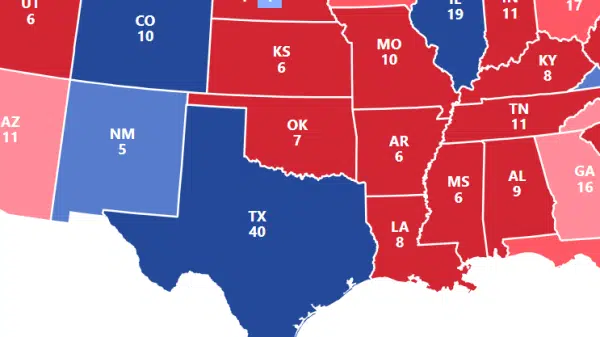

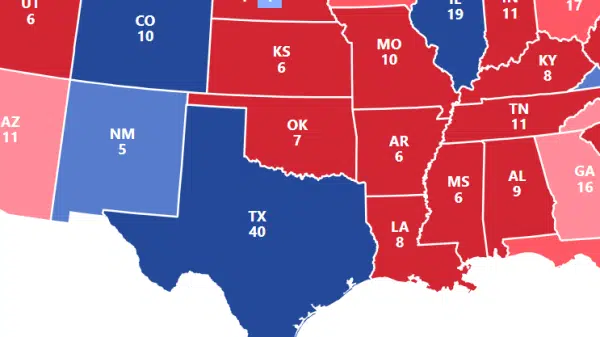

Texas Democrats Overperform Republicans In Senate Primary Voting 2.2 Million To 2.07 Million

By Robert Romano Texas Democrats got more voters to the polls for their Senate primary than Republicans did, 2.22 million to 2.07 million with Democrat James Talarico defeating U.S. Rep. Jasmine Crockett 1.17 million to 1.02 ...

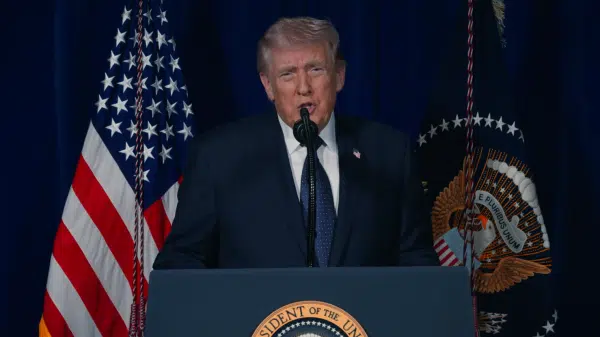

President Trump Promises To Protect The Shipping Lanes As Oil Prices Surge And Iran Targets Middle Eastern Oil Producers

By Robert Romano Light sweet crude oil surged to a high of $78 before slipping back to $73, and Brent crude oil to $81 before dropping back to $78, in trading on March 3, as markets ...

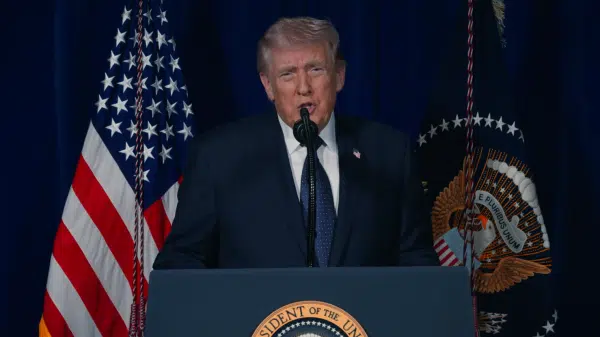

Finish The Job, Mr. President: End Iran’s Revolution Once And For All

By Robert Romano President Donald Trump on Feb. 28 directed the U.S. military to use force against targets in Iran to further degrade its nuclear and missile capabilities, to defeat its forces and to prevent them ...

Cartoon: The Lion

By A.F. Branco Click here for a higher level resolution version.

President Trump Says High Oil Prices ‘Small Price To Pay’ For ‘Destruction Of The Iran Nuclear Threat’

1

President Trump Is Working On A Powerful Solution To Healthcare Costs

2

If You Think The Iran Oil Shock Is Bad Now, Imagine How Bad It Would Have Been If They Ever

3

Cartoon: No More Waiting

4

Democrats’ War Powers Resolution To Ban U.S. From Defending Itself Against Iran Fails

5

Poll: Over 75 Percent of Americans Support Military Action Against Iran, But Only If Conflict Lasts Days Or Weeks

6

Texas Democrats Overperform Republicans In Senate Primary Voting 2.2 Million To 2.07 Million

7

President Trump Promises To Protect The Shipping Lanes As Oil Prices Surge And Iran Targets Middle Eastern Oil Producers

8

Finish The Job, Mr. President: End Iran’s Revolution Once And For All

9

Cartoon: The Lion

10Subscribe

Archives

YouTube

Search

Latest Statements

Latest Statements

- An Urgent Update To Our Union Bosses Vs. MAGA White Paper March 4, 2026

- If Democrats’ War Powers Resolution Were To Become Law, It Would Be Illegal To Protect U.S. Forces In The Region March 1, 2026

- ALG Urges Congress To Give The President And Military Everything It Needs To Win February 28, 2026

- President Trump Should Just Repackage The Tariffs And Use Embargoes In The Meantime February 20, 2026

- We Don’t Just Need Disclosure, We Need Proof February 20, 2026

in Politics

- related

Cartoon: No More Waiting

Cartoon: No More Waiting

Democrats’ War Powers Resolution To Ban U.S. From Defending Itself Against Iran Fails

Democrats’ War Powers Resolution To Ban U.S. From Defending Itself Against Iran Fails

Poll: Over 75 Percent of Americans Support Military Action Against Iran, But Only If Conflict Lasts Days Or Weeks

Poll: Over 75 Percent of Americans Support Military Action Against Iran, But Only If Conflict Lasts Days Or Weeks

Texas Democrats Overperform Republicans In Senate Primary Voting 2.2 Million To 2.07 Million

Texas Democrats Overperform Republicans In Senate Primary Voting 2.2 Million To 2.07 Million

in Economy

- related

Private Sector Grew At 2.78 Percent In Fourth Quarter Of 2025 In Spite Of Schumer Shutdown

Private Sector Grew At 2.78 Percent In Fourth Quarter Of 2025 In Spite Of Schumer Shutdown

There’s Always Trade Embargoes, Mr. President

There’s Always Trade Embargoes, Mr. President

Americans Project Rising Economy And Markets Over Next Six Months Thanks To President Trump

Americans Project Rising Economy And Markets Over Next Six Months Thanks To President Trump

Break-Even From Bidenflation Moves Up To End Of 2026 From Mid-2027 As Inflation Cools Again

Break-Even From Bidenflation Moves Up To End Of 2026 From Mid-2027 As Inflation Cools Again

- related

President Trump Promises To Protect The Shipping Lanes As Oil Prices Surge And Iran Targets Middle Eastern Oil Producers

President Trump Promises To Protect The Shipping Lanes As Oil Prices Surge And Iran Targets Middle Eastern Oil Producers

EPA’s Zeldin Guts 2009 Obama Carbon Endangerment Finding As U.S. Increases Electricity Production 4.5 Percent In 2025

EPA’s Zeldin Guts 2009 Obama Carbon Endangerment Finding As U.S. Increases Electricity Production 4.5 Percent In 2025

The First Real Earth Day

The First Real Earth Day

Is Al Gore Committing Criminal Climate Fraud?

Is Al Gore Committing Criminal Climate Fraud?

Most recent

-

President Trump Says High Oil Prices ‘Small Price To Pay’ For ‘Destruction Of The Iran Nuclear Threat’

President Trump Says High Oil Prices ‘Small Price To Pay’ For ‘Destruction Of The Iran Nuclear Threat’ -

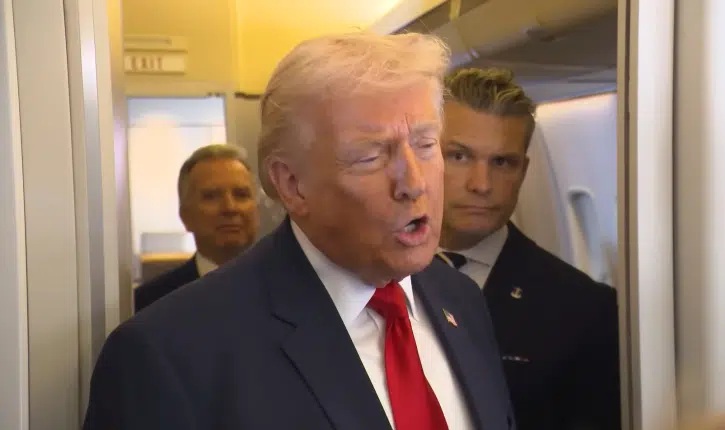

Trump Has Had A History Of Being No-Nonsense With World Leaders, Is Cuba’s Leader Next?

Trump Has Had A History Of Being No-Nonsense With World Leaders, Is Cuba’s Leader Next? -

Trump Talks About Potential “Deal” With Cuba After Calling For “Unconditional Surrender” In Iran

Trump Talks About Potential “Deal” With Cuba After Calling For “Unconditional Surrender” In Iran -

As We Break Down #Iran We Get An Update From Secretary #hegseth

As We Break Down #Iran We Get An Update From Secretary #hegseth -

President Trump Is Working On A Powerful Solution To Healthcare Costs

President Trump Is Working On A Powerful Solution To Healthcare Costs

Trump Talks About Potential “Deal” With Cuba After Calling For “Unconditional Surrender” In Iran

Trump Talks About Potential “Deal” With Cuba After Calling For “Unconditional Surrender” In Iran As We Break Down #Iran We Get An Update From Secretary #hegseth

As We Break Down #Iran We Get An Update From Secretary #hegseth U.S. Degrades Iran’s Fighting Power In Near Entirety As Tehran Fights To Raise Gas Prices

U.S. Degrades Iran’s Fighting Power In Near Entirety As Tehran Fights To Raise Gas Prices President Trump: Our Objectives In Iran

President Trump: Our Objectives In Iran