“The first in order of time is individual insurance . . . the second, a variety of employee benefit plans of which Group insurance is an outstanding American contribution; and the third, social security–designed by the government for the well-being of our fellow citizens . . . Each has its own function to perform and need not, and should not, be competitive with the others. When soundly conceived, each class of insurance can perform its role better because of the other two classes. Properly integrated, they may be looked upon as a three-legged stool affording solid and well-rounded protection for the citizen.” –– Reinhard A. Hohaus, 1949, former member of the U.S. Senate advisory committee on Social Security, in describing that a successful retirement plan for Americans would mostly be provided for by private sources.

Two massive bureaucratic entitlement programs – Medicare and Social Security – will become bankrupt in 2014 and 2041, respectively. Yet another “shock” to those who think that Big Government can create Big Programs that will “pay for themselves” – rather than simply create more Big Problems.

Nothing, of course, could be further from the truth. And we should be reminded of pyramid scams which cruelly promise rewards that cannot be delivered in the end:

“The Social Security trust fund will run out of assets in 2041, the program’s trustees said today, repeating an earlier projection. And spending on Medicare will reach a legal limit much sooner — by 2014 — requiring the next president to propose changes to avert the first train wreck.

“’As the baby boom generation moves into retirement, these programs face progressively larger financial challenges,’ Treasury Secretary Henry Paulson, one of the trustees, said at a press conference today. ‘The Medicare program poses a far greater financial challenge than Social Security.’”

In other words, the systems which were created were supposed to be financed by the workers, but once utilized by those that paid the most into the system, Social Security and Medicare will be under unsustainable strain.

This means that today’s younger generation is going to have to find new ways to pay for their own cost of living and that of retirees. Clearly, an impossible task.

This is not surprising with the benefit of hindsight. The creation of massive government monstrosities like Social Security and Medicare, as designed, never could have been made to work.

When Germany implemented its elderly pension program in 1881, it set up the retirement age at 70 – but the average life expectancy was only about 45! In the U.S., when Social Security was set up, the retirement age was set to 65 – but with the average life expectancy only 60! So the sad fact is: these were scams right from their inception. Now, with the average life expectancy is 77.6, the chickens here have not only come home to roost – they have laid a momentous egg!

To make matters worse, when Social Security was founded, the ratio of workers to retirees was about 30:1. Today, it is closer to 3:1, and that is narrowing. By the time the younger generation retires, the number will be about 2:1. And as government has now finally conceded: both will be bankrupt before then.

This is not what was promised by Social Security’s founders in particular, which was supposed to pay back the money that an individual put in. It was never intended to be the sole source of retirement income, which also must include private pensions and individual savings and investments.

Plus, it offers a terrible rate of return to today’s workers (presently about 2%) – well below market value. The people should be allowed to use individual accounts, such as proposed by CATO in “The 6.2% Solution”, which would offer a far greater rate of return.

Medicare too is becoming crippled similarly because of the rise in life expectancy, and also because of the sky-rocketing costs of healthcare – which are fueled in part by inflation, but also ironically in part because of the monopoly on healthcare which Medicare and Medicaid created in the first place. As Michael Hihn noted in 1994 when he was criticizing Hillary-care:

“Since 1965 [when Medicare was enacted], health costs have more than doubled, to 14% of GDP, and are projected to triple by the year 2000. Government now pays over 43% of all medical costs – and shifts billions more to private insurers. From a 1991 CBO report: Medicare was underpaying hospital average costs by 12%. Medicaid was underpaying hospitals by 12%., and paying doctors 31% less than Medicare rates…

“When government underpays, providers shift their costs to private insurers and cash customers.”

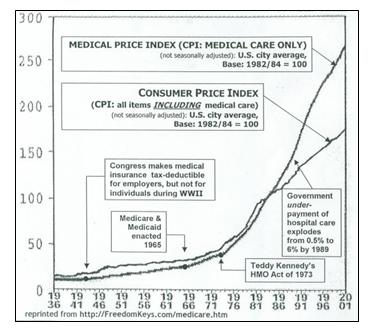

Also, Freedom Keys has provided a useful chart demonstrating the correlation between government-implemented healthcare initiatives like Medicare and the rising medical costs:

Today’s younger generation will never see a penny of what Big Government will invariably ask them to pay into the system. And the Big Government-Big Programs-Big Problems-formula will remain sacrosanct – so long as this failed system remains in effect.

ALG Perspective: Social Security and Medicare never can be – nor were they intended to be – the sole sources of retirement income and elderly medical care. A successful system must include, and place emphasis on, private pensions and individual savings and investments. Structurally, these programs had an initial set of beneficiaries who paid into the system, but over time, the programs were expanded until finally, in the future, benefits will exceed revenues. Individuals need to be allowed to opt out of these failing systems so that they can save their own money for their own retirements and healthcare, and not give much-needed money to Big Government that has already spent all of the money presently invested in the system and does not offer as valuable a rate of return.