It has been argued by critics that the $1.18 trillion debt stimulus, once interest is taken into account, will provide a new baseline for future budgets. And certainly, should the economy not improve in the coming year, neither will revenues both to local and state governments, who in this package receive over $100 billion in funds. They will, in turn, undoubtedly return next year for yet more funds.

Rather than improve the fundamentals of the financial system, Congress is choosing simply to pour inefficient fuel, central government spending, into an ineffective engine: yet more government, and government subdivisions. In the process, it spreads wealth around to special interests—mostly public labor unions—that helped put the Congressmen into power in the first place.

The basic problem with the economy that has gone unaddressed, even through the Year of the Bailout, 2008, was the excessive borrowing and leveraging that was primarily fueled by easy money from the Fed. The nation’s central bank under the Carter era Full Employment Act has had a dual mandate: to keep the currency stable, and to perpetuate economic growth. Over time, the new mandate has been followed to the detriment of the former. Very few politicians have proposed eliminating the dual mandate at the Fed, which to date has caused at least four asset bubbles: tech, housing, commodities, and now, treasuries. The housing bubble was particularly devastating since it had resulted in massive overleveraging of the financial system all over the world, with firms such as Bear Stearns by a factor of about 30-to-1.

True, market forces have dictated that they be reined in, but the causes still remain. To date, the Fed keeps interest rates at record lows and the monetary base at a record high. Congress in turn, is running record deficits—this year it is projected to be anywhere from $1.2 trillion to $2 trillion—with the national debt soaring to $10.7 trillion and probably much larger than that by year’s end. Borrowing from overseas is forced to keep up at a lightning pace with a cycle of diminishing returns for those who deliver the cash to the U.S. Tomorrow, the Treasury will unveil the next installment of TARP, which could cost another trillion dollars. In sum, to make up for the deleveraging—which many analysts try to disguise as “deflation”—government is flooding the economy with as much cash as it can print, borrow, and spend.

It won’t work. The ad-hoc approach that government has taken to date proves beyond any doubt that it is institutionally incapable of reining in its own excesses. The best anyone can say is that if those excesses are not maintained, that the banking and financial system will collapse. Meanwhile, the politicians are scrambling to stop something which they caused but know not how to stop. They claim they are stopping a recession—perhaps even a depression—without stopping to consider that it was that desire that has caused periods of excessive monetary expansion, borrowing, and deficit-spending to date.

In the process, government is mortgaging the future of the nation—on the backs of our children and children’s children—which, when this fails to “fix” the problems caused by massive government interventionism may no longer be a global economic superpower.

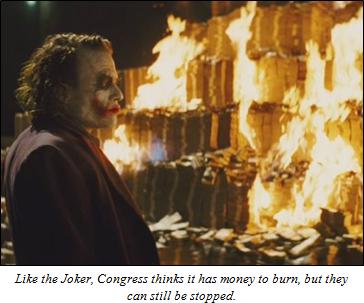

And yet, there is still hope. But it will require political will that heretofore has not existed. Congress can now take a full accounting of its spending habits, have a look in the mirror, and make real changes. It can today defeat the trillion dollar turkey by filibustering, go back to the drawing board, and instead look to the structure of the financial system as governed by the Fed and Treasury that has caused so much destruction to date. It can require that budgets be balanced via constitutional amendment, and that the national debt be paid off—before it is too late and the nation goes bankrupt.

LAR CTA: There is still time to stop the “stimulus.” Concerned citizens should continue calling their Senators, as the Senate Majority still needs 60 votes in order to invoke cloture. The Capitol Switchboard number is (202) 224-3121.