ALG Editor’s Note: In the following featured Press Release, Americans for Tax Reform believe that if Barack Obama really wanted to keep his no tax hikes for middle class promise, he would veto this bill.

Which Tax Hikes in Senate Health Bill Violate Obama’s Tax Promise?

Over and over again, President Obama has promised not to raise “any form” of taxes on families making less than $250,000 per year. Yet, the U.S. Senate is getting ready to consider a government healthcare bill which does just that. Here’s how:

Health Insurance Mandate Taxes on Working Families

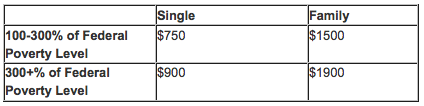

• Individual Mandate Excise Tax. Americans who do not sign up for health insurance will have to pay an excise tax in the following range:

300 percent of the federal poverty line is well under $250,000. For a family of four, it’s $67,000. For an individual, it’s about $30,000.

• Employer Mandate Tax. $400 per employee if health coverage is not offered. Note: this is a huge incentive to drop coverage, as $400 is much less than the average plan cost of $11,000 for families or $5000 for singles (Source: AHIP)

Small businesses pay their tax liability on their owners’ 1040 forms. This $400 employer mandate tax does not hold harmless business owners making less than $250,000

Tax Hikes on Healthcare Spending Accounts

• Cap on Flex-Spending Account (FSA) contributions at $2500: Currently, the contribution level is unlimited

• Medicine Cabinet Tax : Americans would no longer be able to purchase over-the-counter medicines with their FSA, Health Savings Account (HSA), or Health Reimbursement Arrangement (HRA)

• Increase in the Non-Qualified HSA Distribution Penalty from 10% to 20%: This makes HSAs less attractive, and paves the way for HSA pre-verification

There are 30 million Americans with FSAs. About 8 million Americans have an HSA. Virtually all of them make less than $250,000 per year. These are clear tax hike on these families

Denying a Tax Deduction for Medical Costs

• Increase “haircut” of medical itemized deductions from 7.5% to 10% of adjusted gross income (AGI), further denying medical itemized deductions

There is no exemption made here for families making less than $250,000 per year.

If President Obama is serious about his tax pledge, he should immediately renounce the bill.