By Dave Cribbin

In 2009 I listened as one Democratic politician after another stepped forward to endorse the “stimulus,” a bill that was to save us all from what would surely be the next Great Depression. Most of their ill-considered arguments contained copious amounts of economic fallacy seasoned with just a dash of truth to make them palatable. That truth is that if you raise tax rates during a recession you simply get a deeper recession — without raising any additional revenue.

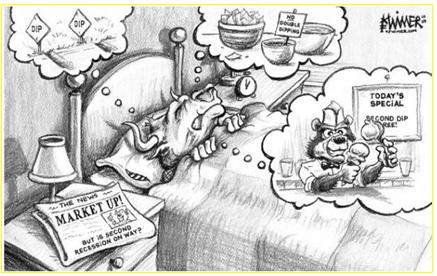

Midway through 2010 with what is at best a tenuous recovery, and without any evidence that government’s spending spree is working, those same folks eying a reckoning with the voters in November are telling us that even more “stimulus” spending is needed. They have now ditched their cover story of not raising taxes in order to fully embrace their inner-redistributionist side. What does this portend for you and I? Six months from now we may experience firsthand how a nation’s economy performs after dramatically increasing tax rates on the incomes and capital that drive economic growth, and devaluing its currency. It ain’t going to be pretty, folks.

If you want a sneak peak of what is in store for 2011 you’ll want to brush up on your economic history. I suggest you start with Herbert Hoover’s tax increase in 1932, the one where he was just raising the rates back to where they were under President Wilson. That increase pushed the top marginal rate of tax on personal income back up to 63% from the 25% rate where Harding’s tax cuts had left them.

Far from producing additional revenue for the treasury it had the opposite effect. Receipts to the treasury from the personal income tax fell from $834 million in 1931 to $427 million in 1932 and $353 million in 1933. In other words, raising the tax rates reduced the amount of revenue the government took in and made the economy worse off in the process. Can anyone spell SNAFU? In light of these facts, might it be time to rethink the tax increases on income and capital scheduled for next January?

If the Bush tax cuts are allowed to expire and tax rates rise next year, the economy will falter, resulting in fewer transactions and a reduction in the demand for money. How will the Federal Reserve respond? Can you see this Fed tightening as the economy falls back into recession? Not a chance! That means we’ll enjoy the additional negative impact that a weaker dollar and higher interest rates have on an economy recently burdened with higher taxes on capital and income. Can you say stagflation?

The historical revisionists in Congress will trot out their favorite talking heads to tell us how they are only raising rates back to the Clinton levels of the 90’s when the economy did just fine. Where have I heard that line before? Of course they will leave out the part where the capital gains tax was cut by 40% in 1997, which just happens to coincide nicely with when the real boom in the economy occurred.

They’ll also forget that there was some semblance of fiscal sanity back then. You remember back when the government’s entire annual budget was only slightly larger than this year’s budget deficit? Nothing their smooth talking experts can say will be able to soothe the real world pain you’re going to experience. How much political hot air does it take to make up for the loss of one’s job?

When the incentives to save and invest are reduced, investor behavior will change accordingly. Expect less capital to be available to business as the rate of tax on that capital is increased.

Less investment will lead to lower production and a lesser need for all things related to production including jobs. I’m just thinking out loud here, but shouldn’t we be considering policies that are pro capital accumulation ? Pro investment and pro growth? Hey, throw in a stable dollar and we could have a boom instead. Wouldn’t that be nice?

Dave Cribbin, President of Tailwind Capital, is a Liberty Features Syndicated writer for Americans for Limited Government.