By Bill Wilson

In 2011, several federal programs providing bailouts to state and local governments are coming to an end. What remains of the $814 billion “stimulus,” which included $145 billion of funding to state and local governments ($56 billion for public sector jobs, $87 billion for Medicaid) will have been spent.

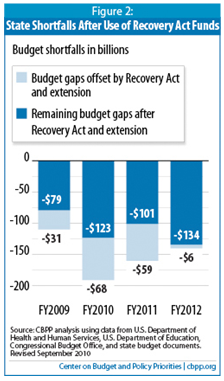

Another $26.1 billion package that passed over the summer of 2010 included $10 billion for public sector teachers unions and $16.1 billion for Medicaid. That money will be spent this year, too. Of federal assistance to states, just $6 billion will remain for Fiscal Year (FY) 2012, according to the Center on Budget and Policy Priorities, which for most states begins on July 1st. Meanwhile, states will likely face $140 billion in shortfalls for that year.

Coupled with the end of the $173.6 billion Build America Bonds program, a Treasury program subsidizing 35 percent of interest payments on state and local government debt, it appears that the day of reckoning has finally arrived for bankrupt states like Illinois, California, and New York.

That means the major cuts in the public sector at the state and local level must begin this summer, and will continue throughout 2012. Barring a miraculous recovery in housing and thus a substantial increase in property tax revenue which funds state and local governments, unemployment will be spiking right during the middle of Barack Obama’s reelection bid.

Or will it? If states are unable to continue to borrow massively from the municipal bond market, the danger now exists that some other entity, like the Federal Reserve, will intervene to bail out state budgets — with printed money — in spite of efforts by legislatures now to scale back spending.

It would be the U.S. equivalent of the European sovereign debt crisis, with the Fed playing the role of the European Central Bank to simply print money to stabilize bankrupt nation-states like Ireland and Greece. Certainly, there are likely candidates for a Fed bailout that will likely have trouble borrowing from the bond market just like the Greeks and Irish.

At least one state, Illinois, wants to forestall the inevitable by borrowing another $15 billion to balance its budget this year. It, like most states, can do so despite having constitutional balanced budget provisions, because of the lack of any restrictions against borrowing. Illinois can go a step even further because of a loophole that allows it to carry deficits over from one year to the next. Only 12 states can do that, including Illinois, New York, and Michigan, according to the National Association of State Budget Officers.

Combined, state and local governments have some $2.8 trillion of outstanding bond debt, as noted by Veronique de Rugy. On top of that, they have about $3 trillion of unfunded public pension and health care liabilities, according to Northwestern University Professor Joshua Rauh and Pacific Research Institute’s Steven Greenhunt. That means these governments have ever-increasing needs to borrow, both to roll over outstanding debt, and to incur new debt to pay out pension and health care benefits to public employees.

Add to that the $21 billion in additional unfunded mandates imposed on states by ObamaCare to add 15.9 million people to Medicaid rolls from 2014-2019 alone, according to the Kaiser Family Foundation. Kaiser’s estimate assumes that the federal government will pay for about 95 percent of the $464.6 billion Medicaid expansion through 2019, as opposed to the current 57 percent.

But if the federal government cannot make good on that promise because of its own fiscal troubles, the states’ tab would increase by about $200 billion (about $33 billion annually) through 2019 instead of the $21 billion. That comes atop another $224 billion approximate annual spending by states on the program. Either way, the fiscal crisis that states face is set to move beyond being unsustainable to becoming simply insurmountable.

The political class, represented by public sector unions like AFSCME, believes that the money’s got to come from somewhere. Dues paid by public employees are the union’s lifeblood, which in turn is the campaign slush fund that Democrats depend on in election years. If public employees are laid off, dues payments to the unions will dry up.

AFSCME donated $87.5 million attempting to elect Democrats in 2010. If the union cannot get another bailout for state and local public employees, what was its investment for?

House Republicans will need to hold the line to make sure that Congress offers no more state and local government bailouts. But even then, they must be prepared to enact legislation that will make it illegal for entities like the Fed to intervene to purchase municipal bonds.

If Fed Chairman Ben Bernanke ignores the clear will of the people, who are demanding spending cuts by governments at all levels, and prints hundreds of billions of dollars to prop up state and local governments, it will be the straw that breaks the camel’s back. It will be time for Congress to consider repealing the Federal Reserve Act — in full.

Bill Wilson is the President of Americans for Limited Government.