By Bill Wilson –

All budget-cutting proposals currently being discussed will do nothing to eliminate the $1.3 trillion annual budget deficit any time soon. The Simpson-Bowles Commission does not foresee a balanced budget until 2037. House Republican proposals to reduce non-defense discretionary spending to FY 2008 levels will save perhaps $66 billion.

These proposals essentially accept that mandatory spending remains at its current $2.1 trillion level, continuing to grow on an annual basis. Without making cuts in so-called mandatory programs, it is impossible to balance the budget. In fact, the entire non-defense discretionary budget of $553 billion could be eliminated, and the budget deficit would still be about $747 billion, as noted by the blog, Mish’s Global Economic Trend Analysis.

A reader, David, writes to Mish, “I went back to the data after getting into one too many arguments with people who claim that we can solve our budgetary problems by eliminating government ‘waste’ — the programs that study the sex lives of jellyfish and that sort of thing — without real cuts in entitlement programs.”

David continued, “Unless the Budget Fairy waves her magic wand, it’s not going to happen.”

David is right. Not only is there no Budget Fairy, unless Congress can find a way to make significant cuts to “mandatory” spending, we’re going to go broke paying for them. Nobody believes that the federal budget is on any sort of sustainable path. By decade’s end, net interest owed on the national debt will total nearly $1 trillion, almost half of current revenue.

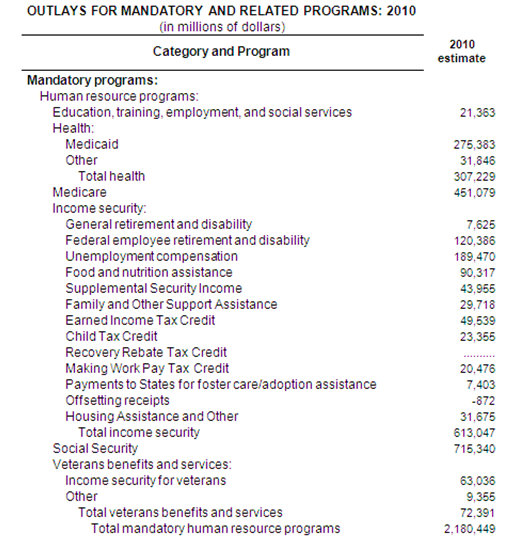

So, what are these mandatory programs? Here follows a chart of those expenses courtesy of the White House Office of Management and Budget:

So, what to cut? For starters, unemployment could be cut by $150 billion, getting back to a more limited approach (less than 6 months) totaling about $40 billion. Food stamps could be cut by $50 billion, the earned income tax credit could be eliminated saving $50 billion, and other tax credits too could be killed saving $43 billion. Medicaid could be cut by $150 billion, as could CHIP by $20 billion, by reducing eligibility (which would require repealing ObamaCare in part). That’s $460 billion roughly in savings.

Add to that $100 billion in cuts to discretionary spending, another $100 billion in defense cuts, and then Congress would be up to $660 billion in savings. Eliminating (or at least defunding) ObamaCare and the “stimulus” saves another $17.5 billion, bringing the savings up to $677.5 billion.

That would cut the budget deficit roughly in half. But how to get such cuts past the Senate and White House? Easy. Attach them to two separate, must-pass votes on the debt ceiling set to be hit on March 31st and the continuing resolution that expires on March 4th.

Then when the House crafts its FY 2012 budget, it can reorganize the entire budget and tax code to get at the rest of the $616 billion deficit. Whole departments and agencies could be eliminated depending on the priorities of the House Republican majority. The $5 trillion Fannie Mae and Freddie Mac could be liquidated. The rest of the bailouts programs could be eliminated, too.

Next, Social Security and Medicare would still need to be restructured by phasing out the programs for Americans 50 years or younger. If they are not reformed, when added together with ObamaCare, they will eat up the entire budget this century. We cannot allow that to happen. To meet the obligations of those 50 years and older, it will be necessary to find a way to pay for them going forward to keep the funds solvent.

But that is not enough. America has to become a good place to do business in again. With over 15 million unemployed, we need to create jobs by rapidly growing the private sector.

Vast swaths of the 650 million acres of federal land could be sold off. Restrictions on oil, coal, and gas exploitation could be rescinded. The shares of bailed-out companies like GM, Chrysler, and AIG could be sold off. The federal workforce could be scaled back by 25 percent or even more as the Baby Boomer generation retires. Taxpayers subsidies for sectors like agriculture could be eliminated.

Finally, the tax code could be flattened at lower rates with exemptions, tax credits, and other subsidies eliminated. America needs to compete globally for capital in the 21st Century, and it needs to become more cost-effective to do business here. We need to be producing things here and creating jobs. A variety of incentives could be placed into the tax code to achieve those ends.

Taken together, these proposals would lead to a dramatic, robust economic recovery, eliminating the rest of the budget deficit as revenues soared and putting the nation in a position to begin paying off the vast $14 trillion debt. This would restore confidence that America intends to honor its obligations and live within its means.

But it cannot be done unless “mandatory” spending is put on the table. There is no Budget Fairy.

Bill Wilson is the President of Americans for Limited Government.