This has become the loaded gun in Barack Obama’s hand.

But there is more than enough revenue to make interest payments even if the debt ceiling is not raised. In 2011, the U.S. is projected to collect $2.174 trillion in taxes. Even if interest payments to Social Security and Medicare are factored in, at most the U.S. has to pay $430 billion in interest this year.

So, the risk of a default is actually zero — unless Obama is threatening not to make interest payments should the debt ceiling not be raised. That is the only true risk at the moment of default.

The true reality, however, is that the rating agencies are really assuming there is a near-term agreement on the debt ceiling. What they are saying is that the longer-term fiscal outlook of the U.S. is what merits a downgrade.

That means if the White House gets what it originally wanted, a clean vote to increase the nation’s credit limit, there is still a 50 percent chance of a downgrade in S&P’s eyes. As reported by Bloomberg News, “The U.S.’s long-term rating may be lowered by one or more notches into the AA category in the next three months if S&P concludes Congress and President Barack Obama’s administration haven’t achieved a credible solution to the rising government debt burden and aren’t likely to achieve one in the foreseeable future, according to a statement.”

This news should actual strengthen the House’s hand as it considers what to send to the Senate. After all, it is more than likely the $14.294 trillion debt ceiling is going to be raised. The only question is under what conditions. S&P is saying we need a long term solution to the debt crisis.

Supporters of the “Cut, Cap, and Balance Act,” including Americans for Limited Government, want any increase in the nation’s borrowing limit to only be in exchange for hundreds of billions of immediate spending cuts, a statutory spending cap of no more than 18 percent of the Gross Domestic Product, and passage by both houses of Congress of the Balanced Budget Amendment.

The “Cut, Cap, and Balance” approach is by far the strongest proposal out there in the context of the disagreeable task of increasing the debt ceiling, and would give the American people a balanced budget this decade.

That would in turn position the U.S. to begin paying down the $14.5 trillion debt before it gets too large to service. “Cut, Cap, and Balance” is the only proposal that achieves this critical metric.

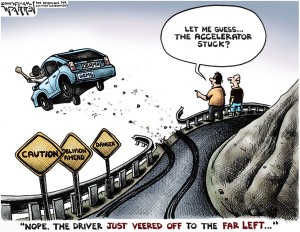

The alternative is unthinkable, where the debt is increased without any preconditions, or worse, with tax increases that will further sink the economy. Worse, it will lead to a future where the when the debt becomes so large it cannot be refinanced, default will be the only option.

Right now, the nation’s total debt to service ratio, principal plus interest as compared to revenue, is already 41.7 percent. That’s a $900 billion average a year over thirty years. If Congress waits until 2021 to get the nation’s fiscal house in order, when the debt will total $26 trillion and interest will have simply normalized to 5 percent, annual debt service will total $2.167 trillion on average over thirty years.

If the economy does not improve as dramatically this decade as the government has predicted, and say tax revenue only rises to $3.5 trillion by 2021, the total debt service ratio will be 61.9 percent.

By then, one will scarcely be able to find a single person who believes the debt could ever be repaid in full.

The “Cut, Cap, and Balance” legislation is the only plan on the table that provides the reasonable assurance that a catastrophic default might be avoided in the near future. Every other plan being considered accepts the doom that awaits us on the horizon.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.