By Bill Wilson — According to conventional wisdom, one of the benefits of a weak dollar is that it boosts exports, thereby reducing the trade deficit. But is that true?

Since the weak dollar — the world’s reserve currency — also has an inflationary effect all over the world, particularly in commodities, Americans also wind up paying more for energy. So, being a net importer of oil, wouldn’t the increased cost at the pump offset gains made in exports?

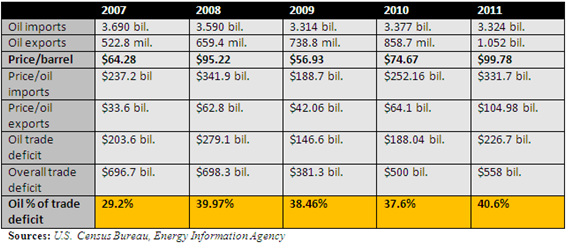

Yes, it does. Despite a weak dollar certainly leading to more exports (they increased in 2008, 2010, and 2011), higher energy prices as a result of inflation apparently offset those gains, exacerbating the trade deficit. Read it and weep, in the following table, courtesy of data from the U.S. Census Bureau and Energy Information Agency.

In other words, contrary to the popular wisdom, the weaker the dollar gets — with the prices of staples like food and energy rising — the worse the trade deficit gets.

At best, it’s a zero sum game, as in 2008, when the trade deficit was virtually identical as it was in 2007. That year, exports increased by $188.1 billion. But that was offset by imports increasing by $189.7 billion, which included a $104.7 billion increase in oil imports, even though the number of barrels imported actually decreased by 100 million.

So, not only does a weak dollar increase the price of energy, it does not discourage imports, resulting in an overall failure to reduce the trade deficit. China has a relative fixed exchange rate with the dollar precisely for this reason — no matter how weak the dollar is, the yuan will be even weaker.

Meanwhile, it does more harm than good. To achieve zero change in the trade deficit, the Federal Reserve’s weak dollar policy in 2008 pushed oil to a high of nearly $150 a barrel and gasoline to well over $4 a gallon. Loose monetary and credit policies were also instrumental in fueling the housing bubble that pushed the nation into the worst recession since the Great Depression.

Yet, the nation is still treated to pure propaganda from the likes of NPR in “The Upside of the Weak Dollar” by Jacob Goldstein. In April 2011, he wrote, “there’s a big upside to a weak dollar: It makes U.S. exports cheaper, which encourages people and businesses around the world to buy more of our stuff. Increasing exports is key to increasing U.S. economic growth without relying too heavily on domestic consumer spending.”

But, since the Gross Domestic Product (GDP) is actually reduced by imports, and the weak dollar has shown no evidence of decreasing imports, it is actually detrimental to economic growth.

Others, like the New York Times’ Paul Krugman, focus singularly on the theoretical benefits to the manufacturing sector, writing in May 2011, “the U.S. dollar has fallen against other currencies, helping give U.S.-based manufacturing a cost advantage. A weaker dollar, it turns out, was just what U.S. industry needed.”

Except, it may be too soon to tell. As Krugman notes, “I don’t want to suggest that everything is wonderful about U.S. manufacturing. So far, the job gains are modest”.

They remain so. Krugman ignores the fact that the dollar was already weak before the economy crashed in 2008. And when the house of cards came tumbling down, it nearly wrecked the domestic auto industry and other manufacturers across the country. With oil running up in price yet again, are we simply preparing for another economic slowdown?

What good is a weak dollar — the world’s reserve currency — boosting U.S. exports in the short-run if it also boosts imports, leads to unaffordable energy, and then threatens the overall sustainability of economic growth? In Washington, D.C., apparently the most progress that can be made is one step forward, two steps back.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.