NRD Editor’s Note: This column was originally published in the Las Vegas Review Journal on August 19, 2012.

By Howard Rich — Across America politicians of both parties will tell you the number one issue facing our country is job creation. They’re right — yet what they continually refuse to acknowledge is that creating these jobs is not their responsibility.

By Howard Rich — Across America politicians of both parties will tell you the number one issue facing our country is job creation. They’re right — yet what they continually refuse to acknowledge is that creating these jobs is not their responsibility.

Government’s role in economic development should always be passive — confining expenditures to core functions while keeping taxes low in an effort to allow the optimum conditions for private sector growth.

“Get out of the way,” in other words.

Unfortunately our elected officials continue standing in the way of prosperity — as evidenced by the looming battle over internet taxation. The U.S. Congress is currently contemplating legislation that would dramatically expand the ability of state and municipal governments to tax internet purchases across territorial lines. In addition to being of dubious constitutionality (i.e. taxation without representation) this legislation would strike at the heart of the private sector in an effort to help state and local governments subsidize our nation’s growing dependence economy.

It’s a road this country has been down before.

“Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it,” former president Ronald Reagan once famously remarked.

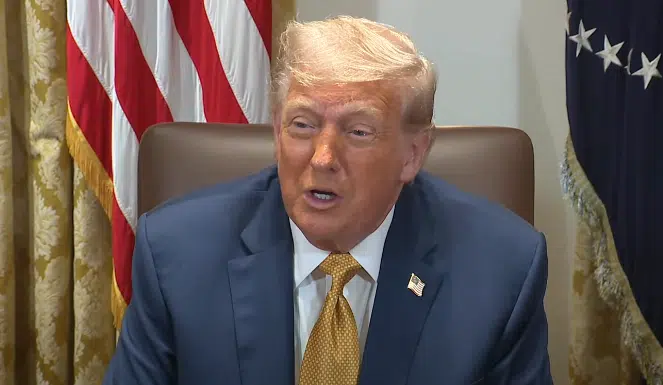

That’s exactly what’s happening with internet commerce. While the broader U.S. economy continues to groan under the weight of President Barack Obama’s failed Keynesian interventionism, internet commerce is one of the few segments of the private sector that’s “moving” – which makes it an inviting target for these state and local bureaucracies.

According to data provided by the U.S. Census Bureau, online sales in America grew from $27.6 billion in 2000 (roughly 1 percent of all retail purchases) to $166.5 billion in 2010 (4.28 percent of all retail purchases). And while total spending cooled during the recent recession, e-Commerce has expanded by double digit percentages on a year-to-year basis over the last seven consecutive quarters.

In fact based on data from industry analyst comScore, the rate of online spending growth during the second quarter of 2012 was four times as fast as the growth in overall consumer spending — with double-digit growth rates projected for the next four years.

Statistics like these make bureaucrats’ mouths water — which is why they are pushing Congress to grant them this expanded taxing power. Under the so-called “Marketplace Fairness Act,” states and municipalities would be permitted to impose internet sales tax extraterritorially – forcing residents who live outside their borders to pay their local sales tax rates. Meanwhile retailers that do more than $500,000 a year in gross receipts would be forced to calculate, collect and remit sales tax on all remote transactions — keeping track of 9,646 different sales tax jurisdictions.

Does that sound fair? Of course not. In fact this legislation would be a death knell for many of the small businesses that politicians claim to be fighting for — not to mention a harbinger of higher consumer prices as these businesses go by the wayside.

“Many of the smallest mom-and-pop operators would struggle to comply,” writes researcher Adam Thierer of the Mercatus Center at George Mason University. “Greater industry consolidation and less competition and consumer choice could be the unfortunate result.”

And for what – so that state and local governments can continue a spending orgy that barely blinked during the recent recession?

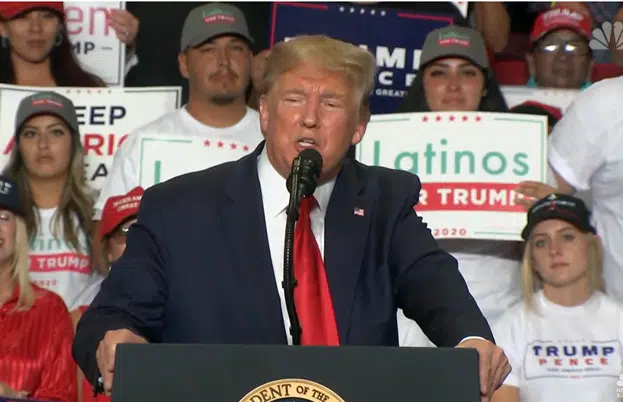

“Politicians want this bill passed to raise new tax revenue for broken state governments facing budget shortfalls,” U.S. Sen. Jim DeMint explained recently. “But legislators in state capitals don’t want to make the hard decisions to cut spending or raise taxes on their constituents — they fear the voter backlash. So they’d like their allies in Washington to make it legal for them to tax people who can’t vote against them.”

How big a dent in the economy are we talking about? According to Forrester Research, the average American shopper spends around $1,700 annually online — which means they would pay an additional $125 annually. Add it all up and we’re looking at a $23 billion tax hike — and that’s before we start assessing compliance costs and the damage done by thousands of lost jobs.

Is the American economy really in any condition to sustain such a blow? No. Tax hikes like this are part of the recipe for recessions, not recoveries.

Internet commerce will follow one of two paths moving forward: It will either continue to grow, driving a rebirth of American consumerism — or it will become yet another vibrant marketplace dragged down by the tentacles of big government.

If our elected officials are serious about “creating jobs,” then this choice is a no-brainer — and best of all it requires them to do absolutely nothing.

The author is chairman of Americans for Limited Government.