Managing director and co-founder of the world’s largest bond trader Pimco, Bill Gross, has released a shocking warning to the U.S. that promised entitlements to citizens may not be worth the paper they’re printed on.

He called the U.S. “an addict whose habit extends beyond weed or cocaine and who frequently pleasures itself with budgetary crystal meth.”

Gross counts some $60 trillion of unfunded liabilities that will ultimately be added to the now $16 trillion national debt to pay for future benefits.

“It just so happens that the $60 trillion comes not in the form of promises to pay bonds or bills at maturity, but the present value of future Social Security benefits, Medicaid expenses and expected costs for Medicare,” Gross wrote in his “Investment Outlook” newsletter.

Gross warned that unless we begin to address our fiscal crisis, disaster will eventually follow. “If we continue to close our eyes to existing 8 percent of [Gross Domestic Product] GDP deficits, which when including Social Security, Medicaid and Medicare liabilities compose an average estimated 11 percent annual ‘fiscal gap,’ then we will begin to resemble Greece before the turn of the next decade.”

Gross is correct. This is a ticking time bomb. In the past fiscal year alone, the national debt has grown by more than $1.2 trillion and under current projections will grow by about $1 trillion every year for the next decade.

The $16 trillion total liability is already larger than the entire economy. By 2022, it is expected by the Office of Management and Budget to swell to $26 trillion. Nobody except for the insane asylum on Capitol Hill expects economic growth will be able to keep pace with that level of debt accumulation.

To stabilize the U.S. debt to the $15.5 trillion GDP, Gross said spending would have to be cut or taxes increased by $1.6 trillion every single year this decade.

But tax hikes will not be enough close the gap. Even if tax rates were to automatically increase at year’s end for all Americans, as they are set to do as a consequence of the 2010 tax deal, Gross points to a Congressional Budget Office estimate that the deficit would only be reduced by $200 billion.

Further, if sequester cuts were allowed to take effect, the reduction in spending only averages to $400 billion a year over a decade.

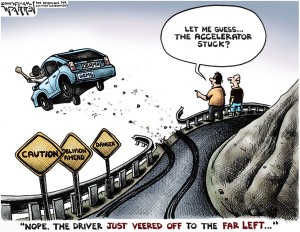

So, even if we fly off the fiscal cliff at the end of the year, Congress would still need to find an additional $1 trillion of spending cuts to meet Gross’ target and avert fiscal catastrophe at the end of the decade.

Conversely, if Congress and Obama opt to extend the current tax rates and cancel the sequester cuts, then a full $1.6 trillion of spending cuts will be needed.

“Unless we begin to close this gap,” Gross wrote, “then the inevitable result will be that our debt/GDP ratio will continue to rise, the Fed would print money to pay for the deficiency, inflation would follow and the dollar would inevitably decline. Bonds would be burned to a crisp and stocks would certainly be singed; only gold and real assets would thrive.”

As a result, Gross warned “the U.S. would no longer be in the catbird’s seat of global finance and there would be damage aplenty, not just to the U.S. but to the global financial system itself, a system which for 40 years has depended on the U.S. economy as the world’s consummate consumer and the dollar as the global medium of exchange.”

In other words, the U.S. dollar would lose its status as the world’s reserve currency. This would lead to hyperinflation here at home, interest rates to go to the moon, and likely global instability as the nation would no longer be able to meet our security obligations overseas.

Gross deserves credit for raising the alarm and calling for deeper cuts than almost anybody to date. This is a real emergency as the debt will soon become so large it cannot be reined in, making default more likely every year that goes by.

Whoever wins the election on Nov. 6, the next president will have perhaps a term to act to restore order to the nation’s fiscal house. After that, there will be no way to honestly finance the $60 trillion fiscal gap before Armageddon arrives.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.