Call it QE4Ever.

The announcement comes atop the Fed’s $2 trillion balance sheet expansion since Aug. 2007 when the financial crisis began, plus its pledge to buy $480 billion of mortgage-backed securities annually announced earlier this year.

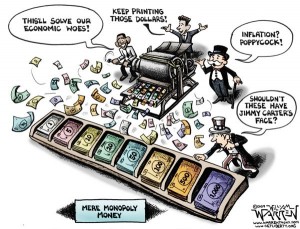

The goal of the plan, according to the central bank’s statement, is “to support a stronger economic recovery.” Which is what it says every time it fires up the printing press.

But what if all this easing was actually prolonging the recession? That’s what Hong Kong Monetary Authority chief Norman Chan thinks might be happening.

Particularly, it is possible the process of deleveraging, necessary for a recovery, is being disrupted by quantitative easing, Chan noted at the 2013 Hong Kong Economic Summit.

Since 2008, financial institutions have shed some $3.3 trillion of debt, and are still deleveraging 4 years after the panic, according to data compiled by the Fed last updated Dec. 6. This is the process of balance sheet repair in the aftermath of the popped housing bubble.

“In order to solve the structural imbalances built up in the past two decades, we must get to the bottom of the problem,” Chan said.

But if all the bailouts are preventing the bottom of credit markets from being felt, then the rebound has been forestalled as the market’s price discovery mechanism remains broken.

Something to consider as Fed head Ben Bernanke promises that central bank support of the economy will continue until the unemployment rate is 6.5 percent. Namely, what if we never get there?

On the balance sheet side of the equation, if the Fed keeps buying U.S. treasuries at the new pace for 10 years, it’ll own an additional $5.4 trillion in U.S. debt — more than half of the $10 trillion of new federal debt that will be issued by 2022.

It already owns $1.6 trillion of treasuries, bringing the Fed’s grand total to $7 trillion, comprising some 27 percent of the $26 trillion national debt projected by that time.

When coupled with its annual $480 billion of mortgage securities purchases, the Fed will be printing more than $1 trillion in 2013 and every year after that to prop up financial markets and the federal government.

In the short-term, the new purchases should push interest rates down even further to historic lows — not unlike Japan has achieved over the past decade.

That is, until inflation ultimately rears its ugly head, at which point the Fed may find it impossible to unwind its position for fear of cutting off the flow of funds to the federal government. That is when the American people will pay — with higher prices for food, energy, and everything else.

This is the problem with a digital currency that can be lent into existence with the click of a mouse by all-powerful central banks.

Now dependent on the central bank, Congress will never balance the budget or significantly cut spending so long as the Fed buys U.S. debt. Bernanke’s policies are poisoning discipline in Congress to ever get our fiscal house in order.

In short, governments that take advantage of funny money see no other way to make ends meet.

Ultimately, printing money to pay the debt perpetuates the current broken financial and political system, in the process passing the hidden inflation tax onto everyone else, who had better hope their wages rise to pay for all this new debt.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.