By Bill Wilson — To hear the White House tell it, the economy shrank in the fourth quarter by 0.1 percent solely because government spending was cut by $40.4 billion, largely in defense.

By Bill Wilson — To hear the White House tell it, the economy shrank in the fourth quarter by 0.1 percent solely because government spending was cut by $40.4 billion, largely in defense.

To be fair, there is a degree of truth to that. If you factor out government spending as a component of the Gross Domestic Product (GDP), real GDP of the private sector grew by a “whopping” annualized rate of 1.3 percent.

Of course, everyone, including here at Americans for Limited Government, too would have slammed that number as weak and tepid.

In any event, it is an interesting point the White House is making, and probably advises why government spending should no longer be included in the measurement of growth. How much money the government wastes every quarter really tells us nothing about the health of the private economy anyway.

In truth, this admission by the Obama Administration actually underscores a wider problem: So hooked on government “stimulus” is the economy that no cuts at all to spending or debt can ever be tolerated by the establishment.

The “real” economy

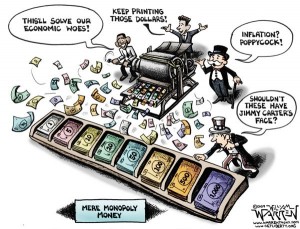

In other words, who needs growth when you’ve got a printing press?

That certainly was the stock market’s message to the American people on Jan. 30 when, despite the latest report from the Bureau of Economic Analysis showing the fourth quarter contraction, the Dow Jones shrugged off the bad news, barely dropping 44 points.

As if one needed any more evidence that U.S. stocks operate devoid of any reality. On the same day, national radio talk show host Rush Limbaugh marveled at how Apple’s stock is tanking, which posts profit after profit, while Amazon posted a loss for the year and whose stock soared on the news.

But beyond a mere superficial glance at either the GDP or stock prices or even the level of government spending, there is a lot of substance to the notion that the American people are suffering through a real economic depression while a relative few are prospering.

The reason for that is because the real movers and shakers in the economy are no longer entrepreneurs taking risk with investment. Instead, they are faceless bureaucrats in Washington, D.C. at a variety of agencies, but particularly, those responsible for the easy money credit policies at the Federal Reserve.

In response to the GDP numbers, the Fed issued a statement promising to keep up its expanded quantitative easing programs to “support a stronger economic recovery”. That probably comes as a relief to investors, since there’s no real growth to speak of.

To the extent that anyone’s making money in this economy, it’s largely off of the government. The only trouble is it’s not doing a thing to stimulate real growth or boost employment.

Fed easing fails

To explain the nation’s collective unease, author Charles Hugh Smith noted recently in an article, “Why Employment is Dead in the Water,” that “the population and GDP have both expanded smartly since 2000, but full-time employment has barely edged above levels reached 13 years ago.”

Meanwhile, Smith reports that financial sector profits as a percent of GDP have roughly doubled during that same period.

Smith urges readers to compare the two findings — full-time employment going nowhere versus record financial sector profits — and “then decide where the Fed’s free money/easy credit is flowing.”

That is a critical observation, because maintaining full employment is part of the Fed’s dual mandate, which also includes price stability. In other words, all of the quantitative easing is supposed to boost employment.

The fact that it has failed spectacular at achieving both missions — an unprecedented housing bubble, price and credit explosion that it helped to finance, followed by the longest period of sustained high unemployment since the Great Depression — barely causes elected officials in Washington, D.C. to bat an eyelash.

Sure, they ordered a partial audit of the Fed’s activities during the financial crisis. That study revealed that of its $1.25 trillion of full-on bailouts of financial institutions — in which it purchased worthless mortgage-backed securities from the financial crisis for 100 cents on the dollar — an outrageous $442.7 billion went to foreign banks.

And how did Washington, D.C. respond? They did nothing.

Time to be honest

Other than former Rep. Ron Paul in the Republican primary process, who spoke of the findings, his colleagues played to the crowd, calling for another audit. As if we didn’t know enough already about the central bank’s activities and its poor record to start passing judgment on it.

As for Obama, he awarded Fed chairman Ben Bernanke, who oversaw the meltdown, with another term in office.

An honest appraisal would find that the Fed’s record of bailouts, privatizing profits and socializing losses, does not actually serve the interests of the American people at all — but instead a select few wealthy and powerful individuals who gambled big-time with borrowed, imaginary money from the Fed and nearly wrecked the global economy.

The other primary beneficiaries of these policies are government and public sector workers — whose existence and livelihoods depends on this form of cheap financing that apparently never needs to be repaid.

One thing is for certain, the economy and high unemployment are going nowhere despite renewed easing by the Fed, which will be pumping $1 trillion of new “stimulus” into the economy every year perhaps for the rest of our lives.

All of which comes atop the nearly $2 trillion it has already dumped into the economy since the crisis began in August 2007.

In the new round of easing, half will go into buying government debt, and the other half to bailing out financial institutions still weighed down with dodgy mortgage-backed securities from the financial crisis.

Where’s the growth?

None of which will boost growth, as can already be seen. Yet, there are those, even on the political right, such as National Review senior editor Ramesh Ponnuru, who pretend that it can, and that the Fed should target nominal GDP of 5 percent in its expansionary monetary policies.

The truth is, a printing press is no replacement for real productivity, a lowered cost of doing business, and regulations that welcome company creation. And it is the antithesis of sound money.

Instead, we have a spiraling national debt backed only by the Fed’s useless paper trade, taxes that were just increased on small businesses, and a regulatory environment in health care, the environment, and labor that would make Soviet Russia blush. The result is sustained high unemployment and no growth. We’re in another depression.

But nobody on Wall Street seems to care, as the Dow flirts with 14,000. Perhaps their leading indicator is not real growth or consumer confidence or the cost of doing business here at all — it is how much cheap, easy money they can get from the Fed.

All of which speaks to how the nation’s central bank has dramatically failed the American people — and why it is time to begin considering alternatives to the current system.

Bill Wilson is the President of Americans for Limited Government.