That’s a pretty small margin for error, especially if the central bank were to ever take any losses on its vast portfolio of U.S. treasuries or mortgage-backed securities, of which it will be purchasing another $1 trillion a year under its latest quantitative easing program. Particularly, if the Fed should have a need to sell off its portfolio, a new sobering study finds.

“Crunch Time: Fiscal Crises and the Role of Monetary Policy” published by the University of Chicago, Booth School of Business examines potential exit scenarios for the Fed in an environment when interest rates may soon be rising.

The paper was written for the U.S. Monetary Policy Forum and is authored by David Greenlaw, James Hamilton, Peter Hooper and Frederic Mishkin.

“[C]ontinued expansion of the Fed’s balance sheet significantly raises the chances that the Fed will, for an extended period, cease to make positive remittances to the Treasury, especially if the Fed elects to sell some of its assets to speed up the runoff of excess reserves,” the paper concludes. Why?

The Fed has bought its $1.736 trillion of treasuries holdings in a very low interest rate environment. The problem is that is a situation the paper’s authors do not expect to persist based on a thorough examination of 20 advanced economies, looking towards interest rates in cases of excessive gross debt.

“[A] country can quickly move from the group without problems to the group that faces nearly insurmountable problems if its debt rises above 80 percent of GDP, particularly if it is running a large current-account deficit,” the study warns.

That’s bad, because U.S. debt now at $16.6 trillion has already topped 103.8 percent of the Gross Domestic Product at the beginning of the year, and the country is running a balance of payments deficit of roughly $450 billion.

By 2037, the Congressional Budget Office (CBO) projects that the debt-to-GDP ratio will reach 159 percent. But that might actually be dramatically understated, the report cautions.

The paper examines a not-so-far-fetched scenario wherein “the looming budget sequester scheduled to occur on March 1 is cancelled and that the steady-state unemployment rate is assumed to be 6 percent (as opposed to the 5.25 percent as assumed by the Congressional Budget Office).”

Then, ominously, the “debt/GDP ratio would rise much more rapidly, hitting 304 percent of GDP by 2037 and bond yields would skyrocket, eventually getting above 25 percent.”

If that happens, it’s game, set, match. No amount of fiscal consolidation would save us then. The debt will have become so large it cannot possibly be refinanced, let alone be repaid. Default would be the only option.

And that’s in less than 25 years.

Even if all goes according to plan per CBO’s baseline of growth and unemployment normalizing over time, even a basic “normalization of interest rates over the course of coming years (to roughly 4 percent for 3-month T-bills and 5.2 percent for 10-year notes), then debt service costs will skyrocket.”

This leaves the Fed in a catch-22 for its much-ballyhooed exit strategy from U.S. Treasury markets. If it stops buying U.S. debt to preemptively avoid a sharp rise in interest rates, market forces could assert themselves, with rates rising, leaving the U.S. with a debt that cannot be serviced.

If it keeps on buying U.S. debt, and rates rise anyway, then it will not be able to sell off its portfolio at a later time without technically becoming insolvent. That is because the value of securities shares an inverse relationship with interest rates. The losses booked for securities would exceed the total of its capital, as noted above, currently at $54.9 billion.

What would happen then? The paper states, “under the Fed’s new accounting practices adopted in January 2011, when net income available for remittance to Treasury falls below zero, this does not eat into the Fed’s contributions to capital or threaten the Fed’s operating expenses. Rather, the Fed would create new reserves.”

In other words it simply would print more capital for itself to cover the losses. And it would be doing so at a time when the U.S. itself was increasingly at risk of a catastrophic default amid rapidly rising interest rates. The UK Telegraph’s Ambrose Evans-Pritchard warns “[s]uch losses would lead to a political storm on Capitol Hill and risk a crisis of confidence.”

That’s putting it mildly.

The paper notes that its approach is actually conservative in predicting an eventual rise in interest rates because its model admittedly “would already be predicting an interest rate for the United States for 2012 that is higher than what we actually observed.” So why haven’t interest rates already spiked?

“[T]he large scale purchases by the Federal Reserve may be one factor that has helped keep interest rates down up to this point.” Uh-oh. That would mean the Fed cannot possibly afford to pursue an exit strategy — ever.

Also, “Another key reason that U.S. rates have historically been low is that the use of the U.S. dollar as the world’s reserve currency creates a special demand for U.S. Treasury securities.”

How much longer that lasts is anyone’s guess. If the paper is correct, the longer one holds onto treasuries in this environment, the riskier they get. In that context, the U.S. bond market is a high stakes game of musical chairs for our overseas creditors. The powder keg is set. All that is needed is a spark.

What will likely set off the crisis is inflation. Why? For one thing, the paper notes, “In a country like the United States, the debt premium presumably would arise from inflation fears rather than concerns about outright default.”

But lest there was any doubt, an Americans for Limited Government study of leading economic indicators from government sources since World War II confirms, among other things, that whenever inflation ticks upwards, interest rates always tend to rise.

And critically, the study shows that one thing that tends to set off inflation, believe it or not, is robust economic growth. With the economy, particularly the financial sector, still deleveraging from the financial crisis, growth has been sluggish at best. But inflation could set on rapidly once the deleveraging ends and the credit cycle reasserts itself.

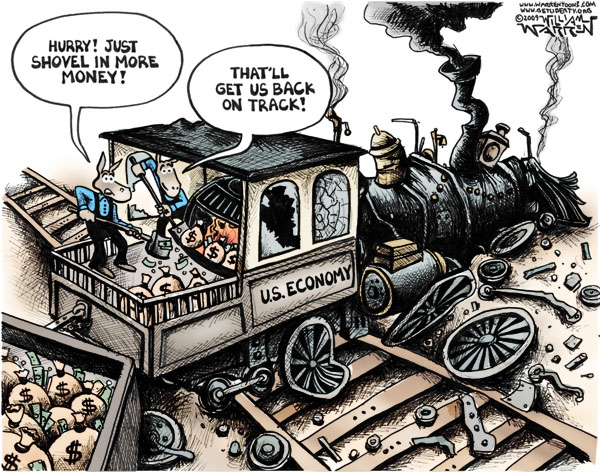

Which means, despite what the masters of the universe tell us, we may not be able to grow our way out of this mess. With the Fed currently increasing its balance sheet at a dramatic pace of 32 percent a year to do whatever it takes, by its own words, to “support a stronger economic recovery,” the onset of inflation may only be a matter of time.

To sum up, the only things propping us up right now are a printing press, the good will of China and Saudi Arabia buying treasuries and trading in dollars, low interest rates, and yes, a weak economy keeping inflation at bay.

Minus that, we face certain insolvency in the time it takes a baby to grow up and graduate college — if not sooner.

Then, we will be unable to meet any of our obligations. If we cannot start cutting spending whether through sequester or other means, and reduce the debt, we’re cooked. But where is national attention at the moment? Not on this devastating study, but on Barack Obama, who swears the economy will collapse if we even try to start cutting.

Bill Wilson is the President of Americans for Limited Government.