Emerging markets, and not monetary policy, appear to have dictated the rapid expansion of commodities prices since at least the 2000s. As demand rose overseas in China, Brazil and elsewhere, prices of everything from food to oil to metals increased.

And now that those emerging markets are in major correction, and demand is down, so too are prices finally correcting.

West Texas intermediate oil fell to about $43 a barrel in August, dangerously close to its Feb. 2009 low of $39. Foodstuffs have tracked very closely too. Rice dropped down to about $375 per metric ton in August, a level not seen since then end of 2007, when the price was still rising. Wheat was down to about $180 in August, a level not seen since 2010, the previous low.

In some cases, like beef, prices do indeed remain elevated, but they’re starting to break, too, down 22 percent off their Sept. 2014 high.

Even commodities besides food and energy are down the past year, by 0.5 percent, according the Bureau of Labor Statistics.

Sure enough, gold is off its Sept. 2011 high of $1,770 an ounce by 37 percent, down to about $1,117 in August. Silver too is 65 percent off its April 2011 high of $42.79 per Troy ounce, all the way down to $14.94 in August.

On oil, many analysts had argued that a supply surge thanks to the shale boom in North America was what had finally pricked the oil bubble.

Yet, with other commodities now falling without any supply surge to speak of, the evidence that global demand for almost everything is decreasing is becoming overwhelming.

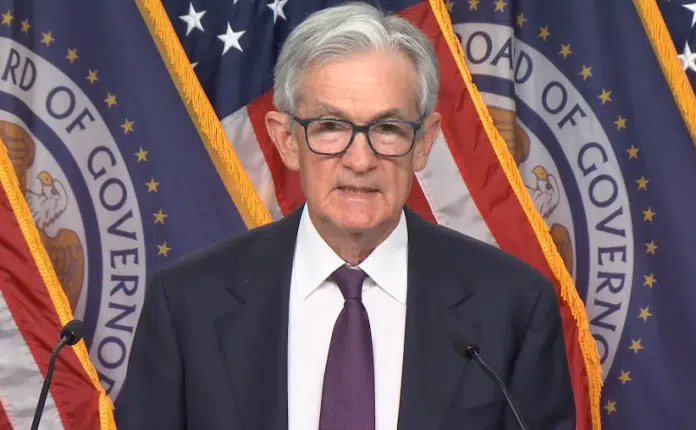

It is in that environment that the Federal Reserve has forestalled hiking the federal funds rate as had been expected in September. In her statement, Fed head Janet Yellen cited low inflation currently as the major reason why the Fed did not act.

But, if declining global demand and collapsing prices presently is signaling a recession on the near horizon, that might mean the Fed simply waited too long for a rate hike.

In 2011, the Consumer Price Index was 3.16 percent, well above the Fed’s inflation target, and yet the central bank never moved interest rates upward to respond. Back then, food and energy prices, and other commodities, too, were surging. That was pretty much true all the way through 2014.

At any point therein, if rates had been raised, it might have been enough to have pierced the emerging markets bubble before it reached critical levels. But that window has passed.

All we know is the Fed has kept the federal funds rate at near-zero levels since 2008 to facilitate bank lending. Advocates of this policy say that the economy was still too weak after the financial crisis for the Fed’s lending rate to be raised.

We’ll never know the counterfactual.

And now, going by Yellen’s statement, if prices do not start increasing closer to the Fed’s target rate of 2 percent soon, we should all expect rates to remain near zero. Right?

Now, with the economy seemingly moving into correction again, the moment to act seems to have passed. If a rate hike does come, it might be at the last minute, and perhaps simply to afford the central bank an opportunity to push rates back down as soon as the recession really does hit.

That’s cynical, but on the other hand, Fed rate hikes do appear to have arrived shortly before the recessions have hit. What would be exceptional is proceeding into a recession with no room to maneuver. Yet, Yellen seems to have talked herself into a corner. If a hike comes but doesn’t meet up with her 2 percent inflation target, it will be an extremely bearish indicator.

So there may not be a rate hike this year after all, but if there is one it will have been too late. Meaning the Fed may have kept rates too low, for too long — again.

Robert Romano is the senior editor of Americans for Limited Government.