By Peter Hong

Remember the raging predatory lending scandals that led to the mortgage crisis of the late 2000s? You couldn’t avoid reports of unscrupulous lenders and brokers exploiting the subprime market and offering adjustable rate mortgages to people who couldn’t afford them. As the housing bubble burst, the financial industry and the economy nearly went with it.

Facing an economic meltdown, Washington responded as it always does — in a frenzy. The first decade of the new millennium ended with a taxpayer bailout (the ill-conceived Troubled Asset Recovery Program) and regulatory overreach (Dodd-Frank Act) — the consequences of which we are still paying today.

Good times.

Well, predatory lending is back. But this time, lenders aren’t just prowling for green; they’re wrapped in it under the façade of environmental “do-goodism.”

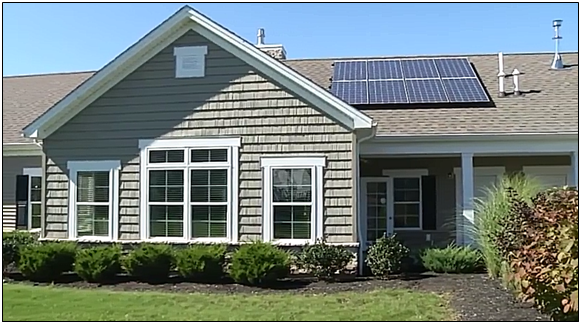

This latest scam is the so-called Property Assessed Clean Energy (PACE) lending industry, which provides financing for energy efficiency or renewable energy upgrades, like solar panels and window insulation. PACE loans are placed on a homeowner’s property tax bill as an assessment. Rather than make a monthly loan payment, borrowers typically pay the assessment on an annual or semi-annual basis; local governments then pass these payments on to the lenders.

Because the loans are based on the value of the assessed property, the borrower’s creditworthiness is of little interest to PACE lenders. Also, the industry uses as its brokers plumbers and repairmen who pitch financing schemes to customers as a means of soliciting contracts and earning referral fees on the side.

Like their predatory lending brethren of the past, these lenders and their contractor-brokers appear to prey on vulnerable and unsophisticated homeowners — particularly the elderly.

A report by Elder Law & Advocacy, which offers legal services to senior citizens in the San Diego area, cited numerous accounts of misleading tactics being used by PACE lending brokers and sales personnel. One case cited a 79-year old widower who was offered new energy-efficient, noise reduction windows at a 1.5 percent financing rate with no payoff penalty, only to receive poorly insulating, noise amplifying windows — at a 26.99 percent interest rate! Another account documented an 82-year old man who was never told that he would lose his ability to refinance his home if he took on a PACE loan. And the horror stories don’t end there.

Complicating matters is the entanglement of government at all levels to promote the PACE lending industry. Local governments in PACE communities effectively serve as the industry’s collections agency for the payment of assessments, which the government distributes to the lenders. Also, because PACE loans are technically property tax assessments, they generally get creditor priority status in case of non-payment or default.

Yes, you read that correctly: in case of default, a loan for residential solar panels gets paid first — even before a homeowner’s mortgage. Non-payment of a PACE loan can result in a home or property being seized as collateral and sold to repay the PACE lender.

In other words, you could lose your home, not because you defaulted on the mortgage you assumed to buy the house, but to pay off a loan for solar panels or attic insulation or LED lighting.

In 2016 — the final year of the Obama Administration — the federal government fully bought into the PACE industry’s lending “green scheme.” In coordination with the Obama strategy to promote green industries, the Federal Housing Administration announced that it would begin using tax dollars to insure mortgages with PACE financing liens attached (so long as those liens did not have super priority creditor status).

And the Obama-Clinton influence games did not end there. A Washington Free Beacon article detailed an undercover lobbying campaign launched by PACE lender Renew Financial — and aided by a deep-pocketed Democratic donor and liberal environmentalist groups — to allow mortgage giants Fannie Mae and Freddie Mac to guarantee mortgages with PACE-financed loans. This would have reversed the policy of the Federal Housing Finance Agency (FHFA), which regulates the government-sponsored enterprises.

While the FHFA did not appear to change its policy, the PACE lending industry did get a Presidential plug promoting this high-interest, private lending industry.

The meetings with President Obama, Hillary Clinton, and top campaign and government officials came to light through the hacked emails of former White House Chief of Staff John Podesta that were exposed by Wikileaks.

Finally, we are talking about big money. While the PACE lending industry paints itself as warm, fuzzy, and green, it is projected to make off with nearly four billion dollars in 2017 alone — making it the fastest growing source of financing in the country. That business is booming should come as no surprise, given the industry’s political influence and the scant level of oversight it is paid by any level of government.

This will change on the federal level if Senator Tom Cotton of Arkansas has his way. Cotton just introduced legislation (S. 838) requiring that PACE lenders be treated under federal law like traditional mortgage lenders — including oversight by a federal regulator, such as the much-feared Consumer Financial Protection Bureau. According to Cotton, “[R]equiring disclosure will reduce the advantage that PACE loan sharks have over hard-working Americans. It’s just the accountability we need.”

Measures like the Cotton bill are a sign that the Obama era of political favoritism toward “green” industries may finally be coming to a halt. And with good reason: it shouldn’t be easy being green — and greedy.

Peter Hong is a contributing reporter at Americans for Limited Government.