By Peter Hong

Barack Obama has been out of office for only seven months, yet the damage from his administrative excesses are still being borne across this country.

Case in point: Operation Check Point (OCP). You remember OCP. Hatched in 2012 by Eric Holder, Obama’s chief henchman at the U.S. Department of Justice (DOJ), OCP purported to “choke out” a number of legal, but disfavored industries from the banking and payment networks businesses need to survive. Purporting to combat fraud, OCP targeted traditional bogeymen to the political Left, such as firearms dealers, ammunition manufacturers, and payday lenders, by labeling them “high risk” industries and lumping them together with online gambling, pornography and escort services. Through OCP, the DOJ worked in conjunction with the federal financial regulators to force banks to terminate relationships with lawful and legitimate businesses, thereby leaving them financially high and dry.

As Iain Murray of the Competitive Enterprise Institute noted, OCP may have been modeled on the federal government’s takedown of the American online poker industry in 2011. In that instance, regulators targeted payment processors that dealt with gambling businesses. As a result, banks became wary of doing business with those targeted payment processors. Finding their lifeblood cut off, some companies had no choice but to turn to less scrupulous processors or disguise transactions with them, leading to criminal liability — which in turn allowed the DOJ to close down the industry.

Banks are always easy targets to do the federal regulators’ bidding. As lenders of other people’s money, banks are by nature conservative enterprises that already have to account for the level of risk every transaction incurs. In addition, they are highly regulated businesses with federal and state regulators constantly looking over their shoulders. By categorizing entire industries as “high risk,” simply because the Obama Administration did not favor them, Holder’s DOJ effectively became another political arm of the Left — with one critical caveat: the power of subpoena.

The DOJ issued its subpoenas under a statute enacted by Congress in response to the savings and loan crisis of the late eighties. The extraordinary powers of non-criminal investigative authority granted under the statute to the DOJ were meant to go after those who defraud banks and other depository institutions — not lawful, legitimate merchants.

A 2014 staff report by the House Oversight and Government Reform Committee found that “in furtherance of Operation Choke Point, the Department (of Justice) has radically and inappropriately expanded its own authority under” the governing statute. The committee’s report noted that the DOJ twisted the law to use an anti-bank fraud statute to combat alleged merchant fraud.

The DOJ also forced banks to do its dirty work, particularly when Holder’s minions wanted to harass an industry but didn’t have sufficient evidence of fraud or wrongdoing to back up a prosecution. As Frank Keating, then-President of the American Bankers Association and a former U.S. Attorney, wrote: “[The Justice Department] is pressuring banks to shut down accounts without pressing charges against a merchant or even establishing that the merchant broke the law. It’s clear enough that there’s fraud to shut down the account, Justice asserts, but apparently not enough for the highest law-enforcement agency in the land to prosecute.” The House committee report indicted the DOJ for misusing the law “to forcibly conscript banks to serve as the ‘policemen and judges’ of the commercial world.

In 2015, the Federal Deposit Insurance Corporation (FDIC) issued guidance encouraging banks to judge customer relationships on a case-by-case basis, rather than “declining to provide banking services to entire categories of customers.” But as an August 10 letter from Congressional leaders to Attorney General Jeff Sessions, Fed Chair Janet Yellen and Acting Comptroller of the Currency Keith Noreika notes, while the FDIC rescinded the high risk merchant blacklist, “it never (a) rescinded its general guidance about reputation risks posed by bank customers, or (b) retracted its assertion that the industries it had listed are particularly high risk.” In other words, nothing has been done to give back to these publicly maligned industries their good name.

As a result of OCP’s legacy of modern-day McCarthyism, banks still do not serve these legitimate, lawful industries because of the smear job by the Obama Administration. The August 10 congressional letter asked the respective Departments and agencies for remedial action plans by month’s end, including clear and public policy statements formally repudiating OCP and its abuses.

Abuses of legal authority, like Operation Choke Point, earned the DOJ its reputation under Holder and his successor Loretta Lynch as an agency run amok and afoul of the rule of law. OCP was just one in a long list of political abuses in the Holder-Lynch era, including Operation Fast and Furious, the infamous Bill Clinton-Loretta Lynch campaign meeting on an airport tarmac, refusals to enforce immigration laws, and repeated political bias in agency hiring.

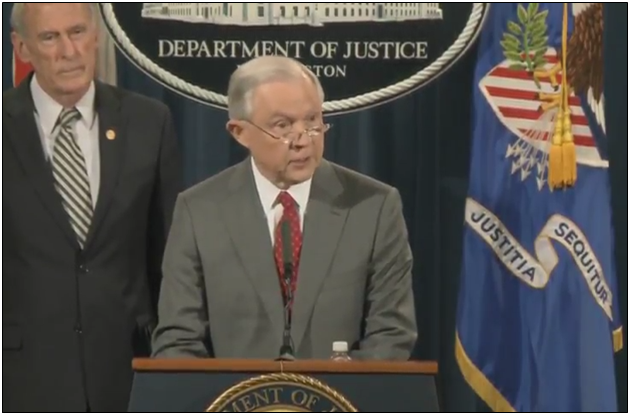

Following eight long years of the Obama Administration’s Wild West shootout against the rule of law, Attorney General Sessions clearly has a monumental task ahead of him in restoring pubic trust in the integrity of the Justice Department. Swiftly repudiating Operation Choke Point and its scandalous blacklist of legitimate and needed business enterprises will help him mop up the mess from the political circus left by his predecessors.

Peter Hong is a contributing reporter at Americans for Limited Government.