By Printus LeBlanc

Another day, another Obama era scandal is revealed. Following the subprime mortgage crisis in 2007-2010, the calamity that almost brought down the economy, lawsuits were abound, including suits brought by the Department of Justice (DOJ). The Obama administration lived by the motto “never let a crisis go to waste,” and used the mortgage crisis to benefit political allies at the expense of fraud victims.

Under the authority granted in the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), the DOJ launched into dozens of lawsuits against banks and mortgage companies. The act was passed in response to the Savings and Loan scandal, and among other powers, granted the federal government the authority to bring civil claims with less rigorous requirements to establish liability in fraud claims.

It seems like a good idea at the time. If banks and mortgage companies misled their investors and customers, they should pay the price. That is until the Obama administration chose to corrupt the process.

The Obama administration began suing over 30 banks involved in the mortgage-backed security crisis. Many of the banks scrambled to reach settlements with the DOJ. One of the first to settle was JP Morgan in late 2013. JP Morgan settled for a then-record amount of $13 billion. Citigroup followed less than a year later, reaching a settlement totaling $7 billion. However, Bank of America gets the grand prize. Bank of America settled for a whopping $16.65 billion. In total, there would be over $110 billion paid out by banks.

If the money went to the victims, there would be no problem, but the money would find its way to political activist organizations that aligned themselves with the Democrat party.

Rep. Bob Goodlatte (R-Va.) began investigating the disbarments of the payments by sending a letter in November of 2014 after noticing something strange in the settlement agreements of the banks.

Many of the settlements have a section that describes a minimum donation to HUD-approved housing counseling agencies. Other segments included minimum donations to housing-related organizations. The minimum payments were often over $10 million per section. In total, many settlements required over $40 million in “donations” to various groups. It gets worse.

The settlements also gave double credit for each dollar “donated,” while money to victims was a one for one exchange. That means after a bank paid the minimum, a $50 million donation would be treated as a $100 million towards the settlement amount. If you’re a bank which would you rather pay?

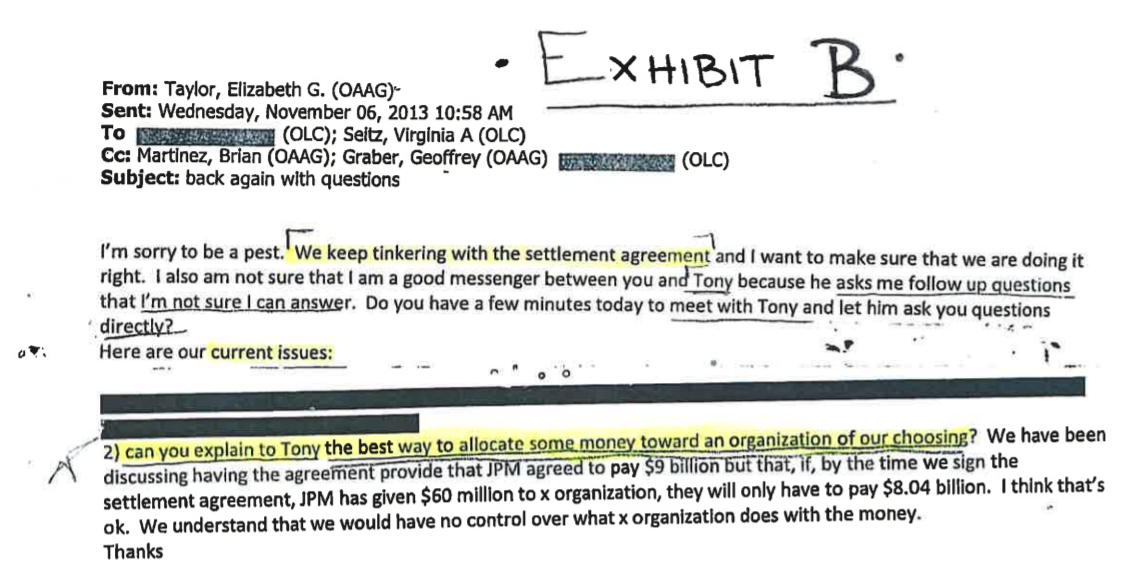

Earlier this week Rep. Goodlatte released documents from his investigation into the DOJ settlements. The documents are internal DOJ emails that show personnel within the DOJ discussing where to direct the “donations.” One email states, “Concerns include: a) not allowing Citi to pick a statewide intermediary like Pacific Legal Foundation (does conservative property-rights free legal services)”

How many legitimate victims were not helped because the Obama administration gave double credit for donations to third-party political activist organizations?

Attorney General Jeff Sessions ended the practice of compensating third party groups in future DOJ settlements this past June. He wrote a memo stating, “Unfortunately, in recent years the Department of Justice has sometimes required or encouraged defendants to make these payments to third parties as a condition of settlement.” Sessions is to be celebrated for taking this step.

However, Congress must go further, and Rep. Goodlatte continues to lead the fight.

Goodlatte introduced H.R.732, the Stop Settlement Slush Funds Act of 2017, earlier this year. It passed the House with bipartisan support earlier this week on Tuesday, 24 October. It now waits where good legislation goes to die, the Senate.

Sessions and Goodlatte are to be commended for fighting this dubious practice. Senate Majority Leader Mitch McConnell must now pass the legislation. Bring the bill up for a vote and force Senators to vote for political activist organizations over victims of fraud. If it is blocked, put it into must-pass legislation such as the budget or debt ceiling. The Senate needs a win, and this piece of legislation is an excellent place to start.

Printus LeBlanc is a contributing editor for Americans for Limited Government.