By Printus LeBlanc

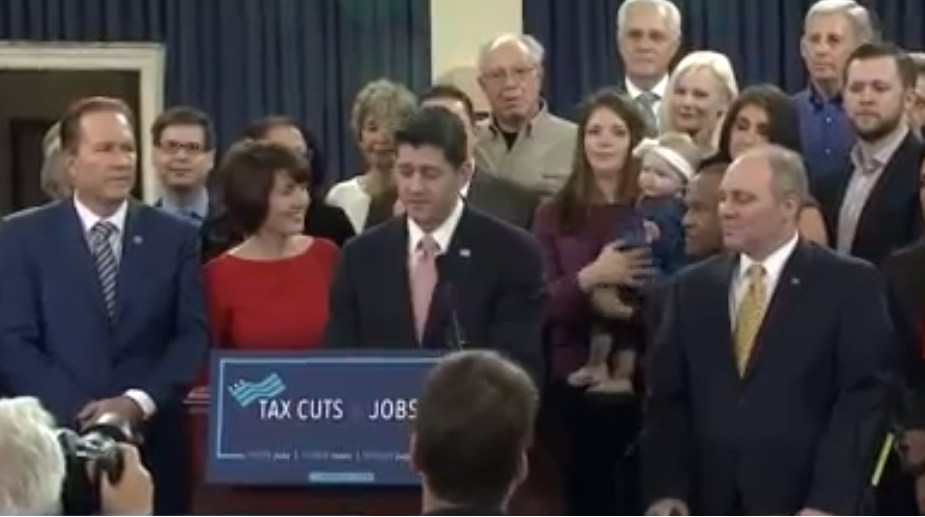

Yesterday, Republicans in the House released their long-awaited tax reform and cuts package. The House GOP and the President have been talking about tax cuts for months, and even made them cornerstones of their campaigns. Business leaders want tax cuts to spur economic growth. Well, something is here. It’s early in the process, but at least we have something to start from.

The House GOP released talking points for the tax bill stating, “The Tax Cuts and Jobs Act is a bold, pro-growth bill that will overhaul our nation’s tax code for the first time since President Reagan’s historic tax reform 31 years ago. With this bill, a typical middle-income family of four, earning $59,000 (the median household income), will receive a $1,182 tax cut.”

Some of the highlights are listed below:

- Lowers individual tax rates for low- and middle-income Americans to Zero, 12 percent, 25 percent, and 35 percent; keeps tax rate for those making over $1 million at 39.6 percent;

- Increases the standard deduction from $6,350 to $12,000 for individuals and $12,700 to $24,000 for married couples;

- Establishing a new Family Credit, which includes expanding the Child Tax Credit from $1,000 to $1,600;

- Preserving the Child and Dependent Care Tax Credit;

- Preserves the Earned Income Tax Credit;

- Preserves the home mortgage interest deduction for existing mortgages and maintains the home mortgage interest deduction for newly purchased homes with loans up to $500,000, half the current $1,000,000;

- Continues to allow people to write off the cost of state and local property taxes up to $10,000 but eliminates the state income tax deduction;

- Retains popular retirement savings options such as 401(k)s and Individual Retirement Accounts;

- Repeals the Alternative Minimum Tax;

- Lowers the corporate tax rate to 20 percent – down from 35 percent;

- Reduces the tax rate on business income to no more than 25 percent;

- Establishes strong safeguards to distinguish between individual wage income and “pass-through” business income ;.

- Allows businesses to immediately write off the full cost of new equipment; and

- Retains the low-income housing tax credit

The Republicans seemed to have found a way around one of the more contentious aspects of the tax debate. Currently, taxpayers have the option of itemizing their deductions instead of taking the standard deduction. When they take the standard deduction, they are not allowed to deduct state and local property taxes from taxable income.

Early reports from the from the negotiations of the bill hinted the property tax deduction would be eliminated. This provision would be a tough pill to swallow for states with high property taxes, like New York, New Jersey, and Illinois. Those three states alone account for 21 Republican Members of the House. Many Republicans in these high tax havens were sure to shoot down any bill that raised their constituent’s taxes.

This plan seems to have found a compromise. The plan limits the deduction to $10,000 while increasing the standard from $6,350 to $12,000 for individuals and $12,700 to $24,000 for married couples. The change will give middle-class families an option, and based on the data, a good option. According to Wallethub.com, the $10,000 deduction is far above the average for the states with the highest average property taxes when compared to the median home value.

| State | Effective Real Estate Tax Rate | Annual Taxes on 179K Home | State Median Home Value | Annual Taxes on Home Priced at Median Home value |

| Ohio | 1.56 percent | $2,794 | $129,900 | $2,032 |

| New York | 1.62 percent | $2,899 | $283,400 | $4,600 |

| Rhode Island | 1.63 percent | $2,915 | $238,000 | $3,884 |

| Vermont | 1.74 percent | $3,116 | $217,500 | $3,795 |

| Michigan | 1.78 percent | $3,172 | $122,400 | $2,174 |

| Nebraska | 1.85 percent | $3,308 | $133,200 | $2,467 |

| Texas | 1.90 percent | $3,386 | $136,000 | $2,578 |

| Wisconsin | 1.96 percent | $3,499 | $165,800 | $3,248 |

| Connecticut | 1.97 percent | $3,517 | $270,500 | $5,327 |

| New Hampshire | 2.15 percent | $3,838 | $237,300 | $5,100 |

| Illinois | 2.30 percent | $4,105 | $173,800 | $3,995 |

| New Jersey | 2.35 percent | $4,189 | $315,900 | $7,410 |

Another point of contention is the mortgage interest deduction. The current system allows homeowners to deduct the interest paid on a primary residence loan, up to $1,000,000, from their taxable income. Many associations including the National Association of Home Builders and the National Association of Realtors, both traditional supporters of GOP members, have come out against any change to this provision of the tax code, fearing it will slow down business.

The Republican plan does not get rid of mortgage interest deduction, but it does cut it by half, to loans up to $500,000. This is unlikely to affect many people considering the median home price nationwide is $202,000, according to Zillow. Republicans near high cost of living areas are also likely to have issues with this change. Significantly for purposes of the House and Senate debate, one such high cost of living region is the Greater Washington D.C. area where the median home price for the 3rd quarter of 2017 was a whopping $551,000. This matters because those most likely affected by the change will be many of the neighbors of those having to vote on it.

One change that wasn’t made immediately jumps out at those who have been following Congress this year. The Obamacare individual mandate tax is still on the books. Taxpayers will still be fined if they do not have health insurance. Hopefully, this means that the GOP still plans to take a run at the replacing Obamacare early next year, and not that they are surrendering on the issue for this Congress.

The GOP plan is not perfect by any stretch. It would be much improved if there were real spending cuts in the budget used as offsets instead of the more limited tax cuts seen here. But, this is a good starting point, and a starting point it is. This is just the first iteration of the bill, and it is expected to change as it makes its way through the Ways and Means Committee onto the floor. Once on the floor, it is easy to see more amendments added to garner the votes for passage. But, the good news is, at least we have a starting point.

Printus LeBlanc is a contributing editor for Americans for Limited Government