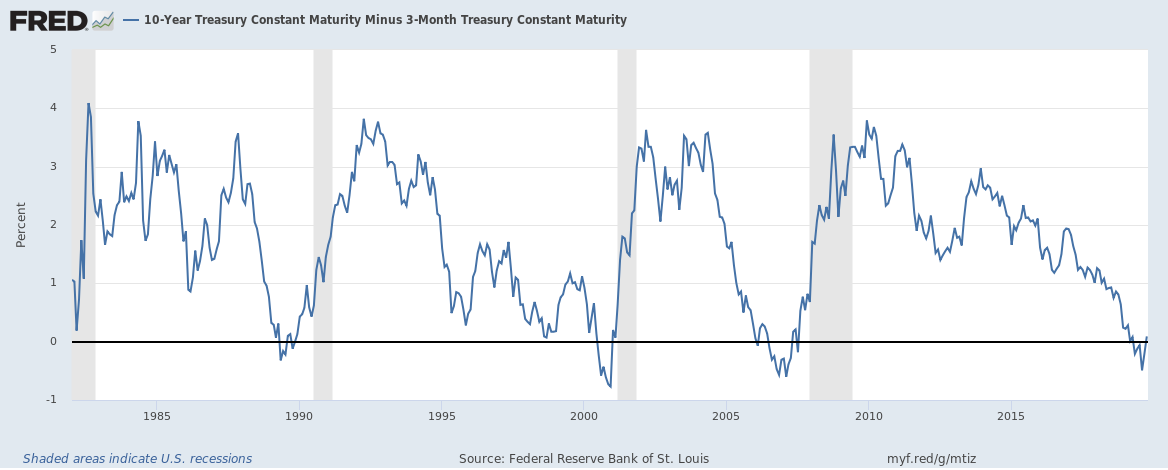

Don’t look now, but the inversion between the 10-year treasury and the 3-month treasury that began in May has uninverted, either calling into question that it was a recession signal or confirming it, depending on what happens in the coming months.

This signal was given much fanfare when it went into negative territory, but now that it’s back in positive territory, not so much.

If it was a recession signal, then you might expect a recession any time in the 9-to-17-month range based on the last three recessions, with an average period of a recession taking place about 14 months after the deepest inversion began. If true, that might signal a recession beginning anywhere from Feb. 2020 to Oct. 2020.

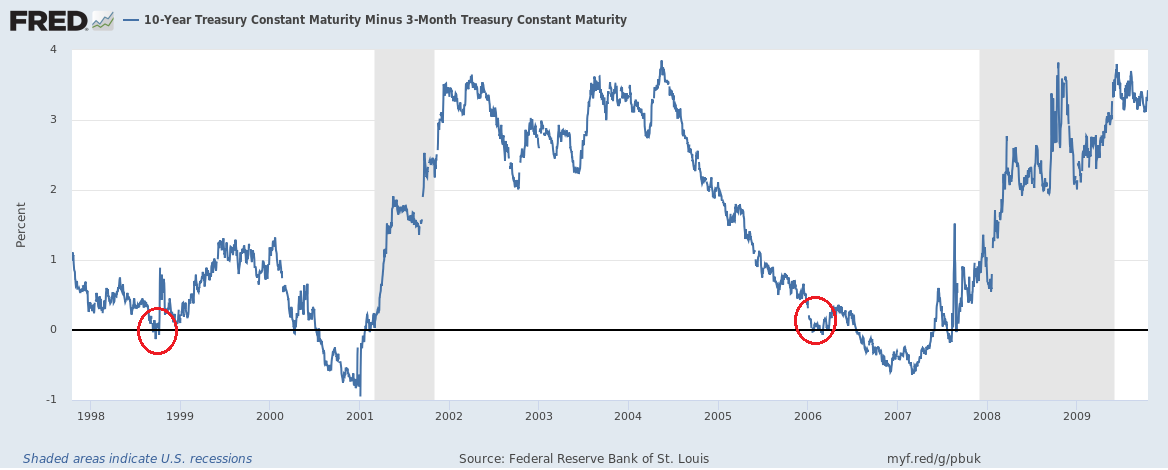

Or it could have been a false signal. In Sept. 1998 and Feb. 2006, the 10-year, 3-month briefly inverted before returning to positive territory and inverting again prior to the recessions. The same thing could be happening here, where there is actually more juice left in the business cycle. It’s not an exact science.

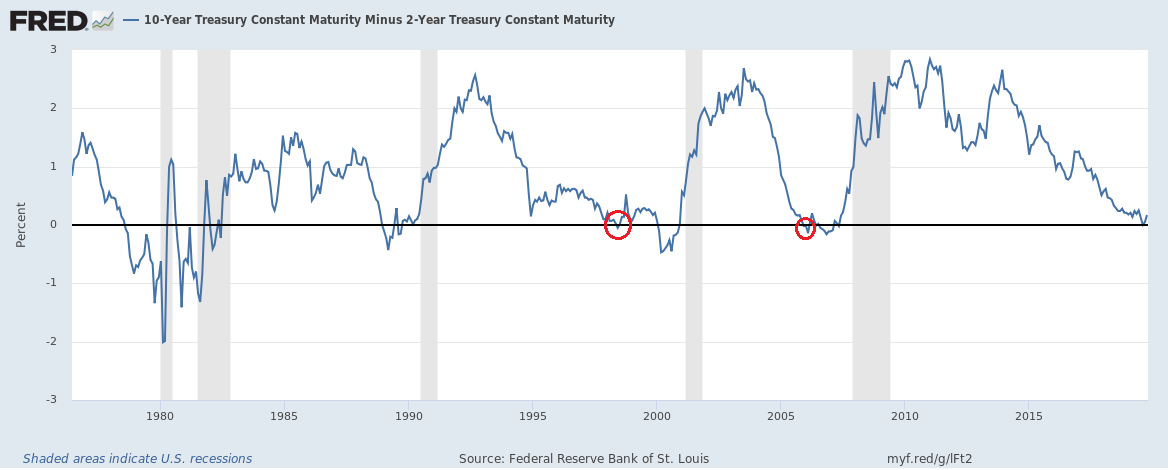

The fun part is you don’t get to find out until afterward. So, it always helps to look at confirming sets of data. For example, the 10-year, 2-year briefly inverted in September for a few trading days before returning to positive territory. It too gave off a premature signals in 1998 and early 2006.

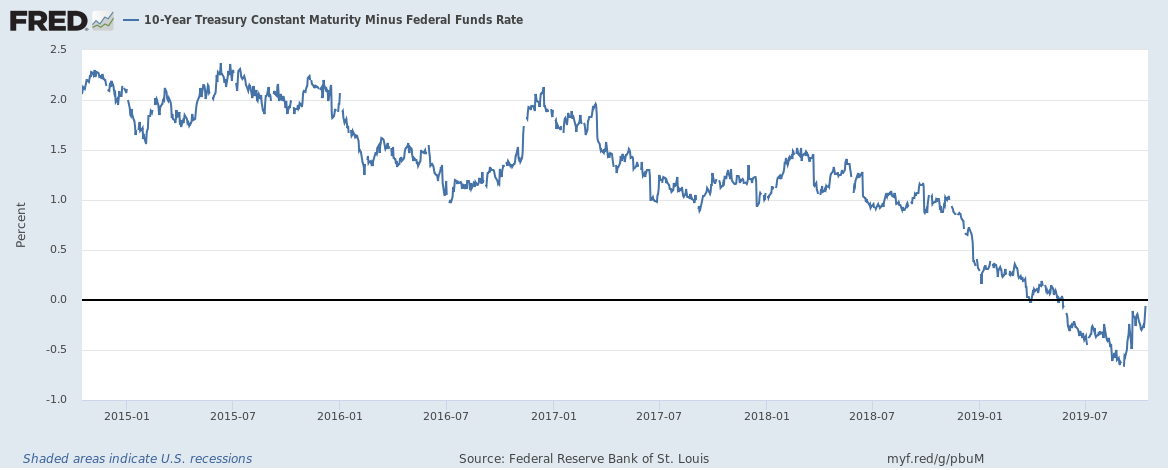

The 10-year, federal funds rate — the federal funds rate is controlled by the Federal Reserve — inverted alongside the 10-year, 3-month in May, but has not yet returned to positive territory.

That’s a lot of mixed signals.

For Democrats hoping for an economic downturn prior to Nov. 2020, then, this signal could be very bad news politically for them — even as it could be very good news for the American people. For every month that goes by where economic data remains strong, the more those inversions might look like a false signal, probably benefitting President Donald Trump in his reelection bid.

Who cares about inversions? You’re probably bored to tears reading this. This is why voters, especially closer to the election, will tend to focus on things that really matter to them: a 50-year low in unemployment, rising incomes and wages and sustained economic growth.

Additionally, it is worth noting that, particularly, the 10-year, 3-month inverted right about the same time the U.S.-China trade talks broke off in May, and has suddenly uninverted now that those talks have reached a verbal trade agreement on Oct. 11.

This could indicate that, given the $737 billion trading relationship between the U.S. and China, investors engaged in a flight to safety when the ongoing trade negotiations turned south, which promptly corrected when those talks successfully concluded.

It could also mean on the other hand, that, even with a trade deal between the U.S. and China, the business cycle is simply at an end and it’s getting near the time for the next recession anyway.

Sometimes, there’s a narrative about recessions, even if we’re just living in a boom-to-bust cycle. In that case, then, it would hurt the narrative that the trade impasse would have been the cause of the next recession, since it turns out the trade tale with China appears to have had a happy ending after all.

I’ve personally written a bit about the strong dollar as being a warning sign, since the last time it was this strong on a trade-weighted basis was prior to the 2001 recession.

And one could go on and on. Ahead of time, it’s all speculation and very much reading tea leaves. You don’t to find out until after the fact.

There are also admitted biases. If you favored the President’s economic policies, you might be more inclined to agree that the inversions were a false signal, because you thought the policies might prolong the business cycle. But if you did not, you might think that a recession is imminent because you think those policies were bad for the economy all along. So, good luck finding an objective opinion on the topic.

It could be that the inversions were in fact a reliable recession signal this time, but that the recession still does not happen until after the election. Which might mean President Trump would get all the political benefits of the boom while it lasted, but his party might suffer in the 2022 midterms afterward (which are also cyclical and might happen either way in a second Trump term).

Is your head spinning yet?

That is why the politics of recessions and ascribing blame tend to be problematic. If blame goes to the incumbent when things are bad, the opposition is assuming a risk that things might actually be good, thereby ensuring the incumbent gets credit when the news is in fact positive.

I tend to think we’re at or near the end of the business cycle, but we might not see another recession until after 2020. But even if a recession did begin in 2020 some time, you might not notice until it turned up in the data after the fact.

The point is, there are a lot of complexities and factors that are impossible to calculate ahead of time. Both Recessionistas and those saying the inversions were a false signal have good arguments to make. But anyone claiming they know the date certain the next recession will be is either lying or wrong. I won’t lie to you. I just don’t think it’s knowable.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.