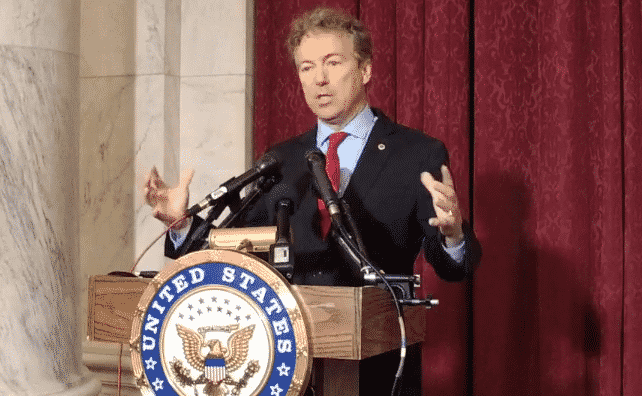

Sen. Rand Paul (R-Ky.) is offering an alternative budget plan that would cut three cents out of every federal dollar spent every year for five years, bringing the budget into balance by 2026, at a time when the U.S. added more than $4.4 trillion to the national debt in 2020 alone to $27.8 trillion.

Overall, the plan would cut spending by $67.4 billion in 2022, and over 10 years would cut $7.2 trillion. In a summary provided by Sen. Paul’s office it notes that the longer Congress waits to address the fiscal state of the nation, the worse it will get.

The summary states, “When Senator Paul first introduced a, flexible, off the top budget, simply freezing spending was all that was required to balance in 5 year.” That is why, per the summary, “To reach balance, this budget must cut 3 pennies each year for 5 years.”

Sen. Paul is not wrong.

That is just how far spending is ahead of revenues at this time: In Fiscal Year 2020, that is, from Oct. 2019 to Sept. 2020, the government took in $3.4 trillion of revenue but it spent $6.6 trillion, largely in response to the unprecedented Covid pandemic that has left much of the economy shut down for months.

In fact, since 1980, the national debt has grown an average 8.97 percent every single year through Republican and Democratic administrations, according to U.S. Treasury data. Under Donald Trump it grew 8.6 percent a year, under Barack Obama it grew 8.8 percent annually, under George W. Bush it grew 7.4 percent, under Bill Clinton it grew 4.3 percent, under George H.W. Bush it grew 11.8 percent and under Ronald Reagan it grew 14.1 percent. Even before 1980, it grew 10 percent a year under Jimmy Carter, and 7.6 percent a year under Richard Nixon and Gerald Ford.

Unfortunately, the federal government gets away with it because interest rates have been collapsing since the mid-1980s, from double digits down to just 1.1 percent on 10-year treasuries today.

It’s a bipartisan problem. And it is a problem. Since 1980, the economy only grew an average 5.1 percent nominally every year, according to Bureau of Economic Analysis data. As a result, the debt swelled from 31 percent of the Gross Domestic Product (GDP) in 1981 to a gargantuan 121 percent debt to GDP in 2020.

So, just taking the average, if the debt continues growing by 8.97 percent a year and the economy only grows 5.14 percent annually, then by 2036 the national debt will top $103 trillion, while the GDP would be $45.2 trillion — a whopping 227 percent debt to GDP ratio in 2036.

And that’s assuming interest rates continue collapsing, but really, how much lower could they really go? The answer, there, sadly is we may go the way of Japan and other countries and pursue negative interest rates to control debt costs, where lenders would actually pay the Treasury interest for the pleasure of holding onto U.S. treasuries. If they do go negative, that would probably mean we were in deflationary territory vis a vis prices and perhaps wages, too.

That’s the path we are currently on. Not as Democrats, or Republicans, but as Americans.

And so far, Sen. Paul is one of the only members of Congress proposing to balance the budget. But I’m not optimistic, and neither should you be.

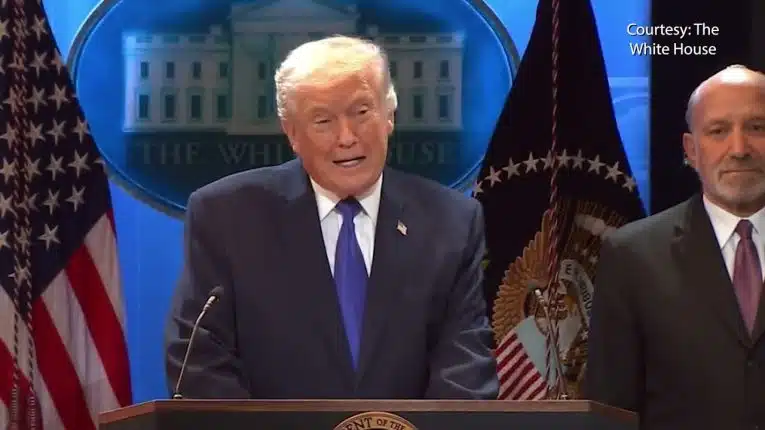

This week alone, Congress is considering another $1.9 trillion stimulus measure proposed by President Joe Biden to address the economic fallout of the Covid pandemic. It will probably pass even if not a single Republican votes for it as Democrats use the budget reconciliation process which foregoes the Senate filibuster and can pass budgeting bills on a simple majority.

The plan would issue yet more checks to American households, this time totaling $1,400 per individual and an additional child tax credit for $3,600 for children under 6 and $3,000 for children over 6, in addition to $350 billion to states and localities $170 billion to schools and universities, plus $70 billion for Covid vaccine distribution and testing.

That’s on top of the $3.1 trillion we already spent in response to the Covid pandemic.

And then depending on how the pandemic plays out, and how quickly the recovery will proceed in 2021 — 25 million jobs were lost when labor markets bottomed, and 16 million were recovered, still leaving 9 million additional unemployed — will likely determine how much more Congress will likely spend. Probably trillions more.

It’s enough to make your eyes bleed. And yet, barring a sudden realization by our leaders in the Washington, D.C. establishment that we are spending future generations into oblivion, it will almost certainly pass. But there a few, like Sen. Paul, who are still keeping tabs and willing to stop the out of control spending — valiantly trying to right ship of state before it is too late. But is anyone listening?

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.