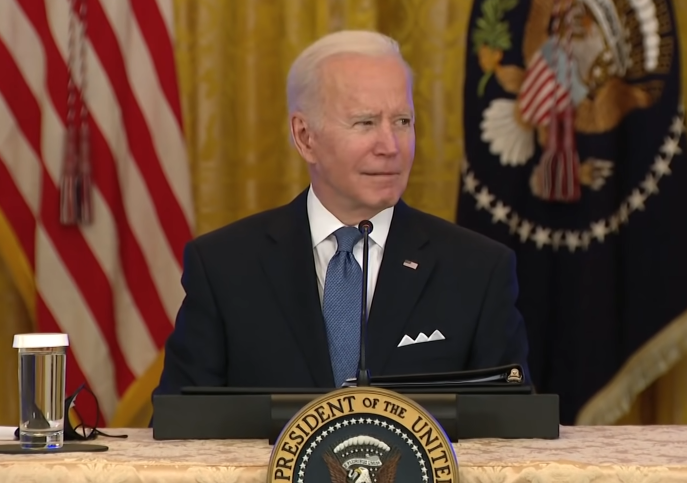

“No, it’s a great asset. More inflation. What a stupid son of a bitch.”

That was President Joe Biden’s hot mic description of Fox News’ Peter Doocy on Jan. 24 after he asked “Will you take questions on inflation then? Do you think inflation is a political liability ahead of the midterms?”

Sometimes it’s hard to tell when Biden is being sarcastic, but this is not one of those circumstances. It is rare to see a president acknowledge electoral vulnerabilities in this manner. As inflation has taken off the past nine months — it’s been above 4 percent since April 2021 and hit 7 percent in Dec. 2021, the highest since 1982 — Biden’s approval ratings have plummeted.

For example, the latest Economist/YouGov poll has Biden at just 42 percent approval and 53 percent disapproval. Meanwhile, 43 percent in the same poll say inflation is a bigger problem than unemployment, with only 10 percent agreeing unemployment was a bigger problem than inflation.

Similarly, Republicans are consistently leading the Congressional generic ballot, according to the latest sampling of polls by RealClearPolitics.com, with an average lead of 3.2 percentage points, 45.8 percent to 42.6 percent. Prediction markets like PredictIt.org are already projecting GOP wins to take control of the House and Senate in 2022. The Red Wave is here.

But Biden and Congress’ approval ratings are not all that’s collapsing. Don’t look now, but the spread between 10-year and 2-year treasuries — a measure of the health of the economy — has been rapidly declining, from 1.58 percent on March 1, 2021 down to 0.76 percent as of this writing. And that could be blood in the water for Democrats in 2022 — and beyond.

If it inverts, that is, when short-term interest rates go higher than long-term rates, it would signify a collapse in demand and a flight to long-term safety. Historically, the 10-year, 2-year spread has predicted almost all of the recessions in modern American history.

Therefore, the 10-year, 2-year spread already beginning to collapse just one year into Biden’s presidency has to be very bad news for the White House, particularly since the measure has an inverse relationship with inflation. That is, when inflation and the economy are running too hot, demand contracts and a recession happens.

In short, when prices are too high, American households run out of money to spend. And so, the longer the high inflation endures, the sooner the next recession will be.

In the five recessions that preceded the Covid pandemic recession, each time inflation got above 5 percent, on average within 14 months there was another recession in the U.S., with a range of zero to 39 months.

Inflation hit 5 percent in May 2021, and so that would put a potential recession following the inflation anywhere from July 2022 to August 2024, assuming the relationship holds up.

But inflation alone does not fully account for an overheating economy, which Investopedia defines as high inflation plus full employment: “The two main signs of an overheating economy are rising rates of inflation and an unemployment rate that is below the normal rate for an economy.”

Since 1948, unemployment has averaged 5.7 percent. Now, with the unemployment rate all the way down to 3.9 percent after rising to 14.7 percent in April 2020 amid Covid lockdowns, has the U.S. economy already peaked less than two years after the Covid pandemic began?

If so, Biden might find himself in the company of Gerald Ford and Jimmy Carter, two consecutive one-term presidents who were hampered by high inflation and recessions in the 1970s, or George H.W. Bush who faced the same problems in 1990 and 1991, leading to their respective reelection losses in 1976, 1980 and 1992.

But why could the economy be weakening so soon after the Covid recession? It could be that Biden has inherited the same business cycle that former President Trump was experiencing prior to Covid, which disrupted the normal functioning of the economy for a year. Now that the economy is open again, perhaps prior trends at the latter end of the Trump-era business cycle are reasserting themselves.

Here are a few things to watch. First, amid the supply chain crisis, it is a looming question of how long inflation will remain high. Since inflation is defined as too many dollars chasing too few goods, as long as there are too few goods to purchase, prices should remain elevated.

Another will be the strength of the U.S. dollar relative to its trading partners. After weakening dramatically during 2020 and 2021 amid the pandemic, the dollar has been strengthening since Oct. 2021. A stronger dollar usually means lower inflation on the horizon, lower interest rates, less growth and fewer jobs created.

Finally, watch interest rates. As the Federal Reserve begins hiking its short-term lending rate, as it is expected to do this year, markets will have to begin pricing in the next recession. If another recession is coming sooner than expected, the Fed needs to hike rates now so it has wiggle room later.

Those short-term interest rate hikes will be coming at the same time the dollar is continuing to strengthen and full employment. It could be produce a perfect storm for the U.S. economy as soon as this year — and prove fatal for Democrats in the 2022 midterms.

If Biden does have one asset, it is time. If a recession does come early in his term of office — Ronald Reagan had a killer recession in 1982 but went on to win his 1984 reelection in a landslide as the economy was already in a full-blown recovery — it won’t help in the 2022 midterms, but there could still be enough time before 2024 for Biden and Democrats to make up lost ground. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

A version of this article appeared at algresearch.org.