Inflation has hit 7.9 percent over the past twelve months, according to the Bureau of Labor Statistics, amid more than $6 trillion of new spending and borrowing by Congress to fight Covid, compounded by the supply chain crisis that was also caused by Covid as oil has surged to well over $100 a barrel.

And, even with inflation accelerating, Congress is presenting another $1.5 trillion omnibus spending bill through the House and Senate this week, with the House passing both the omnibus and another temporary continuing resolution to March 15 in time for a March 11 deadline, when the current continuing resolution funding the government expires, with Senate passage soon expected.

This legislation will not cut any spending. Last year’s omnibus was $1.4 trillion.

It will not defund or repeal any of President Joe Biden’s Covid vaccine mandates for health care workers, federal contractors and the military, even as Covid infection, hospitalization and fatality rates continue to plummet, and even after the Centers for Disease Control and Prevention (CDC) have lifted its own masking guidance because of low transmission levels.

It does not provide for any new oil or natural gas exploration via federal leasing, no approval for the Keystone XL pipeline, no streamlining of regulatory approvals for refineries, pipelines and liquified natural gas terminals, and it does not defund and repeal Environmental, Social and Governance (ESG) regulations and financial subsidies via the federal employee retirement plan and state and private pension investments into green companies, which restricts capitalization for carbon-based oil, gas and coal energies, and even nuclear energy, which is not even carbon-based.

During Covid, producers across the world and industries including oil and gas slowed down production throughout 2020 because demand collapsed, and as the economy has reopened, production has still not caught up. Biden mentioned this in the State of the Union Address on March 1 related to semiconductors, but neglected to relate it to the current energy crisis, which is now being compounded by Russia’s invasion of Ukraine and Western oil and gas embargos against Russia.

Given the supply side of the equation, boosting production would absolutely help bring prices down. But Biden isn’t budging.

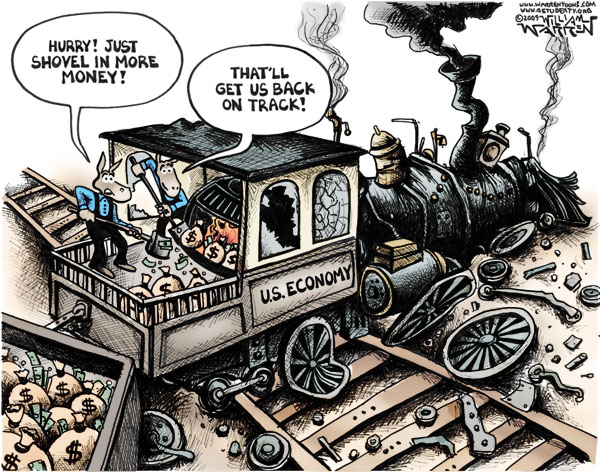

On spending, it will do nothing to eliminate the inflation, which in very large part is owed to the trillions of spending that has already occurred: the $2.2 trillion CARES Act and $900 billion phase four legislation under former President Donald Trump, and the $1.9 trillion stimulus and $550 billion of new infrastructure spending under President Joe Biden.

The national debt has increased by $7 trillion since Jan. 2020 to $30.2 trillion, of which the Fed monetized half, or $3.4 trillion, by increasing its share of U.S. treasuries to a record $5.7 trillion.

As a result, the M2 money supply has increased by $6.4 trillion to $21.8 trillion, a 42 percent increase. More than 90 percent of every new dollar of debt was paid for by printing it.

Combined with close to peak employment numbers — the unemployment rate is down to 3.8 percent — and 5.7 percent inflation-adjusted economic growth in 2021, and a key indicator that has predicted almost every recession in modern history, the 10-year, 2-year treasuries spread is down to 0.27 percent as of this writing. Once it inverts, that will signal a recession on average within 14 months.

So, of course there was always going to be inflation, the war in Ukraine and embargoes notwithstanding. Given the trillions of dollars of printed money and the economy overheating, Biden’s coming recession was inevitable — and with its $1.5 trillion omnibus spending bill, Congress isn’t doing a thing to stop it.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Updated to include latest votes in the House of Representatives.

A version of this article appeared on algresearch.org.