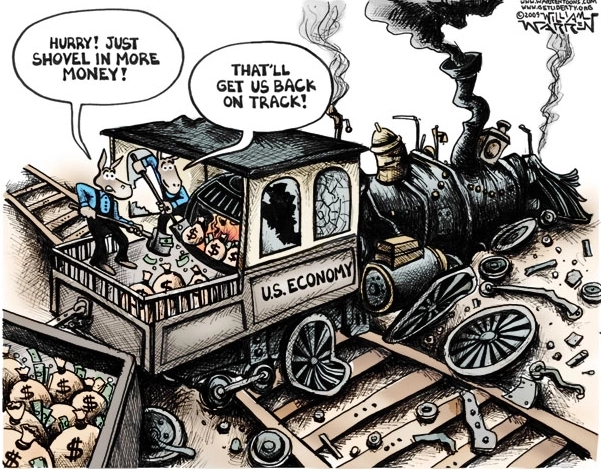

The U.S. economy contracted another 0.9 percent in the second quarter of 2022, following a 1.6 percent decline in the first quarter and thus marking the second consecutive quarter of negative growth — usually thought to signal a recession — according to the latest data by the Bureau of Economic Analysis (BEA).

But wait, says President Joe Biden, not so fast. That’s not a real recession. Isn’t it, though?

Since quarterly tabulation of the Gross Domestic Product (GDP) began in 1947, in almost every single instance where there were two consecutive quarters of negative growth, the National Bureau of Economic Research (NBER) — another agency that chronicles economic cycles — has ultimately said there was a recession anyway.

The lone exception is 1947, when GDP contracted from the second quarter of (Q2) 1947 to the third quarter (Q3) of 1947, but there was said to be no accompanying recession by any government agency.

Otherwise, GDP contractions in Q1 1949 – Q2 1949, Q3 1953 – Q1 1954, Q4 1957 – Q1 1958, Q4 1969 – Q1 1970, Q3 1974 – Q1 1975, Q2 1980 – Q3 1980, Q4 1981 – Q1 1982, Q4 1990 – Q1 1991, Q3 2008 – Q2 2009 and Q1 2020 – Q2 2020 have all accompanied recessions.

That’s 10 out of 11 cases, or 90.9 percent of the time.

But then there were the non-consecutive quarterly contractions of GDP within a twelve-month period that occurred in 1960 and 2001, respectively, which similarly accompanied recessions.

That moves the cases of two quarterly contractions within a 12-month period, consecutive or non-consecutive, to 12 out of 13 cases, or 92.3 percent of the time. That makes the odds NBER will ultimately say we were in a recession anyway rather high.

BEA and NBER are two separate agencies, and so their data doesn’t automatically sync with one another, and when NBER says a recession was technically occurring can occasionally be prior to or immediately after the quarterly GDP contractions. But suffice to say, NBER’s recession calls appear to occur right around the same time give or take some months, or at the same time.

The NBER’s recession calls come months after the fact, typically after a recession has already begun.

Likely, the real question is not whether we’re already in a recession, but how bad it will be?

For that, the thing to watch over the next several months will be labor markets. That is how we measure the magnitude of recessions. How many jobs were lost? How high did the unemployment rate go?

On that count, the last two recessions were massive: the 2008-2009 Great Recession saw 8 million jobs lost and the 2020 brief Covid recession saw 25 million jobs lost. Depending on how bad the problems were that caused the recession — a once in a generation collapse in the U.S. housing and financial markets and a worldwide pandemic that resulted in a halt to the global economy — appears to determine how bad the resulting contraction in employment that occurs.

So, it all depends on how bad you think the ongoing supply crisis, food and energy shortages, inflation, the war in Ukraine and overall the failure of producers to meet demand really are. It could be really bad. Or, perhaps a rise in unemployment might be mitigated by the current bout of labor shortages as Baby Boomers continue retiring en masse, making the recession more shallow. It’s hard to say.

Once labor markets move south — and they may already be as unemployment initial claims appear to have had a slow but steady months-long uptrend from mid-March, when initial claims hit a low of 166,000, even if they were flat this past week, today stand at 256,000 — the attention of Congress will ultimately turn to the economy. This is an area Congressional Republicans might attempt to get ahead of the recession story in the context of the midterms occurring in November.

Most Americans think we’re already in a recession anyway. So, the GOP could simply propose legislation that will help alleviate the supply crisis and boost production domestically on food and energy. Their version of a “stimulus”.

In the meantime, the Biden White House will be insisting throughout the summer that there is no recession, nothing to see here. Will voters really buy that? We’re about to find out. Once Biden and Congressional Democrats start proposing “stimulus,” that will be the tell that they’ve succumbed to reality that we really are in one. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.