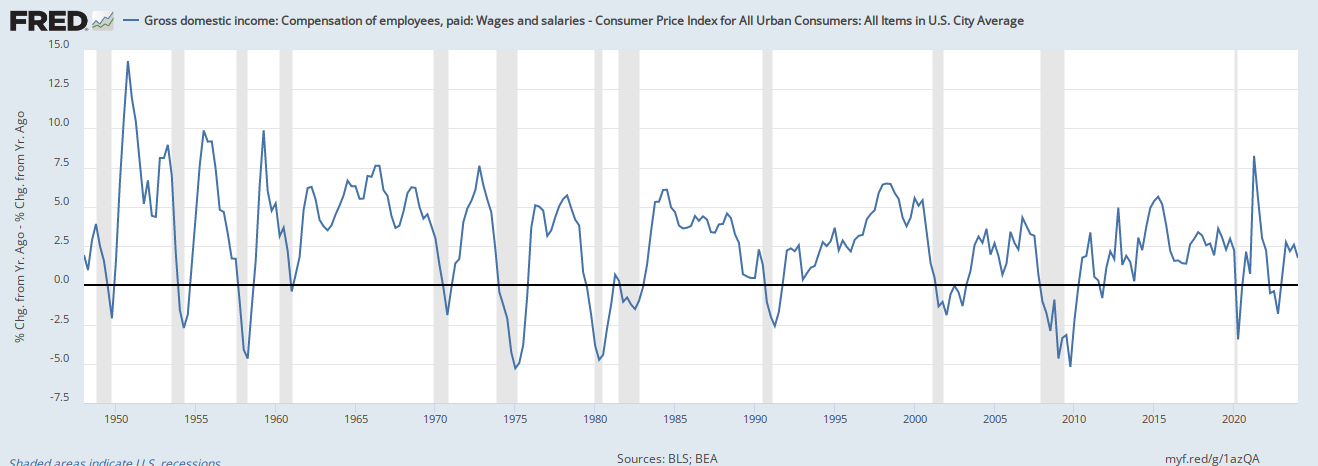

Drops in inflation-adjusted compensation and wages preceded the losses of Harry Truman in 1952, who opted not to run, Gerald Ford in 1976, Jimmy Carter in 1980, George H.W. Bush in 1992 and Donald Trump in 2020, according to Bureau of Labor Statistics and Bureau of Economic Analysis data.

They also preceded the historic wipeouts of Republicans in 2008 by Barack Obama and Senate Democrats in the 1958 midterms, and the Republican House wins of the 2010 and 2022 midterms.

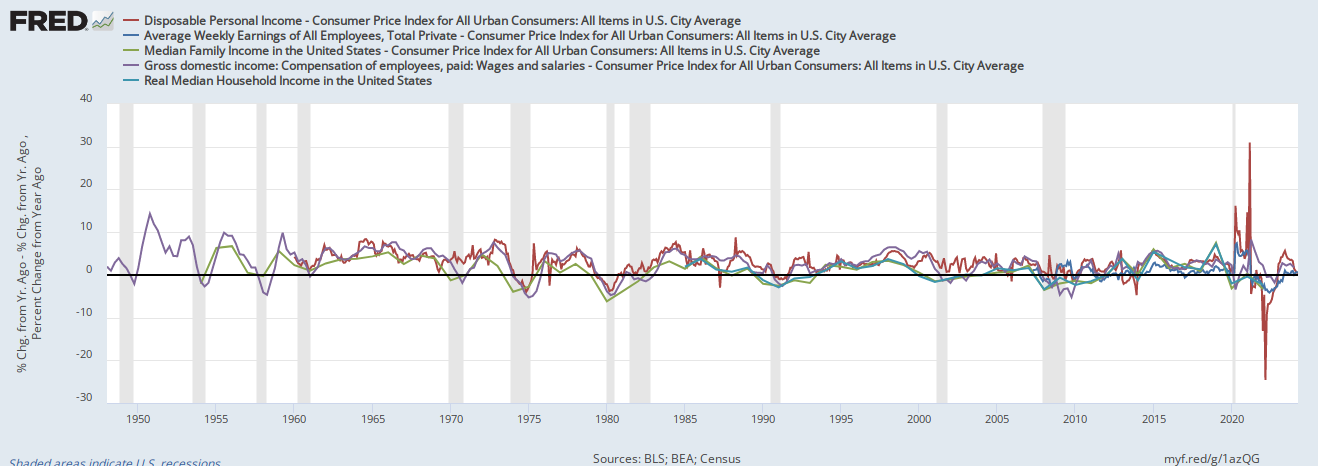

The metric also tends to work with median family income, average weekly earnings, household median income and disposable personal income, all showing that drops in how much Americans make versus inflation have correlated with sometimes dramatic shifts of power in Washington, D.C.

And by certain standards, the loss of personal income to price increases has never been worse. For example, March 2022 showed history’s most pronounced drop in inflation-adjusted disposable income of more than 24 percent, a record.

Real household median income for its part took a major hit in 2022, dropping 2.3 percent to $74,580, amid high inflation that peaked at 9.1 percent annualized in June 2022, according to the latest figures from the U.S. Census Bureau.

In this analysis, even more than unemployment, with notable exceptions like 1932, 1980, 2008 and 2020, inflation is the real reelection killer. When high inflation and unemployment are coupled together, as in 1980 and 2008, incumbent parties have never fared well.

Are you better off than you were four years ago?

In President Joe Biden’s case, unprecedented economic circumstances during and after Covid led to the printing, borrowing and spending close to $7 trillion for Covid into existence since the beginning of 2020 at the same time the global economy was locked down and production halts exacerbated the global supply chain crisis for months and years. All told, the M2 money supply, which peaked at $22 trillion after it increased dramatically from $15.3 trillion in Feb. 2020 to a peak of $22 trillion by April 2022, a massive 43.7 percent.

As a result, consumer inflation first rose above 5 percent annualized in June 2021 to 5.4 percent, up to 7.5 percent by Jan. 2022 immediately prior to Russia’s invasion of Ukraine, and peaking at 9.1 percent in June 2022. Prices have since cooled to 4.9 percent in April, 4 percent in May and 3 percent in June, following the price surges of 2021 and 2022.

Now, amid higher interest rates—30-year-mortage-rates are up to 7.6 percent by the Federal Reserve’s latest reading after the central bank has been jacking up rates—the M2 money supply has finally been shrinking after its April 2022 peak, down 5.8 percent to $20.75 trillion.

The problem is that it’s still 35.6 percent greater than Feb. 2020, and still well above the historical trendline. Prior to Covid, going back to 1981, the M2 money supply would grow at 5.9 percent annually on average. Right now, it’s still averaging 10.9 percent annualized growth since Feb. 2020, hence the continued runup in prices in some quarters.

Now, with military escalations overseas, fuel prices are once again surging, leading to what might be a lethal dose of inflation in 2024. Biden should be worried.

A general loss of confidence in the presidential administration, even after incomes improve versus inflation, as in 1952, 1976 and 1992, has a tendency to become permanent. Confidence, once lost, is almost always a non-recoverable asset, and incumbent parties usually pay the price when standing for reelection.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.