“We gave them a great country with essentially no inflation. And after two years, they drove this country and they drove inflation through the roof. Two years, cost of living went up in some cases by over 50 percent. They say 22 percent. They like to say 22 but it could be much higher and it is much higher depending on what they include. They don’t include things like interest rates…”

That was former President Donald Trump speaking at the Bitcoin Conference on July 27, stating that once interest rates and other increases are included, the cost of living has skyrocketed for American households.

Trump is right. There is no question.

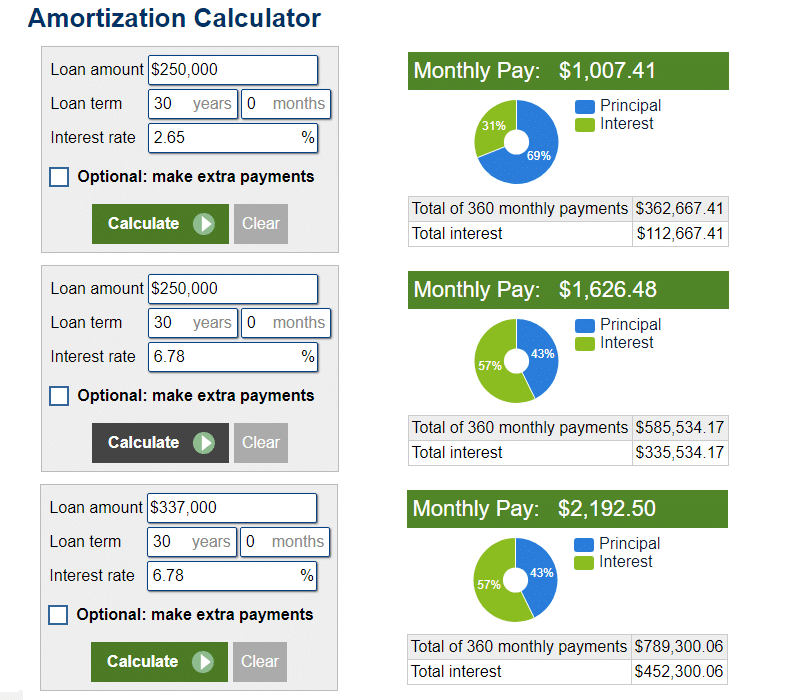

In fact, monthly mortgage payments with higher interest rates and greater home values have more than doubled since Jan. 2021, according to an analysis of Federal Reserve and Freddie Mac data. Let’s break it down.

According to the Freddie Mac home price index, home values in the U.S. have increased by 35 percent since Jan. 2021. Meaning a house that cost $250,000 then would go for $337,000 today.

Additionally, 30-year mortgage interest rates have increased from about 2.65 percent on Jan. 7, 2021 to a current 6.78 percent, according to Federal Reserve data.

Using an amortization calculator, that shows if you purchased a home for $250,000 before former President Donald Trump left office, with the low interest rate of 2.65 percent, the monthly payment with principal and interest would be $1007.

Now, say you had to refinance for whatever reason, or get a new mortgage for a home priced at $250,000, at 6.78 percent, the monthly payment rises to $1,626. That’s a 61.4 percent increase.

But home values did not remain the same. With inflation drive up average home values by 35 percent, the home that cost $250,000 in 2021 now costs $337,000. That’s great if you’re selling your home, not so great if you’re buying one.

Then, with the higher interest rate of 6.78 percent, the monthly payment on the $337,000 mortgage rises to $2,192. That is an 117 percent increase in monthly mortgage payments — for the same house!

One impact of these catastrophic cost of living increases is it is killing home sales. In Jan. 2021, existing home sales were at a seasonally adjusted, annualized rate of 6.69 million units sold. Whereas, by June 2024, it is all the way down to an annualized 3.89 million units sold, as 41.8 percent decrease.

As a result, the Fed has had to keep its own interest rate high at 5.25 percent to 5.5 percent in its July 31 meeting as it acknowledged that inflation “remains somewhat elevated.” No kidding.

And so, the cost of shelter in the Consumer Price Index measured by the Bureau of Labor Statistics is up just 21.6 percent since Jan. 2021. It’d be even higher, but Americans cannot afford to move with the crushing inflation.

That is the price of inflation, and the cost of the nearly $7 trillion printed, borrowed and spent into existence in both 2020 and 2021.

Apparently, the $2.2 trillion spent on the overwhelmingly bipartisan CARES Act in 2020 that Republicans and Democrats supported was not enough for the then-incoming President Joe Biden and Vice President Kamala Harris. Not even as 16 million out of the 25 million jobs temporarily lost during Covid were already recovered by Jan. 2021.

By the time Trump left office, the M2 money supply had already increased by $4.1 trillion, almost 27 percent, from $15.29 trillion in Jan. 2020 to $19.4 trillion in Jan. 2021.

The context was the national and global economy were locked down, schools closed, millions out of work and prices were collapsing. For example, oil briefly went below zero dollars a barrel as Americans stopped driving to work.

No, Biden and Harris wanted an economic stimulus of their own to take “credit” for, and so another $1.9 trillion for the very partisan American Rescue Plan Act of 2021 that only Democrats supported was spent by Congress and signed into law by Biden.

Throwing more fuel onto the fire, Biden then proposed and the Democratic-led Congress passed the so-called Inflation Reduction Act with $891 billion of green energy subsidies and other spending included. Biden signed it and Harris supported it.

By April 2022, the M2 money supply had increased another $2.6 trillion to $22 trillion, a further 13.6 percent.

Making matters worse, the Federal Reserve waited until consumer inflation was already at 7.5 percent in Jan. 2022 and Russia invaded Ukraine in Feb. 2022 exacerbating the global supply chain crisis before it began hiking interest rates in March 2022 to curtail the consequences, intended and unintended, of all the spending. By June 2022, consumer inflation peaked at 9.1 percent.

Note that within a month of the Fed beginning the interest rate hike cycle, the M2 money supply peaked. But the Fed could have acted much sooner. By June 2021, consumer inflation had already crossed to 5.4 percent after Congress acted again. If Congress had not created the additional stimulus in 2021 and the Fed had just begun raising interest rates in the first half of 2021, about half or more of the pain being felt now could have already been alleviated, and President Biden would likely be cruising to reelection.

In other words, there definitely was going to be inflation even if Biden-Harris had done nothing on the fiscal side, which was precisely the thing to do. Congress and the Fed had already primed the pump sufficiently at that stage. But they kept going, along with the Fed, which by that point should have already begun hiking interest rates but didn’t, and so both unnecessarily extended the stimulus all the way through 2021 and into 2022.

And Harris took credit for it. On April 29 at the Economic Opportunity Tour in Atlanta, Ga. Harris stated, unironically, “we are in the process of putting a lot of money in the streets of America…” Yup. We know.

While the American people have been paying the price for all the inflation the entire time, it could be Harris who finally pays the price in November, as voters angry with the status quo say it’s time for a change when they head to the polls. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.