368,000 fewer Americans reported having jobs in October and 150,000 more said they were unemployed in October, according to the latest household survey from the Bureau of Labor Statistics in the last report before the Nov. 5 presidential election between incumbent Vice President Kamala Harris and challenger former President Donald Trump.

Overall, 161.49 million said they had jobs, which is about what it was a year ago, when it was 161.28 million in Oct. 2023. That’s usually what happens during periods of peak employment towards the end of the economic cycle after peak inflation and the economy overheating — as inflation cools amid sinking demand as households max out their credit, the economy tends to start shedding jobs. When it gets particularly bad, that’s when slowdowns or recessions occur.

In fact, there are 1.286 million more unemployed from the low of 5.7 million in Dec. 2022, and the unemployment rate has gradually ticked up over a similar period, from an April 2023 low of 3.4 percent to the current level of 4.1 percent.

In the establishment survey of employers, only 12,000 jobs were added by employers, well below market expectations, and would is almost certainly a very bad sign of what is ahead. 46,000 manufacturing jobs were lost in October alone.

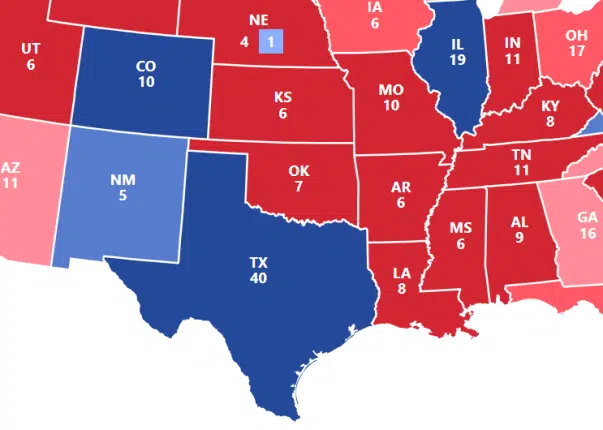

Some slowdowns are worse than others, but what the most recent data might mean is that regardless of wins the election on Tuesday, there could still be a bumpy road ahead even as the Federal Reserve has sought to accomplish a so-called “soft landing” for the economy, not seen since the mid-1990s.

As it is, the Fed has begun cutting interest rates, which, again, usually happens towards or at the end of the economic cycle, which it tends to continue doing until unemployment peaks. Then, after the slowdown or recession subsides, and employment rises along with inflation as demand begins increasing, it will begin hiking them again.

This can happen whether or not income and wages have kept pace with the prior bout of inflation, which in this case, they haven’t — consumer inflation is up 19.87 percent since Jan. 2021, while median weekly nominal earnings are only up 18.5 percent. It will take a prolonged period of relatively lower inflation and the wage gains from a positive growth, but this is a slow process.

Thanks to high inflation — it’s only slowed down but prices have not decreased on an overall basis — interest rates are up 70 percent, with large increases in monthly mortgage payments and in monthly consumer credit payments as Americans became increasingly taxed.

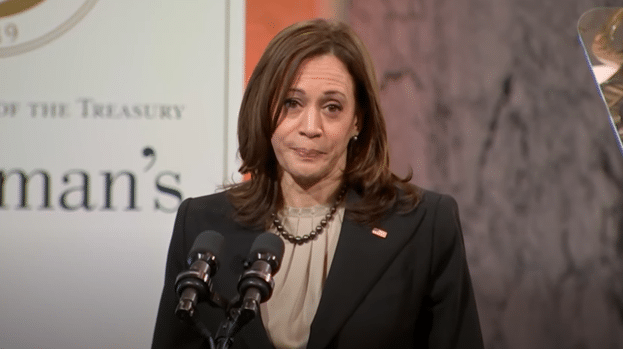

It could mean the economy and labor markets particularly are at the tipping point. It’s a nice idea that recessions can be prevented with the right mixture of policy, but at best, they can be postponed. All things come to an end, and with the crappy jobs report and the imminent presidential, the question is whether it also marks the end of the Biden-Harris administration, with Harris potentially suffering at the polls on Nov. 5. We’ll see. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.