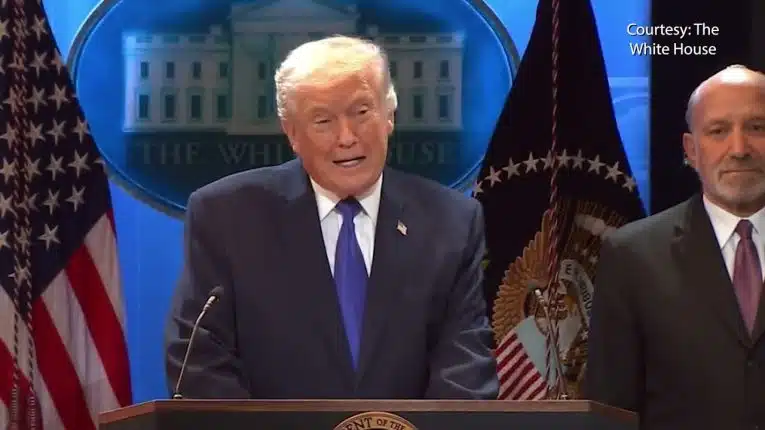

A Public Opinion Strategies-Americans for Prosperity poll conducted April 10 to April 14 has unsurprisingly found that 84 percent think that the current tax rates from the 2017 budget reconciliation measure signed into law by President Donald Trump should remain in place and that 80 percent of voters think it would be a bad time to raise taxes.

And yet, raising taxes is exactly what will happen if Republicans in the House and Senate fail to unite in their discussions and negotiations over their proposed budget reconciliation bill.

Simply doing nothing will cause taxes to be increased on the American people. The National Taxpayers Union Foundation finds that income taxes will increase on 80 percent of Americans if the law expires.

Extending the Trump tax cuts is almost universally popular in the poll: 95 percent of Republicans, 81 percent of Independents and 74 percent of Democrats in the very least want the current tax rates extended.

If the American people had wanted nothing to be done about the expiring provisions of the tax law, they might have just voted for former Vice President Kamala Harris.

If Harris had been elected, depending on the majorities in the House and/or the Senate she might have cobbled together — Democrats might have lost the Senate seats in West Virginia and Montana regardless of the result of the national election — doing nothing and allowing taxes to be increased might have been the likely outcome.

Instead, the American people voted for President Donald Trump and Republican majorities in the House and the Senate — and they are expecting Republicans to enact their tax cut legislation.

And not only to extend the 2017 Trump tax cuts. On the campaign trail, Trump promised no taxes on tips, overtime and Social Security as key reforms that certainly helped him win majorities in the battleground states of Nevada, Arizona, Georgia, Michigan, Pennsylvania and Wisconsin.

Politically, there is a lot riding on the budget bill for House Speaker Mike Johnson (R-La.) and Senate Majority Leader John Thune (R-S.D.). Legislatively, with slim majorities they are unlikely to get Democrats to help them out with bipartisan legislation other than things like continuing resolutions or debt ceilings.

If Johnson and Thune cannot usher the budget reconciliation bill across the finish line, the Republican Congress and President Donald Trump will have been failures.

Now is not the time for in-fighting, which could pose an existential threat to Republicans as a viable political brand. Whether all that trouble in 2024 to elect a Republican majority was worth it will come down to whether Congress can act — and do what 84 percent of Americans expect them to do, which is pass their tax cut legislation.

The bottom line is the American people have already paid enough of the hidden tax of inflation the past four years, and the last thing they need is another tax increase, this time from the federal government — and they know it.

If Republicans cannot get this one thing done, the one thing they all uniformly campaigned on, you do not need a poll to figure out that the American people will likely not reward them in the 2026 Congressional midterms. Congressional Republicans have one job: Cut taxes or go home.

Robert Romano is the Executive Director of Americans for Limited Government.