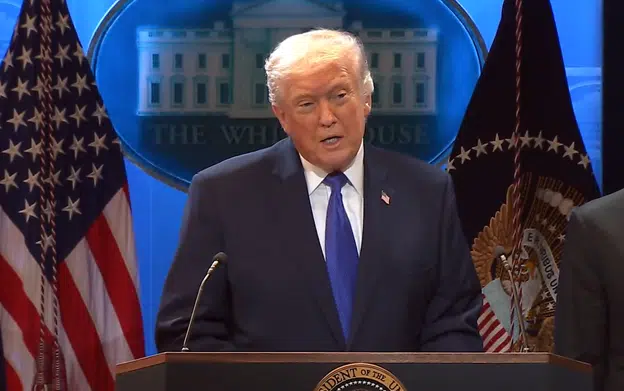

“We have a very, very united party.”

That was President Donald Trump’s description to reporters after addressing the House Republican Conference on May 20 of the political state of the One Big Beautiful Bill Act that will extend and expand the 2017 Trump tax cuts including no income taxes on tips and overtime plus the boosted deduction for seniors, puts $46.5 billion towards the border wall and removes Medicaid from 1.4 million illegal aliens.

The House is currently composed of 220 Republicans and 212 Democrats following the 2024 elections and the death of now three Democratic members in 2025, with special elections not until later this year.

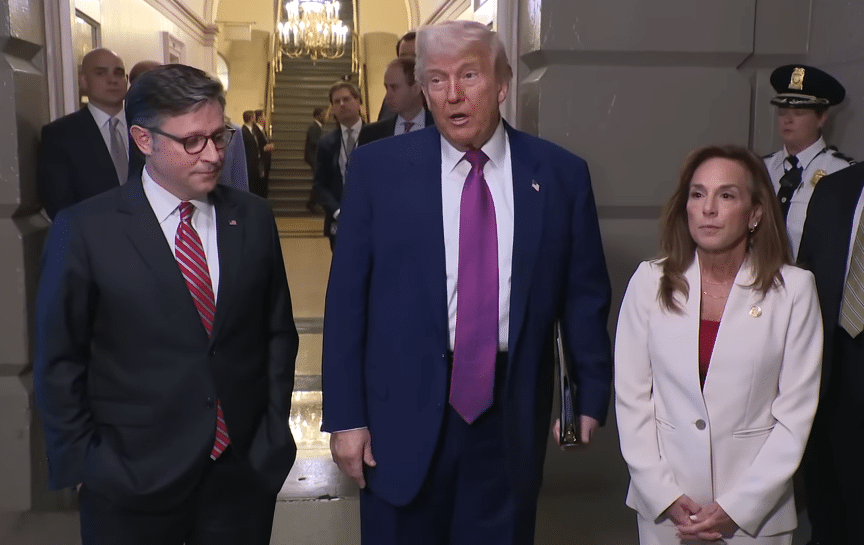

That gives House Speaker Mike Johnson (R-La.) just three votes to spare if Republican members vote in opposition, or up to seven votes to spare if Republican members voted present or didn’t vote. That’s a little bit of wiggle room, but not much in terms of getting Republicans’ signature legislation to the Senate and from there to the desk of President Trump.

Trump’s talk with House Republicans came after a contentious weekend wherein the bill failed at the House Budget Committee before the four Republican opponents, U.S. Representatives Chip Roy (R-Texas), Ralph Norman (R-S.C.), Andrew Clyde (R-Ga.), and Josh Brecheen (R-Okla.) abstained, allowing the legislation to proceed to the House Rules Committee.

That’s more than enough to sink the legislation should they vote no again. But have they thought through the implications?

The National Taxpayers Union Foundation finds that income taxes will increase on 80 percent of Americans if the 2017 Trump tax cuts expire.

That’s not good. A Public Opinion Strategies-Americans for Prosperity poll conducted April 10 to April 14 that found 80 percent of voters think it would be a really bad time to raise taxes.

Especially since President Trump and House and Senate Republicans swept the 2024 elections in part on the promise to extend and expand the Trump tax cuts. The American people are expecting the President’s agenda to get enacted. That’s what they voted for.

But with only 53 Republican Senators, Republicans do not have the votes to pass their agenda under regular order, and like in 2001, 2003 and 2017, they are depending on budget reconciliation to get the tax cuts done, and it by the rules it cannot achieve every single goal.

At the end of the day, nothing will be perfect, and now it is up to President Trump, House and Senate leaders to continue consulting with members to work through every objection.

If more tax relief is needed, then provide more tax relief. If more spending cuts are needed to reduce deficits, then get more cuts. Those are two things that the American people support. The less we spend, the less we should be taxed.

Again, on Dec. 31, if nothing is done, taxes will automatically increase on most Americans. They were promised if President Trump won and Republicans had elected majorities, taxes would not go up. If the American people had wanted taxes to go up, they could have just voted for Kamala Harris.

Politically, the consequences of not getting the legislation done would be Congressional Republicans despite winning the popular vote, the White House, the House and the Senate could not deliver on their promises to the American people, disenfranchising 77 million voters.

If that’s the record members want to run on in 2026, then do nothing. But if members want to run on tax cuts, border security and fiscal sanity, then come together, make the compromises that are necessary, be mindful that it will never be perfect — and then pass it!

Elections have consequences, and one of them is you keep your promises — or voters will remember.

Robert Romano is the Executive Director of Americans for Limited Government.

Correction: House Republicans have three votes to spare if they vote in opposition. If four vote no, then the bill would fail 216-216.

Updated 5/21/2025 to reflect the tragic passing of U.S. Rep. Gerry Connolly (D-Va.) that impacts the math needed for passage of legislation.