Consumer and producer inflation continued cooling in the month of May, only rising 0.1 percent in both categories, according to the latest data compiled by the Bureau of Labor Statistics, amid increasing energy production and cooling demand.

Energy dropped 1 percent on the consumer side including gasoline down 2.6 percent, and remained at 0 percent on the producer side. This comes amid boosted OPEC and U.S. production, with OPEC increasing from 22.8 million barrels a day at the end of 2024 to now about 23.1 million barrels a day in April and U.S. petroleum production up more than 400,000 barrels per day the first three months of 2025 to 13.4 million a day.

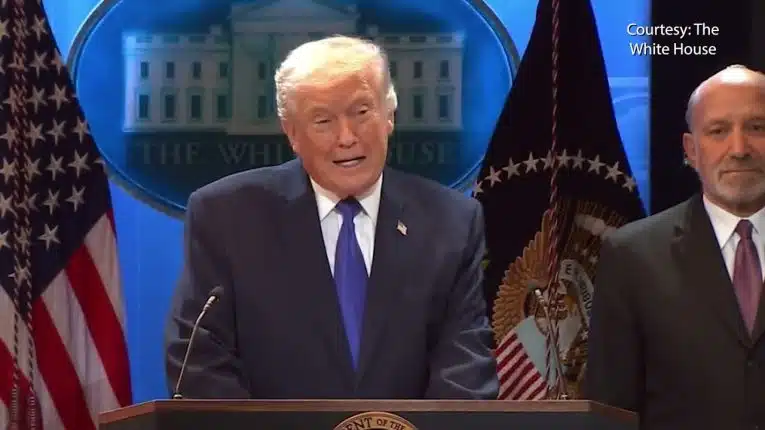

On the consumer side, inflation was down from a 0.2 percent increase in April, below market expectations that have been sitting around waiting for price spikes arising from President Donald Trump’s tariff policies that have yet to materialize.

Along with the 2.6 percent drop of gasoline, piped gas service was down 1 percent.

New cars were down 0.3 percent.

Used cars were down 0.5 percent.

Apparel was down 0.4 percent.

And transportation services were down 0.2 percent.

Obviously, that is all great news, and belies doom-and-gloomer panicans who promised as early as February that President Trump’s tariff policies would lead to dramatic price increases.

On Feb. 1, House Minority Leader Hakeem Jeffries (D-N.Y.) similarly suggested that prices would go up, stating, “The tariffs imposed by the administration and strongly supported by House Republicans will not lower the high cost of living for everyday Americans. Instead, it will likely do the exact opposite and make life more expensive.”

On March 2, Senate Minority Leader Chuck Schumer (D-N.Y.) predicted, “President Trump’s tariffs are going to raise prices on families by as much as $1,200 per year.”

On March 11, Schumer also declared, “inflation has gone up under Donald Trump, from groceries to retail to cars.”

On March 3, Sen. Elizabeth Warren (D-Mass.) also projected price hikes, saying, “Donald Trump promised on ‘Day 1’ to lower costs, but instead working families now have to worry about giant corporations using his haphazard tariff announcements as an excuse to raise prices – and the Trump Administration has no plan to stop it.”

So much for that.

Instead, inflation continues slowing down as it has for the past three years, consistent with other economic data.

That includes the slight decrease of the Gross Domestic Product in the first quarter, the steady uptick in unemployment of 1.49 million since January 2023 and also consumer credit in outright contraction, demonstrating that U.S. households maxed out their months and years ago, slowing purchases and cooling demand.

The best news for the American people, and the most important part of analyzing prices, is personal incomes continue outpacing consumer inflation — the crucial “better off” metric that tipped the 2024 election to the opposition party just like it did in 1976, 1980 and 1992.

At the moment, personal incomes are growing 5.5 percent on an annualized basis while consumer inflation is at 2.4 percent. That’s a healthy sign.

Besides reducing the money supply — overall flat since April 2022 — boosting food and energy production, along with domestic manufacturing, can do much to increase overall supplies, which will continue to put downward pressure on prices and create an even stronger case for lower interest rates.

President Trump ran on a promise to boost production and to help get prices under control, and he’s keeping that promise. There’s still more progress to be made, but so far, so good.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.