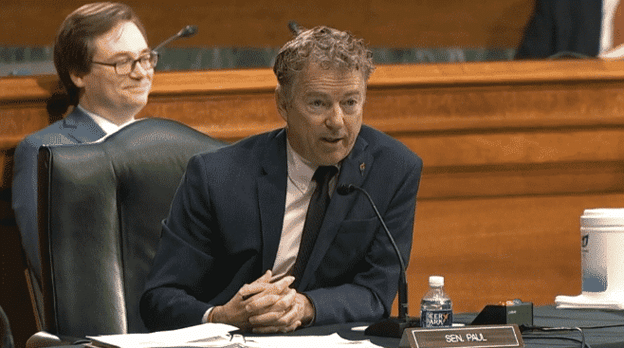

“I want to see the tax cuts made permanent, but I also want to see the $5 trillion in new debt removed from the bill. At least 4 of us in the Senate feel this way.”

That was Sen. Rand Paul (R-Ky.) on X.com on June 3 outlining his and at least three other Republican senators’ opposition to the House-passed One Big Beautiful Bill Act that will extend and expand the 2017 Trump tax cuts, including no income tax on tips and overtime, provide tax relief for seniors who collect Social Security, allocates almost $47 billion for the border wall and bars 1.4 million illegal aliens from collecting Medicaid and other public benefits.

That is, unless the $4 trillion increase of the debt ceiling is removed from Section 113001 of the bill.

Explaining himself on CBS’ Face the Nation on June 2, Paul stated, “I think there are four of us at this point, and I would be very surprised if the bill at least is not modified in a good direction… I want the tax cuts to be permanent. But at the same time, I don’t want to raise the debt ceiling five trillion… The GOP will own the debt once they vote for this.”

With just 53 Republican senators and there not being a single Democrat supporting President Donald Trump’s agenda, four no votes would be enough to sink the budget reconciliation legislation, and so with no margin for error, Paul’s concerns cannot be dismissed out of hand.

On one hand, since its inception in 1917, the debt ceiling always gets increased one way or another, usually on a bipartisan basis. In fact, since the end of World War II, Congress has increased or otherwise modified the debt ceiling 103 times to allow for more borrowing without much interruption, according to the Congressional Research Service.

So, by holding up the tax cut extensions, Sen. Paul and other Senate Republicans joining him appear to be accepting that when, not if, the debt ceiling is increased, it will be on Senate Minority Leader Chuck Schumer’s (D-N.Y.) terms. Just so we’re clear.

What will Senate Majority Leader John Thune (R-S.D.) have to give up later to get the debt ceiling raised separately? I guess we’ll find out soon enough! Whatever helps the tax cuts to be extended and expanded, I suppose.

It would a political catastrophe for Republicans if at the end of the year taxes were to increase, after campaigning on the idea in 2024, the 77 million Americans who voted for President Trump and Republican majorities in the House and Senate are all expecting that the President’s legislative agenda would be enacted via the budget reconciliation bill now under consideration. They would be disenfranchised if Republicans were to defeat their own legislation.

One question to ask is whether the debt ceiling is essential to the deal that secured passage in the House.

It might not be. For example, House Freedom Caucus members had to hold their nose too when voting for the debt ceiling increase. Taking it out would likely make the bill easier to pass in the House, even as House Speaker Mike Johnson (R-La.) and Senate Leader Thune have warned about making too many changes to the other delicate items in the compromise.

Again, usually debt ceilings pass on a bipartisan basis. And some Republican members of the Senate simply don’t want to get their hands dirty. They could just get the debt ceiling over with by putting it in the budget bill that will pass on a partisan basis, and then not have to make a deal with Democrats. But, oh well.

The most recent debt ceiling increase came with a $1.5 trillion sequestration of discretionary spending, nominally one of the largest spending cuts in Congressional history. Similarly, the 2011 debt ceiling came accompanied came with budget sequestration of $917 billion.

Objectively, 2011 sequestration did more to reduce deficits than the 2023 version, but only because mandatory spending including Social Security, Medicare, Medicaid and interest on the debt is set to nearly double over the next decade from $4.4 trillion in 2023 to more than $8 trillion by 2034, according to a 2024 estimate by the White House Office of Management and Budget (OMB). That’s not even including the discretionary budget including the military, which will be another $2.2 trillion, with total outlays expected at $10.2 trillion by 2034. And that’s the baseline!

Here’s the important part: Even if the Trump tax cuts were not extended, revenues won’t nearly keep pace with spending, only reaching $8 trillion by 2034. That is owed primarily to the rapidly aging workforce, with more than 900,000 Baby Boomers retiring every single year and fertility plummeting over the past 65 years thanks to the advent of birth control. But rather than have an uncomfortable conversation with women, we beat each other up pretending mightily we can tax our way out of this, spending cut our way out of this, or both. It’s a fantasy.

We should have had more children, but we didn’t, and so the debt and deficits are baked into the cake. Therefore, Congress will almost certainly keep on raising the debt ceiling over the next decade. The question is at what price.

Meaning, the Senate Republicans holding up the One Big Beautiful Bill Act over the debt ceiling might not end up “owning” the debt ceiling, but they could wind up owning whatever concessions need to be made to get the debt ceiling passed later with Democratic votes. So be it.

Robert Romano is the Executive Director at Americans for Limited Government.