The U.S. Gross Domestic Product (GDP) grew by 2.97 percent annualized in the second quarter, according to the latest data compiled by the Bureau of Economic Analysis. It’s a good number.

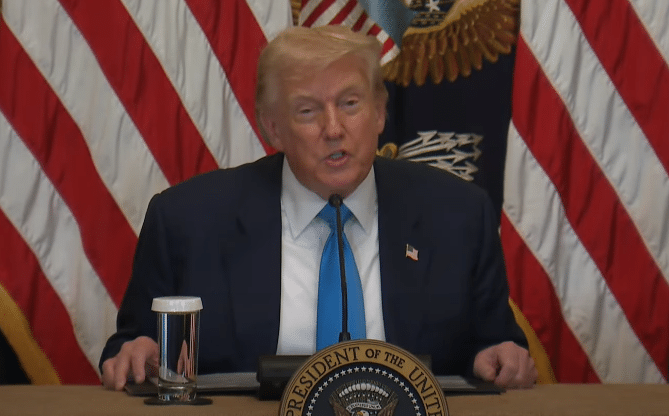

The number, following a 0.5 percent decrease in the first quarter, when imports — which are subtracted from GDP — were stockpiled in anticipation of President Donald Trump’s tariff policies taking effect, comes with fewer imports in the second quarter.

Still, hitting 3 percent even on a rounding basis is still nice to see for the U.S. economy when everyone and their mother was projecting gloom and doom (although not this author) from the President’s tariffs taking effect, which for top trading partners including Mexico, Canada and China have been in effect since February.

Federal Reserve Chairman Jerome Powell is still holding out for price increases from imports to get baked into inflation before even considering any interest rate cuts, but they certainly did not appear in the second quarter GDP report. The price index for imported goods actually decreased 2.5 percent annualized. So too did the price of exports by the U.S. decrease by 1.6 percent. Generally, this is unsurprising amid cooling economic activity, demand and inflation globally that has already prompted central banks pretty much everywhere else to cut interest rates.

But just consider that, in the second quarter, when the tariffs were taking into effect and all the smart people were saying prices of imports would have to go up, wrongly treating trade as a zero sum game, instead countries exporting to the U.S. cut prices! That can be accomplished at the company level setting prices but also by countries weakening currencies to cheapen exports via exchange rate manipulation. Either way, there was always a predictable offset to the tariffs when it comes to prices for companies and countries that want to maintain a competitive edge.

And the GDP news comes as the U.S. has finalized more trade deals with South Korea, Japan and the European Union on top of deals with the United Kingdom, Philippines, Indonesia and Vietnam. A tentative agreement was also reached with China but that can still change with the President’s Aug. 12 deadline to be finalized or else the new tariffs go into effect.

Still, that’s another thing all the experts said couldn’t happen, that countries would never want to deal with the U.S. if the President threatened tariffs. What a bunch of weaklings with no concept of leverage. Countries have been tripping over themselves to get a deal with President Trump, as they should.

So, that’s all good news. On hitting the magic 3 percent GDP number for the year, unfortunately, with the weak negative growth in the first quarter following the disastrous Biden economy on the books, that will likely have to wait until at least 2026.

Part of the issue is how annual GDP is calculated by averaging GDP for each of the four quarters and computing the growth rate, which gives outsized importance to the first quarter of the year and the fourth quarter of the previous year: “this measure places more weight on economic growth in the fourth quarter of the previous year and the first quarter of the current year than it does on growth in other quarters.”

Unbelievably, the economy would need to hit around 8.5 percent in each of the remaining quarters — the quarterly annualized rates use a variant of the compound interest formula — to hit 3 percent for the year.

But there’s always fourth quarter to fourth quarter estimate. That needs to get to an inflation-adjusted $24.249 trillion by the end of the year, which can be achieved with a little more than 4.8 percent annualized growth in the remaining two quarters. Tough but still doable. Again, there’s always next year. Psychologically, 3 percent growth is important, largely because besides 2021 when the U.S. was bouncing out of the Covid recession, it simply has not been achieved since 2005, with U.S. growth largely cooling for the past 30 years since the booms of the 1980s and 1990s.

Now, with trillions of dollars being promised by trade partners to invest in the U.S., and the President’s commitment to making goods in the U.S., that equation may begin to shift in favor of domestic growth.

Headwinds include about 900,000 Baby Boomers leaving the labor force every year, overall aging demographics and therefore a labor force that simply does not grow as robustly as it did a generation ago even when immigration is factored in, meaning a lot of the growth has to be eked out by increasing productivity per worker.

With the artificial intelligence boom that can be more doable too but, like the promised investments from the trade partners, remain difficult to quantify until we actually see it show up in the data. It will be up to the President to hold the trade partners and companies making investment commitments to their promises, as much depends on that. But for now, the numbers look good. As usual, stay tuned.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.